Custom Lending Software Development Company With Proven Expertise

AddWeb Solution brings you the complete gamut of IT solutions specially created for the lending industry. Our custom lending software development company simplifies loan management, improves risk assessment, and helps collect debt. Starting from debt collection platforms, credit scoring tools, and merchant cash advance systems, our expertise encompasses commercial lending software, mortgage solutions, loan management systems, auto financing, and much more, equipping your business for adequate growth.

Tech-Efficient Lending Software Development Services to Empower Business

P2P lending platforms connect people with specific financial needs. Opportunities abound for borrowers seeking funds and lenders seeking to gain returns. These platforms provide users with a seamless and user-friendly interface that enables easy management of loans and investments.

Empower Financial Growth Through Digitalized Lending Solutions

Explore more options with crowdfunding, P2P lending, and, as well as business lending on online platforms. With AddWeb Solution’s innovative series of lending platforms, we bring about new horizons and an opportunity to get into new finances designed with the primary aim of growing and being successful.

- P2P Lending u0026amp; Borrowing

- Loan Origination Software

- Loan Management Modules

- Crowdfunding Platforms

- AI-Powered Tech

- Centralized Database

Peer-to-peer lending brings the borrowers directly to the lenders and bypasses conventional financial institutes. The whole process saves a lot of costs. It reduces the expenses of fetching money and interest provided on loans versus the same process in financial institutes, which processes faster, too. The open financial platform facilitates a dependable, truthful, and trustworthy ecosystem where a person or business entity can easily borrow and lend without requiring an intermediary.

Loan Origination Software (LOS) streamlines the loan application process from application to closing. LOS can automate workflows, offer real-time tracking, and handle documents that can ease the underwriting, credit scoring, and approval process. LOS makes the user experience more effective, reduces processing times, and minimizes errors. Financial institutions and lenders are empowered to provide fast, reliable services to the borrower.

Loan Management Modules comprehensive loan portfolios, from disbursement to final payoff. Loan Management Modules automate payment scheduling, compliance monitoring, and customer communications with proper organization, which results in the smooth operation of the institution. Minimal risk is incorporated into the management process, simplifying immediate adjustments with real-time insights in customizable settings.

Platforms directly give the power to businesses and individuals to access a large pool of investors. Crowdfunding allows campaigns to share stories, attract supporters, and collect funds without traditional loans. Our custom lending software development company’s crowdfunding provides the ability of a community-driven investment alternative to help projects get some exposure, validate ideas, and build a loyal network for long-term success.

AI-powered technology introduces revolutionary changes in lending due to advanced data analytics, predictive modeling, and decision-making automation. Using analysis of borrower behavior and credit patterns, AI creates a faster and more accurate lending process. Fraud detection and tailoring lending solutions enhance their provision and can satisfy different borrower requirements to promote efficiency and build trust in a process or institution.

It thus becomes essential for safe and efficient access to all lending data stored in central databases. The departmental systems coordinate efficiently in this manner and achieve much more accurate data; minimal duplication of efforts leads to the ready availability of every borrower’s immediate profiles, transaction histories, and loan statuses. It makes a lender’s decision process effective with enhanced customer service optimized through the entire process involved in lending.

Empower Your Financial Institution with Digital Loan Software Solutions

Our services will help you get the most from your app. Create solutions that are business-oriented and meet user expectations. Our expertise is in creating customized automotive finance software solutions that optimize loan approval processes.

We have developed comprehensive loan servicing, management, origination, and decision-support systems solutions. These solutions are designed for customers to enhance operational efficiency and streamline workflows.

Expert Developers

Web Solution Delivered

Years of Experience

Tools and Technologies we use for Lending Software Development

We maintain open and reliable relationships and solid expertise and upgrade it to the latest technology in lending software development.

Why Partner with AddWeb for Lending Software Development Services?

AddWeb Solution stands out as a leader in lending software development. Selecting the right partner is crucial if you are looking for lending software solutions, such as p2p software, lending management, or loan origination.

Our expertise is in creating customized automotive finance software solutions that optimize real-time loan approvals, ensuring smooth operations.

Our Methodology for Lending App Development

We at AddWeb Solution follow a well-organized and tested flow for developing lending software.

Our Lending Software Development Portfolio

We proudly present our portfolio as the best proof of our expertise and experience in bespoke software development. Check it out!

SageFlow

Sageflow is a consulting company that builds business and improve organizational capacity. It provides strategic solutions for changing markets…

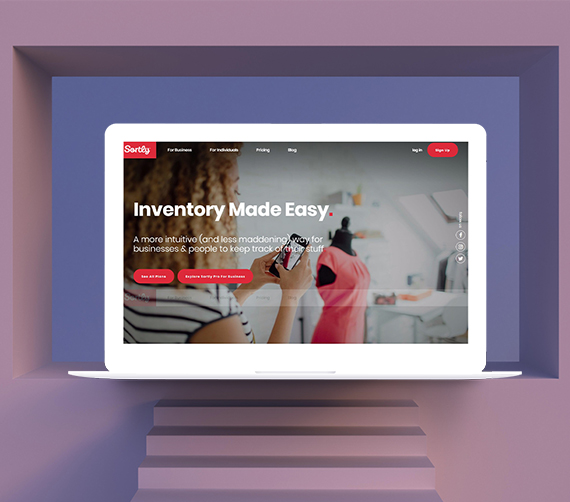

Sortly

Sortly is an inventory management application build in WordPress. Team AddWeb has integrated a bunch of futuristic features like online…

Our Lending Software Development Portfolio

We proudly present our portfolio as the best proof of our expertise and experience in bespoke software development. Check it out!

Sortly

Sortly is an inventory management application build in WordPress. Team AddWeb has integrated a bunch of futuristic features like online…

CBE

CBE International is a nonprofit website speaking for equality as explained Bible. CBE is a Drupal being the fundamental forte of #AddWeb, we recently…

Frequently Asked Questions

Get answers to some of the most common queries related to lending software development.

With dedicated development, the price per hour is the lowest, as the specialist is paid monthly and is not distracted by any other projects. The risk of the project needing to be completed on time is minimal.

A loan management system (LMS) is an automated software that provides back-office and forward-office support to banks and financial institutions for managing and servicing credit. These systems are now evolving into powerful AI-based machines hosted in the cloud that can improve bank performance and customer experience.

You should first distinguish between personal loans and corporate loans. Personal loans can be divided into four categories: unsecured loans, secured loans, fixed-rate loans, and variable-rate loans. Corporate loans are available in bridging, overdrafts, and term loans. We can provide you with the most suitable software solution based on the types of loans that your business offers.

Lending software services are helpful for various industries that engage in lending. This includes banking, financial institutions, credit unions, and mortgage companies. Microfinance organizations and peer-to-peer platforms are also included. This software can be tailored to the needs and regulations of any industry. It enables efficient and compliant lending.

Alternative finance is a term used to describe financial assets other than cash, digital currency, and equity. Alternative products include commodities, real estate, private equity, and venture capital. Alternative finance sources on the digital market include cryptocurrencies, equity crowd-funding, revenue-based solutions, big data, and online lending platforms.

Power your lending journey with our custom solutions!

What are alternative financial products?