When money is on the line, there’s no room for shortcuts. Financial technology (FinTech) companies handle some of the most sensitive data on the planet—from banking credentials and transaction histories to personal identification numbers and payment cards. A single security breach doesn’t just cost money; it shatters trust, triggers regulatory penalties, and can sink an entire business overnight.

That’s why choosing the right development framework isn’t just a technical decision—it’s a business-critical one. Laravel, the powerful PHP framework trusted by developers worldwide, has emerged as a go-to choice for FinTech applications, and for good reason. It doesn’t just offer clean code and rapid development; it delivers security by design and compliance-ready features right out of the box.

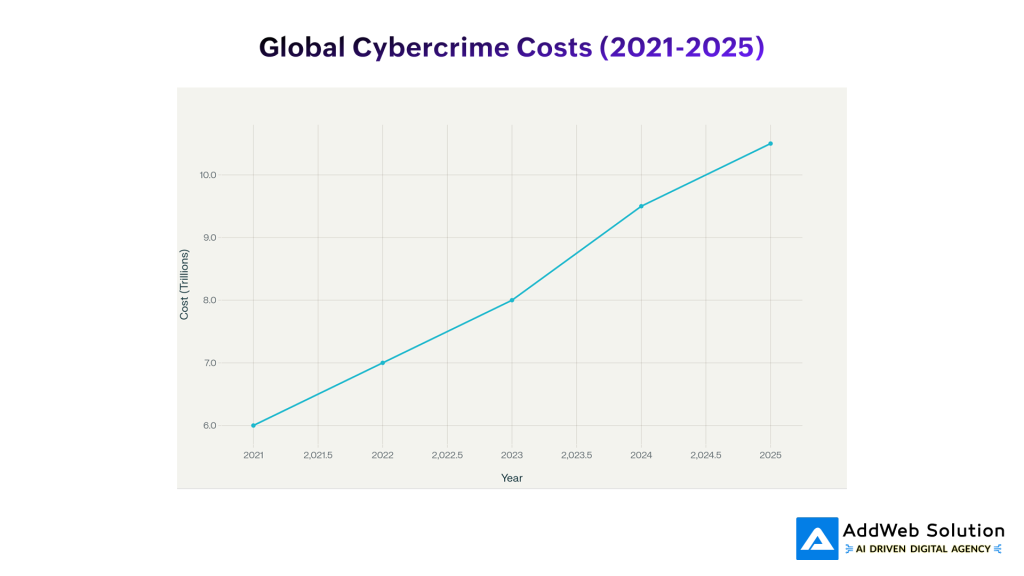

In 2025, with cybercrime costs projected to hit $10.5 trillion annually and financial services facing average data breach costs of $6.08 million per incident, security can’t be an afterthought. It has to be the foundation.

Projected growth of global cybercrime costs from 2021 to 2025, reaching an estimated $10.5 trillion annually

The High Stakes of FinTech Security.

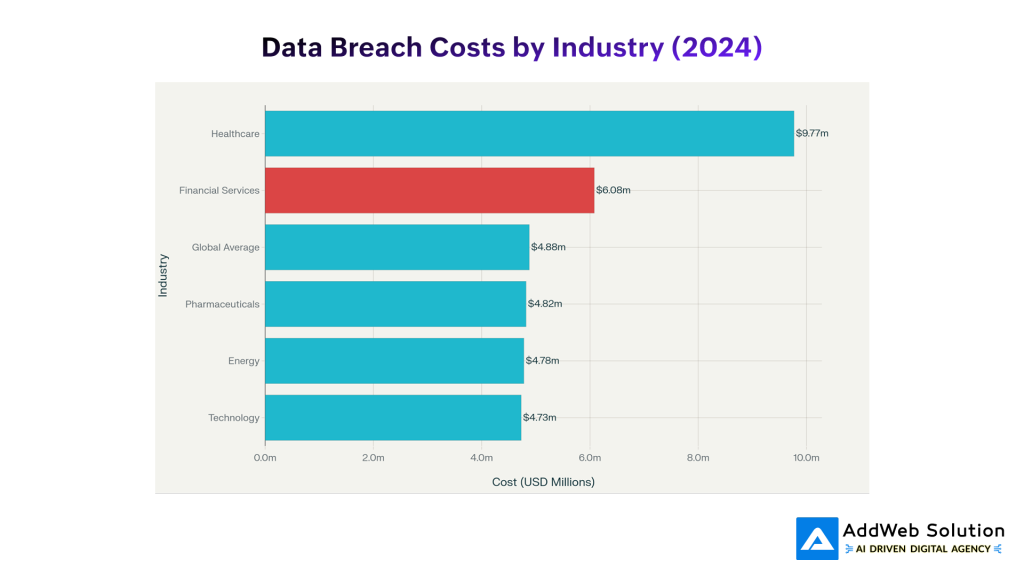

Let’s talk numbers. According to IBM’s 2024 Cost of a Data Breach Report, the financial sector faces the second-highest breach costs of any industry, averaging $6.08 million per incident—22% higher than the global average. When breaches involve 50 million records or more, costs skyrocket to a staggering $375 million.

Comparison of average data breach costs across industries, highlighting that financial services face significantly higher costs than the global average

But the damage goes beyond immediate financial losses. Research shows that 38% of customers would switch financial institutions after a breach, and companies typically see their stock prices drop by an average of 7.5% following a security incident. In an industry built on trust, these reputational hits can be devastating.

Distribution of data breach attack vectors in the financial sector, showing that malicious attacks account for over half of all incidents

What’s causing these breaches? The data tells a clear story. In the financial sector, malicious attacks account for 51% of breaches, while IT failures and human error make up 25% and 24% respectively. This means that while external threats are real, internal vulnerabilities and system weaknesses are nearly as dangerous.

Why Laravel Stands Out for FinTech

Laravel isn’t just another PHP framework—it’s a security-first platform designed with modern web application needs in mind. While many frameworks bolt on security features as add-ons, Laravel bakes them into its core architecture. For FinTech companies navigating complex regulatory landscapes and sophisticated cyber threats, this makes all the difference.

Built-In Security Arsenal

Laravel comes equipped with a comprehensive suite of security features that address the most common and dangerous vulnerabilities facing financial applications today:

CSRF Protection: Every form submission is automatically protected against Cross-Site Request Forgery attacks through Laravel’s built-in VerifyCsrfToken middleware. Simply add the @csrf directive to your forms, and Laravel handles the rest.

XSS Prevention: Laravel’s Blade templating engine automatically escapes output using the {{ }} syntax, preventing malicious scripts from executing in users’ browsers. This means developers are protected by default—they have to actively choose to render unescaped content.

SQL Injection Defense: Through Eloquent ORM and the Query Builder, Laravel uses parameterized statements that make SQL injection attacks virtually impossible. Your database queries are safe without requiring developers to remember escaping rules.

Military-Grade Encryption: Laravel uses AES-256-CBC cipher for data encryption, the same standard trusted by governments and military organizations worldwide. The Crypt facade makes encrypting sensitive data as simple as calling Crypt::encryptString($data).

Robust Authentication: Laravel offers multiple authentication options through Guards and Providers, with built-in support for Bcrypt and Argon2 password hashing—algorithms specifically designed to be computationally expensive and resistant to brute-force attacks.

Comprehensive Security Features Overview

| Security Feature | Built-in Support | Implementation Method | FinTech Relevance |

| CSRF Protection | Yes | @csrf directive, VerifyCsrfToken middleware | Critical |

| XSS Protection | Yes | Automatic Blade escaping {{ }} | Critical |

| SQL Injection Prevention | Yes | Eloquent ORM, Query Builder | Critical |

| Data Encryption | Yes | AES-256-CBC cipher, Crypt facade | Critical |

| Authentication System | Yes | Guards, Providers, Sanctum, Passport | Critical |

| Password Hashing | Yes | Bcrypt, Argon2 hashing | Critical |

| Two-Factor Authentication | Via Fortify/Jetstream | Google Authenticator, SMS, Email | Highly Recommended |

| Rate Limiting | Yes | Throttle middleware | Critical |

| HTTPS Enforcement | Yes | Force HTTPS in middleware | Mandatory |

| Session Management | Yes | Secure cookie-based sessions | Critical |

Authentication: The First Line of Defense

In FinTech, you can’t just ask for a password and call it a day. Modern financial applications need multi-layered authentication that balances security with user experience. Laravel delivers through several powerful options:

Laravel Sanctum: Perfect for Modern Apps

Laravel Sanctum is the lightweight champion for SPAs (single-page applications) and mobile apps. Unlike heavy OAuth2 implementations, Sanctum provides:

- API token authentication for mobile clients

- Cookie-based authentication for first-party SPAs

- Token abilities/scopes to control granular permissions

- CSRF protection built-in for web requests

It’s the sweet spot for most FinTech applications—simple to implement, yet powerful enough to handle complex authorization scenarios.

Laravel Passport: Enterprise-Grade OAuth2

When you need full OAuth2 compliance for third-party integrations or multi-application ecosystems, Laravel Passport steps up. It’s perfect for:

- Banking APIs that other services consume

- Financial data aggregators connecting multiple platforms

- Payment gateways requiring delegated authorization

- Open banking implementations

While more complex than Sanctum, Passport ensures you meet industry-standard OAuth2 requirements.

Two-Factor Authentication: Non-Negotiable for FinTech

With $10.5 trillion in annual cybercrime damage projected for 2025, passwords alone aren’t enough. Laravel makes 2FA implementation straightforward through:

Laravel Fortify provides the backend logic for time-based one-time passwords (TOTP) compatible with Google Authenticator, Authy, and Microsoft Authenticator.

Laravel Jetstream offers complete 2FA workflows with beautiful, pre-built UI components.

The implementation is remarkably simple. Add the TwoFactorAuthenticatable trait to your User model, and Laravel handles:

- QR code generation for authenticator app setup

- Recovery codes for account recovery

- Secure confirmation flows before enabling 2FA

- Challenge screens during login

Compliance: Meeting Regulatory Demands

FinTech isn’t just about building great software—it’s about operating within a complex web of regulations designed to protect consumers and financial systems. Laravel’s architecture supports compliance with major frameworks including GDPR, PCI DSS, DPDP Act, SOC 2, and ISO 27001.

GDPR: European Data Protection Standard

The General Data Protection Regulation applies to any company serving EU citizens, with penalties reaching up to €20 million or 4% of annual global turnover—whichever is higher.

Laravel facilitates GDPR compliance through:

- Data encryption at rest and in transit using AES-256

- User consent management via custom validation rules

- Right to erasure through model lifecycle hooks

- Data portability enabled by Laravel’s API capabilities

- Breach notification supported by comprehensive logging

PCI DSS: Protecting Payment Card Data

If you handle credit card information, PCI DSS compliance is mandatory. Laravel helps meet these stringent requirements:

- Encrypted database connections to Amazon RDS or other providers

- SSL/TLS enforcement through middleware

- Secure session management with encrypted cookies

- Access logging for audit trails

- Role-based access control limiting who sees sensitive data

One developer shared their PCI compliance journey: “Amazon RDS and Laravel made my life pretty easy. The ‘zero config’ that comes with RDS saves time and money. Laravel was really easy to configure to use SSL—all you need to do is download the RDS certificate chain and amend your database configuration.”

DPDP Act: India’s Data Protection Framework

For companies operating in India’s booming FinTech market—projected to reach $150-155 billion by 2025—the Digital Personal Data Protection Act introduces critical requirements:

- Explicit user consent for data processing

- Data localization for certain information types

- Time-bound data retention and deletion

- Transfer restrictions to jurisdictions without adequate protection

- Breach notification protocols

Laravel’s event-driven architecture makes implementing consent workflows and automated data deletion straightforward.

Compliance Regulations Overview

| Regulation | Region | Key Requirement | Laravel Implementation | Maximum Fine |

| GDPR | EU/Global | Data protection and privacy | Data encryption, user consent, data deletion | €20M or 4% of annual turnover |

| PCI DSS | Global | Secure payment card data | Encrypted database, SSL connections | Up to $500K per incident |

| DPDP Act (India) | India | Digital personal data protection | Consent management, data localization | Up to ₹250 crore |

| SOC 2 | Global | Security and availability controls | Audit logs, access controls | N/A (Compliance-based) |

| ISO 27001 | Global | Information security management | Security policies, risk management | N/A (Compliance-based) |

Ready to turn compliance into a competitive advantage? Start with Laravel.

Pooja Upadhyay

Director Of People Operations & Client Relations

Real-World FinTech Success with Laravel

Laravel isn’t just theoretical—it powers production FinTech applications processing millions of transactions daily:

Barchart.com, a premier financial data destination for analysts and traders globally, leverages Laravel’s backend framework for real-time dashboards, financial news aggregation, and account management. Processing millions of data points daily, Barchart relies on Laravel’s routing system, Redis caching layer, and API generation features to deliver data at scale.

A recent case study highlighted how a fintech company rebuilt its lending platform using Laravel, resulting in improved code quality, enhanced security measures, and better regulatory compliance. The modular architecture allowed them to quickly adapt to changing regulatory requirements while maintaining system stability.

Industry experts note that Laravel’s event broadcasting support via Echo, Pusher, and WebSockets makes it ideal for real-time notifications critical in financial applications—transaction confirmations, limit alerts, OTP delivery, and fraud warnings.

Advanced Security Practices for 2025

As cyber threats evolve, so must our defenses. Here are the cutting-edge security practices Laravel developers should implement for FinTech applications in 2025:

Rate Limiting and Throttling

Protect your APIs and login endpoints from brute-force attacks using Laravel’s built-in throttle middleware:

Php

Route::post(‘/login’, [LoginController::class, ‘login’])

->middleware(‘throttle:5,1’); // 5 attempts per minute

Proof-of-Possession (PoP) Tokens

Unlike traditional bearer tokens, PoP tokens are cryptographically bound to a specific key, making them useless if stolen. Implement them for high-value endpoints like payment processing.

Mutual TLS (mTLS) for Microservices

For service-to-service communication in distributed FinTech architectures, mTLS ensures both parties authenticate with certificates, blocking unauthorized services.

Column-Level Encryption

Don’t just encrypt the database—encrypt sensitive fields individually:

Php

// Using Laravel’s Encryptable trait

protected $encryptable = [‘ssn’, ‘account_number’, ‘card_number’];

Forensic Audit Logging

Maintain immutable logs of all administrative actions, failed login attempts, and sensitive operations. Laravel’s event system makes this elegant:

Php

Event::listen(LoginAttempt::class, function ($event) {

AuditLog::create([

‘user_id’ => $event->user->id,

‘action’ => ‘login_attempt’,

‘ip_address’ => request()->ip(),

‘timestamp’ => now(),

]);

});

Role-Based Access Control (RBAC)

Implement granular permission systems using packages like Spatie Laravel Permission:

Php

// Assign roles

$user->assignRole(‘Admin’);

// Check permissions in controllers

if ($user->can(‘approve-transactions’)) {

// Process transaction

}

// Protect routes

Route::group([‘middleware’ => [‘role:Admin’]], function () {

Route::get(‘/admin’, [AdminController::class, ‘index’]);

});

Laravel Authentication Options Comparison

| Authentication Method | Best For | Token Type | Complexity | FinTech Suitability |

| Laravel Sanctum | SPAs & Mobile Apps | API Tokens | Low | Excellent |

| Laravel Passport | Third-party OAuth2 | OAuth2 Tokens | High | Good (for third-party integrations) |

| Laravel Fortify | 2FA & Authentication Logic | N/A (Backend only) | Medium | Excellent |

| Laravel Jetstream | Full-stack Starter Kit with 2FA | Uses Fortify + Sanctum | Medium | Excellent |

| Laravel Breeze | Simple Authentication Starter | Session-based | Low | Good (for MVPs) |

Performance Meets Securit

Security shouldn’t mean sluggish applications. Laravel’s queue system, caching mechanisms, and event broadcasting ensure your FinTech app stays responsive while maintaining ironclad security:

Background Jobs: Process time-consuming tasks like statement generation, fraud detection, and transaction validation asynchronously using Laravel Horizon and job queues.

Redis Caching: Cache frequently accessed data like exchange rates, account balances, and user permissions to reduce database load without compromising security.

Database Query Optimization: Laravel’s Eloquent ORM with eager loading prevents N+1 queries that can slow down financial dashboards and reporting tools.

Looking Ahead: Laravel’s Future in FinTech

The FinTech landscape is evolving rapidly. India’s fintech market is projected to reach $150-155 billion by 2025. Global cybersecurity spending is expected to rise 15% to $212 billion. And AI-generated deepfakes have risen 10x globally, with crypto and fintech as main targets.

Laravel is evolving too. With each release, the framework introduces new security enhancements:

- Laravel 12 brings improved starter kits with built-in 2FA

- Enhanced encryption key rotation without logging out users

- Improved API security through Sanctum updates

- Better compliance tooling for audit logs and data management

The framework’s vibrant community, extensive documentation, and official partnerships ensure it stays ahead of emerging threats.

Making the Choice: Security and Compliance Start Here

If you’re building a FinTech application in 2025, you face a fundamental choice: build security from the ground up, or retrofit it onto an insecure foundation later. The first approach is harder upfront but saves countless headaches (and millions in breach costs) down the road. The second is a gamble you can’t afford to take.

Laravel doesn’t just make the first approach possible—it makes it practical. With security baked into its DNA, compliance-ready features out of the box, and a developer experience that encourages best practices, Laravel turns FinTech security from a daunting challenge into a manageable reality.

The numbers don’t lie. With $6.08 million average breach costs in financial services, 38% customer churn after incidents, and regulatory fines reaching into the millions, the cost of insecurity is simply too high. Laravel offers a proven path to building secure, compliant, and scalable financial applications that protect both your users and your business.

In FinTech, security and compliance aren’t just checkboxes—they’re the foundation everything else is built on. And in Laravel, that foundation is solid.

Ready to build the next generation of secure FinTech applications? Laravel gives you the tools. The rest is up to you.