The integration of AI development is transforming trading stocks with new opportunities for maximizing profits from trade quicker than traditional methods could ever achieve. It has unrivaled computing and intelligent decision-making capabilities based on massive data sets. Even as an app that trades stocks using Artificial Intelligence, it will help investors and traders in the dynamism of the global stock market to make the most of lucrative opportunities while reducing risk at the same time.

By constantly analyzing stock prices and processing vast amounts of unstructured data, financial institutions will gain valuable insights into complex trading possibilities that can assist in making immediate buying and selling decisions.

It’s no secret that investing in the stock market is among the most effective methods for making money. However, success in the stock market is only someone’s cup of tea. Everyone has been privy to stories of the one side: people made billions of dollars in a matter of hours and, on the flip side, lost all their wealth in the same period.

What Is Stock Trading?

Stock trading involves the purchase and sale of shares of companies to earn money from price fluctuations.

“Stock Trading” refers to any transaction involving buying or selling stocks. However, it is also used to describe short-term investments made by active investors. Stock trading can be challenging and risky, but educating yourself can reduce risk and increase your chances of success.

Don’t miss out on the AI revolution! Partner with us for game-changing Artificial Intelligence Development Services.

Pooja Upadhyay

Director Of People Operations & Client Relations

Types of Stock Trading

Stock trading and those who conduct it are available in various forms and employ numerous strategies and methods. Stock trading is generally classified according to the preferred holding time, also called a time horizon.

Long-term trading involves purchasing and holding a firm’s shares for extended periods, typically a few years or even decades. The purpose of long-term trading is to profit from the expansion of the business as time passes and earn dividends from the shares. Long-term buy-and-hold traders are usually classified as investors. However, they can also be referred to as position traders.

Conversely, short-term trading involves purchasing and selling shares in a short time, typically just a few days or weeks. Short-term traders aim to earn quick cash by profiting from the market’s fluctuations. Day traders operate on an intraday time horizon, trading multiple times in a day or a few days. Swing traders have more of a long-term view, seeking trends and a trend for months or even weeks.

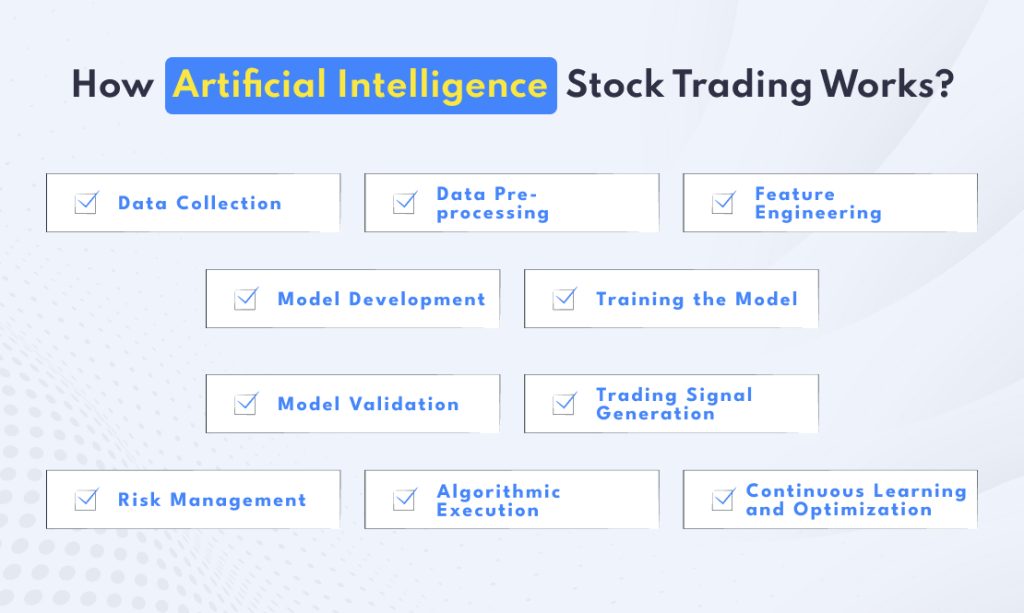

How Artificial Intelligence Stock Trading Works?

AI software for trading stocks is nothing more than applying sophisticated algorithms and machine-learning methods to study various aspects, such as financial data, detect patterns, and make trade-related decisions without human intervention.

Data Collection:

AI stock trading platforms start by acquiring vast quantities of financial information from various sources. This includes historical stock prices, company financial statements, economic indicators, news articles, social media comments, and other relevant data.

Data Pre-processing:

The collected data is processed to cleanse and arrange it to facilitate analysis. This involves removing noise, removing incomplete data, and standardizing information to guarantee accuracy and consistency.

Feature Engineering:

At this point, essential features are gathered from the processed data to depict various market elements. These features could include moving averages and volatility, trading volume, news sentiment scores, and other indicators.

Model Development:

Machine learning models, such as those used to analyze the richness of data and create predictions using AI algorithms, are popular. Random forests, decision trees, support vector machines, neural networks, and Deep Learning architectures are a few examples of popular models.

Training the Model:

The historical market data are divided into two sets to develop the AI model: a training set and a test set. The model is then trained on the training set to spot patterns and connections between the features and price changes.

Model Validation:

After the model has been trained, its performance is assessed using a test set to verify that it can apply to data that is not seen. This test helps determine the accuracy of the model and its effectiveness in predicting outcomes.

Trading Signal Generation:

After the AI model has been developed and verified, it creates trading signals based on real-time market data analysis. These signals determine whether or not to buy, sell, or even hold a particular financial instrument or stock.

Risk Management:

AI trading systems for stocks incorporate risk management strategies that limit the risk of potential losses. Risk management algorithms can alter the size of a position or stop-loss limits according to the market’s conditions and risk tolerance.

Algorithmic Execution:

If the strategy for trading involves automated execution when the strategy is automated, the AI system is directly connected to the broker platform or market exchange to perform trades. This process is called algorithmic or automated trading.

Continuous Learning and Optimization:

AI Stock trading software is usually built to learn and adjust to changes in market conditions continually. This could mean periodic updates to the model and the inclusion of new data sources to aid in better decision-making.

Understanding that AI trading systems for stocks need to be more foolproof and have inherent risks is crucial. Market conditions are unpredictable, and past results do not necessarily guarantee future performance. Human oversight, risk management, and continuous surveillance of AI systems are essential to ensure efficiency and minimize potential disadvantages.

What Are AI Trading Signals AI Stock Trading?

AI signals for trading are signals or alerts generated by AI algorithms that provide traders with important information and insight into the stock market, allowing them to make better-informed investment decisions.

AI trading signals are created using different AI methods, such as machine learning and natural language processing. Learning methods allow AI algorithms to analyze vast quantities of data, including historical price fluctuations and financial reports, news articles, and social media sentiment analysis-information that traders may overlook due to the limitations of their cognitive processing capabilities or sensory perception. When an algorithm processes this data, it can reveal patterns or trends that humans might be unable to discern.

Artificial Intelligence algorithms analyze information to find trading opportunities and produce signals accordingly. These signals indicate the decision to purchase stocks, sell them, or hold them, as well as the best starting and ending points. By taking advantage of market inefficiencies using AI trade signals, investors can dramatically increase the profitability of their businesses.

One significant benefit of AI trade signals is that they can eliminate human emotion from their trading processes. Human traders are often affected by greed and fear, which cause them to make uninformed trading choices; artificial algorithms don’t suffer from these emotions and make more objective and rational decisions.

AI trading signals provide further time-saving and energy-saving benefits to traders. Rather than spending hours studying intricate market data or charts, traders can count on AI algorithms to manage this aspect of their trading strategy, freeing them to focus on managing risk and diversifying portfolios.

However, traders must keep in mind that it is true that AI trading signals are not able to ensure 100% accuracy in predictions. However, AI algorithms are highly sophisticated and are based on previous data patterns.

Benefits of AI in Stock Trading

In recent years, the field of Artificial Intelligence (AI) has experienced an exponential expansion across many sectors, and stock trading is no exception.

Enhanced Data Analysis

AI for stock market trading has many benefits, including its capacity to process large amounts of data in real-time. Traditionally, traders spend long hours analyzing financial reports, charts, and market trends before handing over to AI algorithms that can process the information faster by quickly identifying patterns or trends humans overlook. This enables traders to make better choices based on precise and current data.

Increased Efficiency

AI-powered trading systems accomplish tasks more quickly and effectively than human traders. AI software, for example, can complete trades in milliseconds, an incredible benefit in markets where split-second decisions can make an enormous difference. In addition, by automating repetitive tasks, AI trading systems save traders time and energy, which they can use to develop strategies and analyze instead.

Improved Risk Management

Stock trading is a risky business that must be carefully managed. Artificial Intelligence can assist traders in identifying opportunities and risks by studying the past and trends in markets and more precise risk assessments that allow traders to limit losses by taking different factors simultaneously. In addition, AI algorithms can monitor the market’s conditions in real time and perform trades based on predefined risk management strategies.

Enhanced Trading Strategies

AI algorithms can be taught from previous data and adapt to changes in market conditions to constantly improve and refine trading strategies. With the help of machine learning techniques for stock market strategies, AI can identify profitable patterns and adjust strategies to suit them. This adaptive nature helps traders keep ahead of the curve and profit from market opportunities that otherwise would be difficult to spot.

Emotion-free Decision Making

Human emotions can influence judgment and result in uninformed decisions while trading stocks. Insecurity, fear, and other emotional reactions could influence decisions made during stock trading sessions and cause costly errors.

AI makes decisions without emotional repercussions based purely on data and established rules. This eliminates emotions and makes it easier for traders to remain committed to their strategy even in volatile market conditions.

Back testing and Simulation

AI can perform thorough backtesting and simulations of trading strategies based on historical data. This allows traders to test the effectiveness and profitability of various strategies before applying them to real-time trading. Simulating various scenarios also gives traders insight into their plans’ potential risks and benefits, allowing them to make better-informed decisions.

Scalability

AI-powered trading platforms can process massive amounts of data while trading on various markets, allowing traders to explore many possibilities and diversify portfolios. AI can effectively monitor many assets, sectors, and markets to maximize every trading opportunity.

How Artificial Intelligence Transforms Stock Trading?

With unbeatable computational capabilities and intelligent decision-making capabilities based on massive amounts of data sets, the role of AI software development in trading stocks opens up new opportunities to improve trade margins faster than traditional methods could offer.

In today’s constantly changing stock markets, in which time is a precious asset for many investors and traders, using AI-based trading is a great option, whether in the form of a stock trading application that allows you to profit from opportunities while reducing risks. Financial companies can gain valuable insights into the complexity of trading possibilities that will enable real-time purchase and sale decisions by continuously analyzing the prices of stocks and processing massive amounts of unstructured data.

AI Use Cases in Stock Trading

Trading in complicated and ever-changing marketplaces can become complex and tedious, requiring traders to continually discover ways to gain an advantage and make well-informed choices to maximize profits. With the advancement of AI technology, artificial intelligence (AI) has become an influential asset in trading stocks, changing the way traders work while providing new possibilities.

Predictive Analytics

Predictive analytics is among the most efficient uses of AI in stock trading. By analyzing vast amounts of historical data, AI algorithms can quickly detect patterns that human analysts might ignore and use the information to formulate precise forecasts of future stock prices. This enables traders to make more informed investment choices with greater precision and understanding. AI-powered predictive analytics have the potential to dramatically improve trading strategies, reduce risk, and increase overall profit.

Sentiment Analysis

AI can play a vital role in the stock market by performing sentiment analysis. Through analyzing news blogs, social media posts as well and other sources to determine the sentiment of individual stocks or the entire market and the overall market, AI algorithms can gauge the public’s mood in real-time, providing traders with valuable information about the behavior of investors as well as giving a better knowledge of market sentiment as well as investor behavior so they can make more informed choices and leverage market sentiment to benefit.

Algorithmic Trading

AI has revolutionized the process of algorithmic trading. Algorithmic trading involves using pre-programmed trading guidelines to perform trades automatically following predefined rules and with AI offering traders sophisticated algorithms that can adapt to changing market conditions and make trading decisions in real-time. In addition, these advanced AI-powered algorithms can handle vast quantities of data processing with speeds humans can’t achieve; this automated trading improves efficiency and reduces the risk of errors and emotional repercussions of trading.

Risk Management

Effective risk management in the stock market is crucial to safeguard investments and limit losses, with artificial intelligence (AI) playing a vital part in this. By analyzing historical data and identifying possible risks, AI algorithms have proven helpful in managing risk by analyzing market volatility, liquidity indicators, and other indicators that could be used to formulate strategies for reducing risk.

Portfolio Management

Optimizing your investment portfolio is a complicated task that requires a deep understanding of market dynamics and individual stocks. Artificial Intelligence can aid traders in managing their portfolios by analyzing vast amounts of data and offering insightful suggestions. AI algorithms can help identify the most effective strategies for asset allocation, analyze the performance of individual stocks, and provide ideas for diversification. This can help traders make informed choices to get the most value from their portfolio investments.

Trade Execution

AI has revolutionized the execution of stock trading trades. Thanks to AI algorithms, traders can now execute trades at the best prices without much slippage. AI-powered trade execution systems analyze the market’s liquidity, order book information, and other elements to determine the optimal time to execute trade orders. This automated process helps save time and boosts efficiency while reducing transaction costs.

Conclusion

Stock market trading is experiencing a significant technological change due to the advent of AI (AI). As a reputable Artificial Intelligence Development Company, we know AI’s revolutionary potential in stock trading. AI for trading stocks is highly accurate in its predictions while providing reduced performance and lower costs than conventional techniques. However, it is crucial to recognize the possible negatives of relying on AI strategies for stock trading. However, keeping an equilibrium between AI technologies and human judgment is vital.

Recent advances in AI algorithms and models like Deep Learning, Natural Language Processing, Reinforcement Learning, Sentiment Analysis, and Quantum Computing have opened the way for more precise and accurate informed investment decisions based on data. As the world of finance is constantly changing, adopting AI isn’t just an option but an essential requirement for investors who wish to increase their profits while minimizing risks. If you are also looking to build a more substantial investment portfolio that is risk-adjusted, consider utilizing AI models and tools to determine the price of stocks with greater precision.

Ready to Innovate? Hire an AI Development Expert to Take your Company to the Next Level and Unlock New Possibilities.

Pooja Upadhyay

Director Of People Operations & Client Relations