Lending software is revolutionizing the way financial institutions manage their loans. It offers various features and abilities to streamline and simplify the lending process. Many software solutions can help lenders manage their loans.

Choosing the best software as per your business needs can be complex, especially with so many choices on the market.

Peer-to-peer loan apps are leading the charge in this new age of financial technology.

P2P platforms connecting lenders and borrowers directly are more than a fad. Recent statistics confirm their importance. The global P2P market is expected to reach $804.2 billion in valuation by 2030.

A P2P lending application could help businesses stay on the top in financial market.

This article will give you all the details about lending software development, including the features it must have and the technology stack needed.

What Is a Lending Application?

We sometimes need to borrow money for various financial situations, from mortgages to auto loans.

A money lending app is an online solution that lets you borrow money from any bank in your country.

This app will allow you to borrow money without any hassles, including from friends or family.

First compare interest rates and then determine which is best for you. It also allows you to see if your loan application has been approved. You can rest assured that all your personal information is protected, and you can repay the loan with the same application.

Not only do borrowers benefit from a lending app, but It also helps lenders reduce their operating costs, accelerate the KYC process, serve multiple customers simultaneously, and reach out to new markets.

How Does P2P Lending Work?

Peer-to-peer lending applications are digital platforms that enable direct loans between lenders and borrowers. This allows all parties involved to bypass traditional banking systems.

P2P lending applications offer a more streamlined alternative than conventional lending by establishing direct connections between lenders and borrowers. They also cater to a larger range of participants.

The P2P app lets borrowers outline their loan requirements, and lenders select and finance them. Credit evaluations, risk assessment, and interest rate setting are often part of this process.

This is a short explanation of how P2P lending applications work:

- Both lenders and borrowers can sign up on the platform and provide essential information.

- Borrowers must specify their loan requirements, including amount and purpose.

- The platform performs credit evaluations of borrowers and assigns a risk score or category to help lenders.

- Lenders evaluate available loans and decide which to finance. Lenders can choose to finance the entire loan or a portion of it.

- Interest rates are determined by the borrower’s risk profile or through a competitive bidding process between lenders.

- Borrowers must adhere to a repayment schedule that includes both principal and interest.

- The platform may deduct a fee from the repayments, but lenders receive their contributions back.

- The P2P platform will manage the situation in case of a loan default. This could include collection actions or tapping reserve funds.

Considerations Before Developing a Lending Software

Legal concerns and financial approvals should be the first things you consider when building a money-lending app.

Select a legal entity. Limited Liability Company and Corporation are the most common. Both protect you against creditors in bankruptcy or force majeure but are taxed differently.

An LLC is automatically taxed under the pass-through entity status, meaning all profits and losses will be reported on individual tax forms for its owners. A corporation, on the other hand, is taxed like a legal entity capable of generating income. Dividends are taxed in addition to corporate tax (which is not deductible) and taxes on profits. The profits of an LLC are based upon the agreement, while the corporate tax is calculated as on the number of shares each shareholder holds.

When you are ready to move forward, you must register your business name in the country of choice. Pay the required fees and follow all legal requirements. Also, come up with a catchy business name. If you register your business in the USA, ensure that your trademark name differs from your legal name. It should also be available on the uspto.gov trademark register.

You must also obtain the initial capital. Both the peer-to-peer lending app and your first loan will require this. Investors are usually attracted to these platforms only when users actively seek loans. So, you will need some money to get started before investor funds kick in.

Three popular methods are available to raise the initial capital.

- Initial Public Offering (IPO) or Initial Coin Offering: If you want to use cryptocurrency to raise money, an ICO is a great way. Launch an IPO if you’d prefer traditional financial instruments. Sell your stocks to secure your investments.

- Venture Capital: Create a business pitch and a plan to get the attention of VCs. You must give them a percentage of your business or pay a set amount plus agreed interest if they invest.

- Bank Loan: It may sound silly, but taking a bank loan is one way to raise funds to build a money-lending app. Many banks offer credit to various ventures. Creating a fintech product can be just as successful as any other.

Last, you must choose the bank holding your operating capital for peer-to-peer lending.

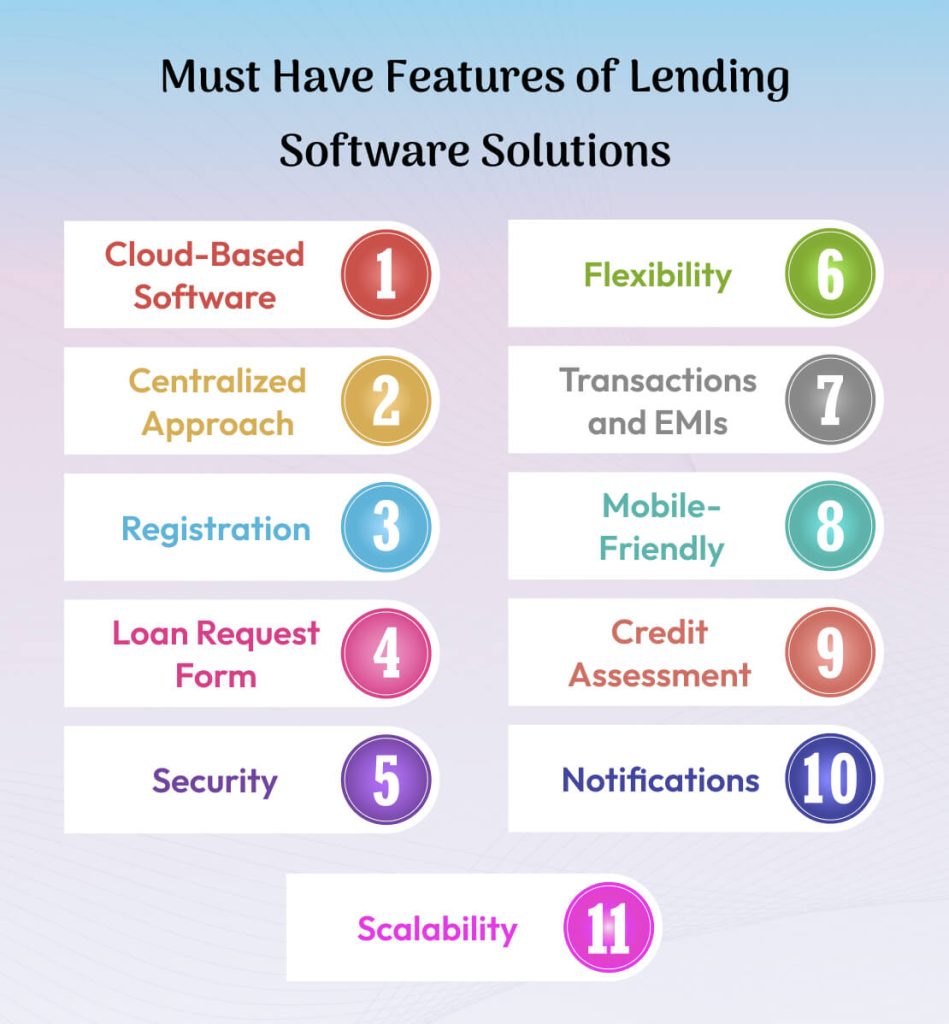

Must Have Features of Lending Software Solutions

A loan management software should include the tools necessary to streamline the loan process. Software should have the features required to complete a transaction faster and provide better analytical insights and customer information.

Your loan management system should have the following features to enhance borrower satisfaction:

Cloud-Based Software

Sometimes, businesses need an IT team to help implement new software. Cloud-based software can be beneficial in such cases. Cloud functionality allows for easy deployment of reliable loan management software.

It allows for quick implementation, flexibility in the software, and contact with the IT department at your service provider. These cloud-based software systems often include regular and automatic upgrades. Cloud-based systems give your team access to loan management software anywhere, and information is available faster.

Centralized Approach

A centralized storage system is essential to host the different stages of the loan lifecycle. In the lending industry, there are often not enough systems to work efficiently from the beginning until the end of a loan cycle. Small businesses need help to afford different systems to store and retrieve data from borrowers.

Software that offers a variety of loan management modules – from origination to servicing – will save your company much money each month. It will also give you a complete view of your applicant’s profile. You can see where the loan application is, who is handling it, and the relevant information from anywhere.

Registration

Almost all applications require users to register. To make your lending application stand out, you can:

- Allow users to browse and test the app’s essential features without registering.

- Users can login and register their accounts using an email ID, a phone number, or social handles like Google or Facebook.

At this stage, an easy and frictionless experience for the user is critical to a higher adoption rate.

Loan Request Form

This is the most essential feature of your app.

This feature should allow users to create their loan application, select the estimated repayment period, communicate directly with lenders, and check the status of their application.

Consider breaking down the loan application process into separate steps to guide users through the entire process.

Security

Lenders must follow best practices for data security when managing sensitive data from borrowers. Select a lending program that will allow your business to create centralized data storage, which people can access only with the proper permissions. As a lender, you should also ensure that the loan management software is compliant with industry standards and compliance measures.

Flexibility

Each lender has its way of running their business, and each company has its requirements. Selecting a dynamic loan management system that can be easily configured is essential. You can then decide what works best for your company and adjust the software to match its needs.

Transactions and EMIs

A borrower is required to pay EMIs that cover both the interest and principal to repay a loan. All transactions are saved for easy auditing and reference.

Mobile-Friendly

Today’s borrower wants to receive loans as quickly and efficiently as possible. Lenders can’t afford outdated software if they want to remain competitive. You need a loan management system to access from anywhere and on any device to stay updated with current trends.

Most borrowers have smartphones today, so having a mobile feature for your loan management program is crucial.

Credit Assessment

Accuracy in credit assessments is crucial to the success of any lending deal. It is, therefore, essential to use lending software that helps assess creditworthiness. The system must be able to pull information from credit bureaus to provide accurate information quickly. The best loan management software provides these integrations to increase efficiency and provide a complete view of the applicant’s credit score.

Notifications

Push notifications are best to inform users about upcoming due dates and payment schedules.

These features will make your app more appealing to your users.

- Reward points and ratings

- Chatbots

- Live Chat Support

- Discounts and Offers

- Reports that can be customized for everyone

Scalability

Every business aims to expand and grow its products and services. Many loan management systems have been hard-coded and need more scalable, making it difficult to support an expanding business. A good loan management system should scale with your growing business. Software should enable you to add new products and services to your business to meet market demands.

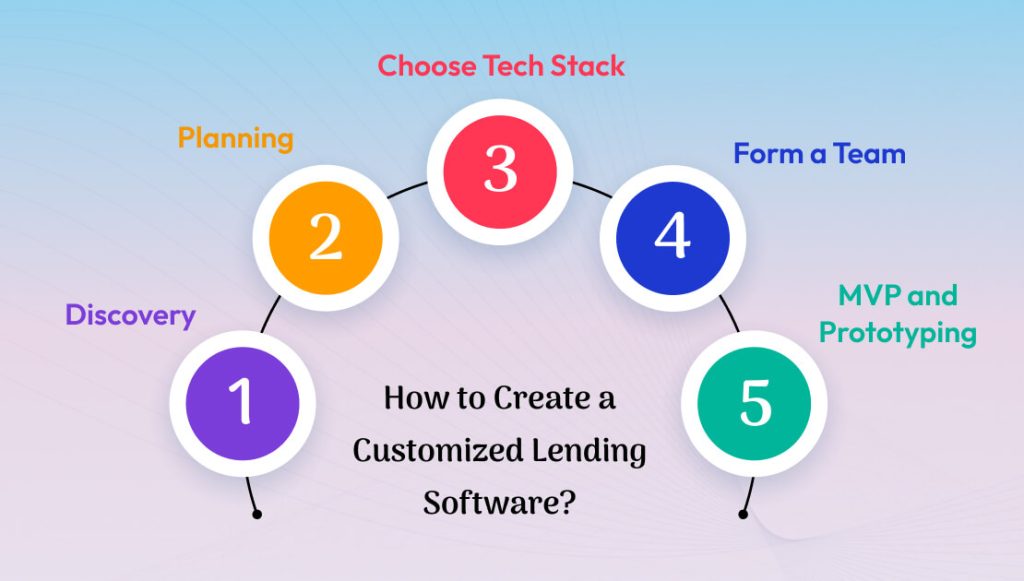

How to Create a Customized Lending Software?

Before building a lending application for your company, you must first understand the market and its expectations. List the different MVP (minimum viable product) features your app must meet, then choose the technology stack for cost-effectively building the features.

You must build a powerful app to lend money, as the FinTech competition is fierce.

The stages involved in building an app for money lending are listed below.

You must understand the market’s expectations to create an app such as Possible Finance. Then, list the MVP features you will use to meet these expectations. Finally, select a technology stack that is proven cost-effective and delivers the features within the timeframes.

Before starting engineering, here are the steps you need to take.

Discovery

Do some market research. Download a few popular apps (usually free), analyze their features, and see where they excel. Pay attention to negative comments, which may indicate a place for improvement and a Unique Selling Proposition for your product. Focus groups and questionnaires are great ways to gather opinions from the target audience. Then, you can list features for your app based on that research.

Planning

Discuss with your team the features you want to see implemented in your app. Select the most essential features for your users, then prioritize them within the MVP scope. Work with a team leader, business analyst, and project manager. This stage should conclude with a Scope of Work document (SoW), a roadmap, project deliverables and cost estimates, and a timeline.

Choose Tech Stack

Choose the best tech stack to develop fintech apps. Utilize your team’s technical expertise and the data gathered from competitor analyses. Consider aspects such as security, performance, and future scalability. Also, consider the ease of integration and adding new features.

Form a Team

Depending on your final scope and technology stack, it may be necessary to hire a lending app software development company, UI/UX developers, front-end and back-end programmers, iOS and Android programmers, QA specialists, and a project coordinator.

MVP and Prototyping

After the technology stack has been selected and the team assembled, the prototyping process can begin to produce a clickable, interactive prototype of the future app. Once you’re satisfied with the look and feel of the app, the team will build an MVP using the SoW document.

It’s not that you have to build an MVP. However, we recommend it to get the app out faster and gather feedback from users sooner. It helps you avoid investing in apps users don’t need or enjoy.

Benefits of Developing Lending Software for This Competitive Market

The need for lending software has resulted in increased demand for lending software development services as more and more businesses are planning to set their foot in this market.

Customers Feel More Satisfied

Fintech software has led to an increase in customer satisfaction across the globe. Clients can now easily access services with the help of easy-to-use interfaces. Customers no longer have to wait long in queues; transactions are efficient and transparent, and support is often digital and instant.

Fintech software is more than just speed. These applications offer personalized recommendations by analyzing real-time data and assessing each investor’s financial goals and risk appetite. The high level of customization encourages engagement between companies and their customers, resulting in higher customer satisfaction.

Simplified Loan Management Processes

Each loan is the culmination of an enormous amount of data and documents. These are scrutinized to arrive at sound decisions and ultimately to approve or deny a loan. In the past, lenders performed several time-consuming and complicated tasks to underwrite and originate a loan. A loan management system, however, can automate the document-gathering process, input data points in advance, and complete the underwriting process in minutes.

Loan servicing is not the same for all loans! Flexible and robust loan management solutions support various loan products in the same industry or within the same company. Making strategic decisions is more important than performing several manual tasks to stay afloat. Talk about a simplified process for loan management!

Single Data Source

You might have to use multiple software applications designed for a specific task. This can make it hard to generate reports and understand your business metrics.

Your data can be accessed in a single place with a lending platform. This provides a single source of truth. API integration connects your software with all your other programs. This will increase the value of your data. You can act quickly on data insights when you have a single source.

Some lending cores let you attach third-party applications, like payment processors or originators, to ensure that lenders remain in control. These features allow you to keep all your loan origination and servicing in one location. No need to switch programs. This allows for true digital transformation.

Improve Customer Relationships

Customer satisfaction is influenced by three factors: customer understanding, customer service, and customer technology. A mature loan management system can have a positive impact on all three.

- Understanding: Understanding customer preferences is a big part of understanding customers. In this case, some clients prefer to check their balances online, while others prefer to do so via the phone or text message. Zappos is one of the companies that has always been obsessed with “customer happiness.” They understand that catering to customer preferences will help them earn their loyalty.

- Examine Service: It is the most misunderstood term in every industry. Lending is no exception. It’s about more than someone willing to speak to you on the phone and make concessions. Amazon is an excellent example of a company that understands the importance of convenience. They offer a variety of products at your doorstep quicker than anyone else. In the lending industry, convenience can mean a smooth loan application process or a text message with a link for paying my loan each time it is due.

- Latest Tech: It is easy to discuss the benefits of a good loan management system. Clients prefer to check their account balance online rather than open a statement mailed. Who wants to receive more envelopes?

Easy Loan and Portfolio Management

Banks and financial institutions must better understand their loan portfolios and loans to improve service. It is necessary to categorize and group continuously, but this takes a lot of resources and time.

Cloud-based loan management solutions can automatically group and categorize loans according to their status, portfolios, and origin company. It allows loan officers to quickly identify and organize accounts, allowing them to provide better service.

If a customer asks for a loan to buy a business, the officer can quickly determine if the borrower is part of a group that has already paid their loan off or is in the “Bankruptcy Portfolio.” The information they receive allows them to tailor loan offers, set pricing, and improve loan management processes.

Streamlined Loan Servicing

Every lending business relies heavily on collections. In the traditional model, each collector is assigned a group of loans to search for. It takes too long and reduces the collector’s productivity.

Grouping the loans allows a collector to find them all in one location. The collector will only spend time looking for each loan individually. They can navigate between loans and perform any required tasks faster.

This feature will improve the productivity of any lending business or bank. It will pave the way for an exciting digital future within the lending industry.

Cost of Developing a Lending Software

You can estimate the cost of developing a P2P lending platform or a payday loan application based on factors such as the team size, the type of technology used, and the scope of the work. Here are the ranges for hiring a team across various regions around the world:

- North America: $50 to $250/hour

- South America: $20 to $75/hour

- Western Europe: $50 to $200/hour

- Eastern Europe: $20 to $100/hour

- Australia: $40-$170/hour

Quality of service also varies depending on where you are. The demand for top talent in the US is much greater than the supply. Therefore, bolder entrepreneurs prefer to find loan lending app development offshore. They find that Eastern Europe is the most cost-effective place to outsource.

The Key Takeaway

Money lending apps are popular these days, especially if they’re well-prepared. Traditional banks are one of many options for people who need a loan. They also want simpler and easier options.

Speak to us if, like so many startups, you are planning to invest in P2P lending software development. You can improve your customer service by selecting the right lending software. Take your time and find the perfect fit for your institution.

AddWeb Solution will create a digital solution that is innovative for you. We will take all the technical burden off your shoulders to create the best solution your customers love.

To Get an Instant Quote for the Lending Software Development, Feel Free to Reach Us

Pooja Upadhyay

Director Of People Operations & Client Relations