The statistics don’t lie: financial services have experienced a phenomenal 217% increase in Flutter adoption since 2021, making it the most rapidly expanding sector for this Google-backed platform. What began as hesitation from legacy banks has changed into wholesale adoption, with modern-day giants like Nubank, Société Générale, and even Google Pay itself at the forefront.

Flutter adoption is surging across industries, with financial services leading at 217% growth since 2021

The Security Issue That Flutter Addresses

Let’s be honest: secure banking app development has always meant sacrificing speed or security. Native development provided bulletproof security but needed to have different teams for iOS and Android, doubling costs and timelines. Cross-platform solutions set efficiency on the table but usually miss the banks’ ironclad security requirements.

Flutter turns this equation around completely. Whereas interpreted frameworks, which execute on virtual machines, leave room for attack vectors in JavaScript-based solutions, Flutter directly compiles to native ARM code, closing down those attack vectors. That means your sensitive banking code executes as quickly and securely as it would be written in Swift or Kotlin, but with a common codebase.

Flutter architecture diagram showing the Framework, Engine, and Embedder layers that enable cross-platform mobile app development

How Flutter’s Architecture Keeps Your Money Safe

The sorcery is in Flutter’s three-layered security strategy. The platform-specific embedders at the core manage sensitive tasks such as biometric verification and secure storage via iOS Keychain and Android Keystore support. The C++ engine layer provides rendering and system event handling without leaking sensitive information to upper-level code. Last, the Dart framework layer is protected by robust typing that intercepts possible vulnerabilities at compile time, not at runtime.

This architecture allows your banking app to safely store encrypted credentials, use certificate pinning for API requests, and take advantage of hardware-backed biometric authentication. all without sacrificing the development pace fintech startups require to stay competitive.

User interface of a modern mobile banking app showing balance, transaction history, activity overview, and payment confirmation screens

Real Success Stories from the Banking Trenches

Nubank’s transformation speaks for itself. Latin America’s biggest digital bank, with more than 48 million customers, made Flutter its core mobile tech following rigorous testing. The payoff? 30% higher merge success rate than native platforms and 600% quicker pull request processing. Months-long processes now debut in weeks; they released Life Insurance in three months flat after embracing Flutter.

But Nubank is not the only one. Société Générale developed Europe’s first Flutter banking app, allowing corporate customers to control multiple businesses on one device while seamlessly integrating with heritage banking systems. The app won the Tagline Awards’ Best Finance App, demonstrating that Flutter can provide winning user experiences in addition to enterprise-level security.

While that is happening, Google Pay uses Flutter for certain features, leveraging the same security practices that safeguard billions of transactions every day. If Google trusts Flutter with its payments infrastructure, it sends a strong message to the banking sector.

The Performance Advantage That Matters

This is what distinguishes Flutter from other cross-platform options: Skia rendering engine produces 60-120fps performance, which gives banking apps the smoothness of native apps. No more janky transaction flow animations or slow biometric authentication screens.

This performance is not hypothetical. Development teams say Flutter apps cut development time 20-50% compared to native app development on their own, without sacrificing the responsive character that customers from banks expect. Where milliseconds count for transaction approval, this performance benefit translates to a competitive advantage.

Hierarchical widget tree diagram illustrating a basic Flutter app architecture with MaterialApp, Scaffold, and child widgets

Security Features That Actually Work

Banking apps developed with Flutter enjoy layers of security and can interact with one another:

Hardware-Level Protection: Flutter effortlessly integrates with the Secure Enclave of iOS and the Hardware Security Module of Android, so encryption keys never reside in software-accessible memory. Your customers’ biometric information and payment tokens are still secure even if the device is hacked.

Code Obfuscation: Flutter’s build process can obfuscate class and function names automatically, significantly increasing the difficulty of reverse engineering. Paired with AES-256 encryption for the storage of sensitive data, this offers several obstacles for potential hackers.

Safe Communication: Integrated support for certificate pinning and TLS 1.3 enforcement allows banking applications to stop man-in-the-middle attacks without the need for custom networking code. The framework includes secure API communication out of the box.

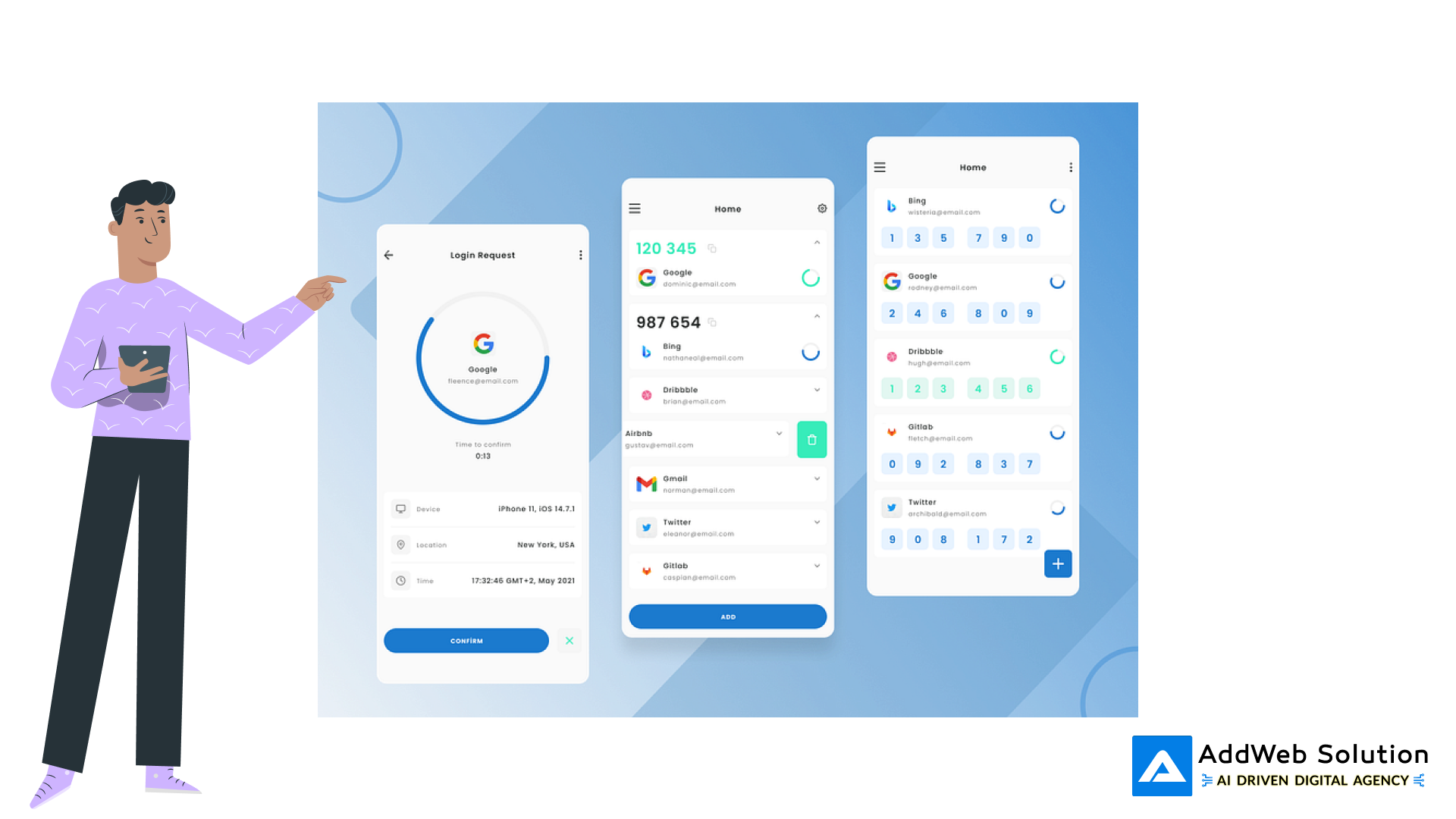

Mobile authentication app interfaces showcasing secure login confirmation and multi-factor authentication codes for multiple services

The Business Case Is Compelling

For banks, Flutter provides quantifiable ROI:

– One development team rather than distinct iOS and Android teams

– 40% decrease in testing efforts (as observed with HDFC Securities)

– 90% cut in code duplication (Nubank’s experience)

– Improved user experience on both platforms, lowering support complexity

But most significantly, Flutter allows for swift feature deployment. For fintech, the speed to respond to regulatory updates or competitive threats can be make-or-break for market leadership. Flutter’s hot reload and shared codebase result in features being launched on both platforms at the same time, keeping banks ahead of challenger fintech firms.

Turn Flutter into secure digital banking experiences

Pooja Upadhyay

Director Of People Operations & Client Relations

Best Practices of Implementing Banking Apps

Major banking institutions implement well-established security trends with Flutter:

Multi-Layer Authentication: Pairing biometric authentication with device integrity verification through libraries such as `local_auth` for fingerprint/Face ID and root detection based on the platform.

Secure Data Architecture: Implementing `flutter_secure_storage` for secure credentials while using additional AES encryption for vital financial information. This provides defense-in-depth in case one layer is breached.

Compliance-Ready Development: Flutter’s design enables GDPR, PCI-DSS, and other compliance needs via its secure-by-design philosophy and end-to-end audit trails.

The Future Is Already Here

The trend is clear. 38% of startups created post-2021 leverage Flutter for cross-platform development, while only 23% use React Native. Financial services adoption continues to grow, with Flutter becoming the de facto standard for new bank apps.

This change is a paradigm shift in how banks think about mobile development. No longer do security and speed have to be against each other; Flutter facilitates both at the same time. Banks can provide consumer-grade user experiences with enterprise-level security, a juxtaposition that was not possible with older methodologies of development.

The question isn’t whether financial services will adopt Flutter’s how quickly traditional institutions can adapt to compete with the Flutter-powered fintech companies already disrupting their markets.

For financial institutions still relying on legacy mobile development approaches, the window for competitive advantage is closing. Flutter isn’t just a development framework; it’s become the foundation for the next generation of secure, scalable financial services.