We use mobile apps for everything. Using apps to get short-term credits and small loans is now more popular than ever, and the number of people using such apps is also rising.

One of the biggest examples is MoneyLion. The app enables users to get short-term loans. And users are utilizing the app well.

Naturally, many businesses want to build such apps with the help of a mobile app development company. And if you are a business looking to capitalize on the chance, you may have many questions about it.

How to build the app?

How much does app development cost?

How to hire reliable mobile app development services?

These are some of the questions. As a mobile app development company, we get all these questions with almost every project.

That’s why we decided to publish this blog to help you develop cash advance apps like MoneyLion and others.

What Are Cash Advance Apps?

Instant cash advance apps-often called ‘cash advance apps’-enable users to access their earnings before payday, depositing the money into a designated checking account.

Most apps like MoneyLion offer their services for free, while a few may impose a modest fee. Many of these apps do not burden users with interest charges. Cash advance apps are designed with user convenience in mind.

Any fees that need to be paid with the app are repaid at the end, making them a practical alternative to traditional payday loan programs and credit cards. The apps are accessible on various platforms and users can access it on any device.

Best Cash Advance Apps: Key Facts and Figures

The cash advance app market is increasing, with significant expansion on the horizon. Here’s a look at some key statistics that highlight this trend:

- Market Growth: By 2032, the global cash advance service market is projected to reach $138.5 billion, up from $73.7 billion in 2022. This growth represents a compound annual growth rate (CAGR) of approximately 6.6% from 2023 to 2032.

- Quick Access to Funds: Cash advance apps provide users fast access to funds, often instantly or within a day, making them a convenient financial tool.

- Merchant Cash Advance Market: The global merchant cash advance market is also on the rise, with predictions that it will reach $26.3 billion by 2029. This represents an annual growth rate of about 5.03% from 2019 to 2029.

These statistics underscore the increasing popularity and utility of cash advance apps for individuals and businesses. Next, we’ll dive into how cash advance apps work and what you can expect when using them.

How do Cash Advance Apps like MoneyLion Work?

Cash advance apps provide a convenient way to borrow money, typically charging interest only on the amount you borrow. While no hidden fees exist, some apps may require a monthly subscription or membership fee. These apps vary in function; some operate similarly to online lenders, while others resemble mobile banking services. In addition to short-term loans, many apps offer features like overdraft protection.

To find the best cash advance app for your needs, it’s essential to research and compare different options. Though each app is unique, they generally follow a similar process:

1. Application Process

The first step is to complete a short application, which helps the lender assess your eligibility. You’ll typically need to provide basic personal details, employment status, and bank account information. Most apps require you to link your bank account to their platform, enabling them to make direct deposits and withdraw funds on the due date.

2. Application Review

Once you submit your application, the app evaluates your creditworthiness to determine if you qualify for the requested amount. This process usually takes about five minutes, and you’ll receive a decision quickly via email or push notification.

3. Receiving Funds

You’ll be asked to review and sign a credit agreement if your application is approved. After that, the lender will deposit the funds directly into your bank account. The entire process is fast, and you can typically expect to receive the money within a few hours or by the next business day.

4. Repayment

Repayment is automatic. The lender will withdraw the loan amount and any applicable fees from your bank account on the due date. You must have enough funds to cover the repayment to ensure a smooth process.

Interesting Statistics

Over 30% of cash advance users reported not recommending the service to friends or family.

By understanding how cash advance apps work, you can decide whether this financial tool is right for you.

What Are Cash Advance Apps?

Cash advance apps, also known as payday loan apps or short-term lending apps, offer users a way to get a small amount of cash to cover immediate expenses. These apps provide quick access to funds to help you manage financial emergencies, make necessary purchases, or pay bills before your next paycheck arrives without resorting to high-interest loans.

How Do They Work?

Download and Install: First, download the cash advance app of your choice, such as MoneyLion or a similar app, from your device’s app store.

Create a Profile: Set up your profile by providing accurate details, including your name, banking information, employment details, and sometimes your credit score.

Eligibility Check: The app will run an eligibility test based on the information you provide to determine if you qualify for a cash advance.

Apply for a Loan: Once your profile is approved, you can apply for a loan. The amount you can request typically ranges from $10 to $10,000, depending on the app.

Review Terms and Conditions: Before finalizing your application, review the loan’s terms and conditions, including interest rates, repayment modes, due dates, and additional fees.

Approval and Disbursement: The app will process your request after submitting your application. Loans are usually approved within 1 to 7 business days, depending on the amount and the app’s terms.

Receive Funds: Once approved, the funds will be deposited directly into your bank account.

Repayment: Repay the loan, along with any additional fees and interest, by the due date to avoid penalties.

MoneyLion: An Overview of the Popular App

MoneyLion is a leading instant cash advance app that offers free access to instant cash payments, with a maximum limit of $250. It is one of the top choices in the cash advance app category.

It is useful in dynamic work scenarios when you require funds before your next paycheck arrives. However, the users must meet certain eligibility criteria to qualify for the $250 cash payout.

The borrowed money app amount will be repaid after your subsequent deposit, aligning with the due date. This repayment model is one of the ways through which the app generates revenue, ensuring continued service.

Top 15 Cash Advance Apps Like MoneyLion

Let’s understand the top 15 cash advance apps like MoneyLion in the market now.

1. Brigit

Like MoneyLion, Brigit stands out as an established app. It is designed to empower users to manage their finances when in need. Offering quick cash access of up to $250 without the hassle of credit checks or interest charges, it goes beyond simple solutions.

Brigit extends its benefits to credit building, expert financial insights, and more. This makes it a great companion for anyone with quick financial needs.

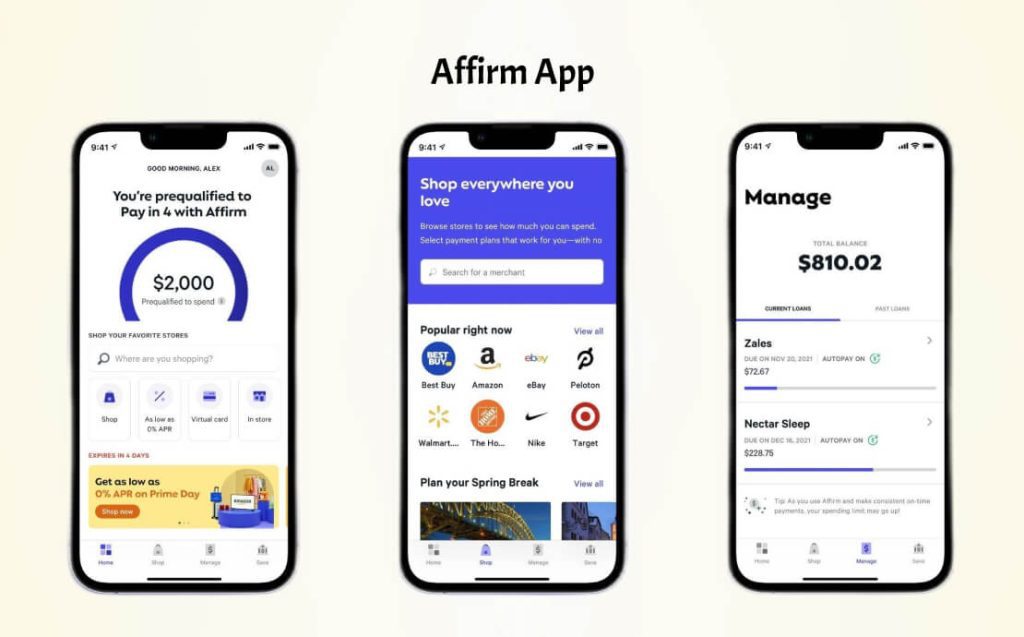

2. Affirm

Affirm breaks the mold of traditional finance programs. It introduces a remarkable and unique approach to acquiring desired items without depleting your funds.

Affirm users can make purchases without the looming specter of late fees or hidden costs.

Another element that makes the app super valuable is that it is easy to use, making it ideal for newcomers.

3. FlexWage

FlexWage streamlines paycheck management for both employers and employees. With FlexWage, users can avoid the headaches of paying and getting checks.

Employees can access their earnings on-demand with the app, and it offers the convenience of reloadable paychecks, too.

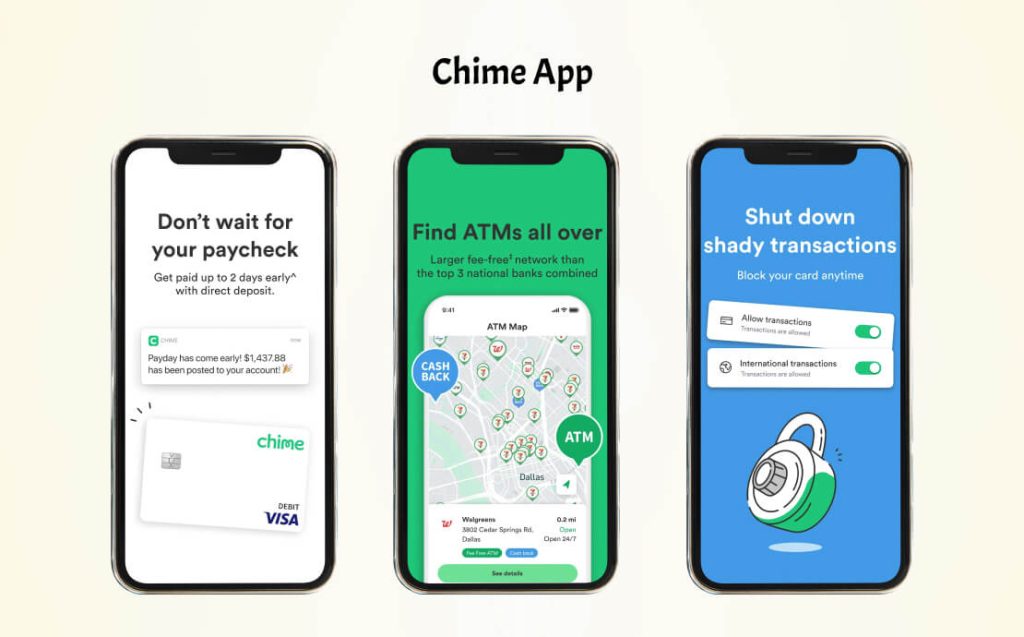

4. Chime

Another prominent player in the fintech realm, Chime, takes center stage by delivering free mobile banking services through its website and mobile apps. Making banking easier for individuals, it also provides a $200 fee-free overdraft option with the added flexibility of early payment.

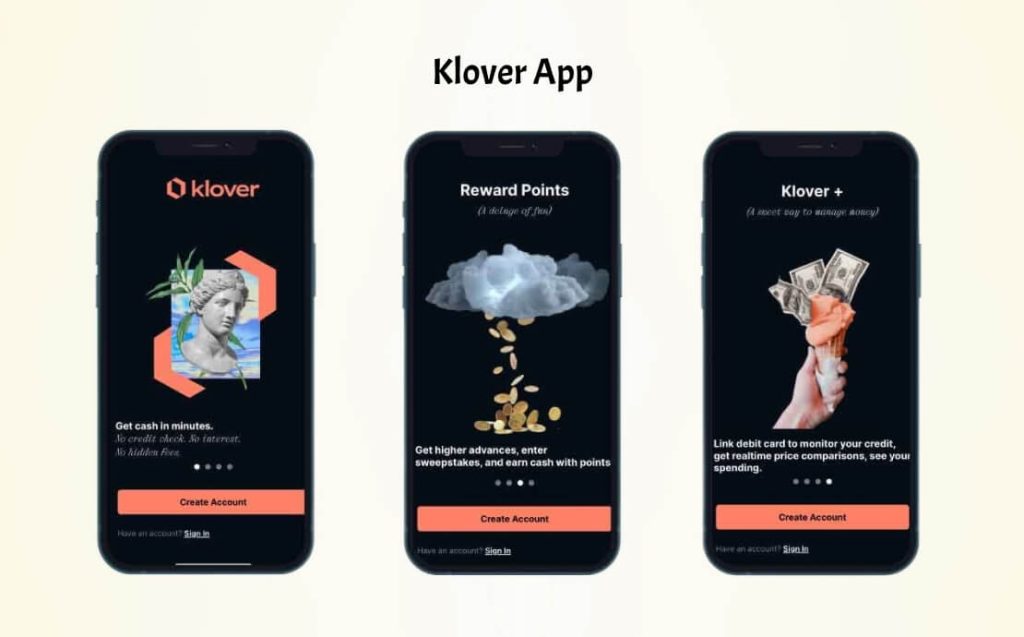

5. Klover

Like MoneyLion, Klover also provides its users with an option to get an advance of up to $250. The app also allows you to get points by completing simple tasks, such as answering a few questions.

Klover can also be used to improve the users’ credit score.

6. Rufilo

Rufilo is a registered NBFC (Non-Banking Financial Company) under the RGI, serving the Indian market.

It offers Instant Credit Lines, allowing you to secure a $2500 cash deposit to your bank account. Unlike its counterparts, Rufilo has a very stringent process to check the credits of its users.

The stringent may make it hard for some customers to use the app.

7. Dave

Dave specializes in providing rapid cash advances for urgent and future needs.

With a user base exceeding 5 million, Dave’s mobile app has been a catalyst in improving financial prospects through its innovative financial services.

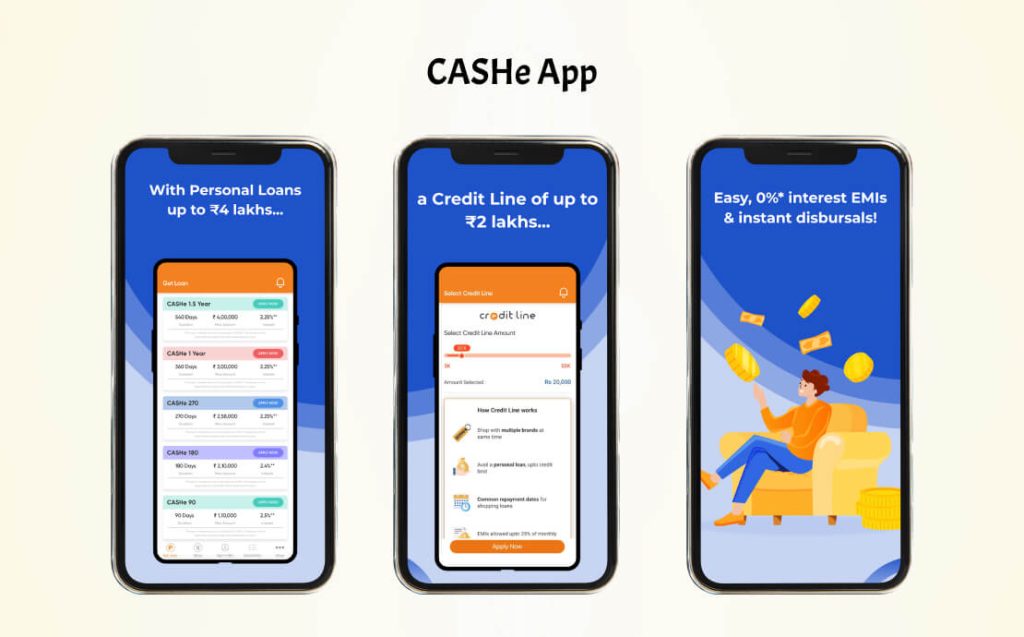

8. CASHe

CASHe stands as a personal loan app, extending instant cash loans ranging from $100 to $10,000 without the need for collateral or a guarantor.

Using a unique credit rating algorithm, it ensures rapid loan disbursal within minutes of approval. The repayment window spans 15 days to 6 months, with competitive interest rates.

CASHe is a great help for those in need of quick funds for emergencies, medical expenses, travel, or unforeseen financial challenges.

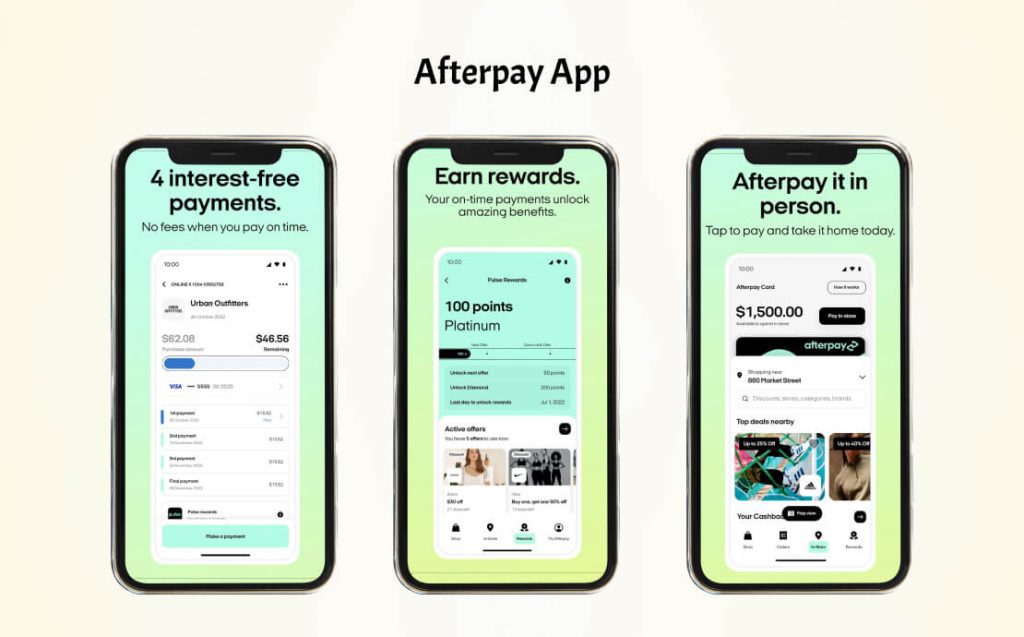

9. AfterPay

AfterPay follows the footsteps of MoneyLion and lets users buy now and pay later. After the initial payment, the remaining four installments are spaced evenly, and the purchase is dispatched quickly.

This app boasts off many features, shielding you from rising interest rates and providing seamless installment payments.

10. Pocketly

Pocketly app has been Tailored to meet the requirements of the youth of India. It offers a secure and expedited personal loan experience with a two-click signup, minimal KYC requirements, and rewards for punctual repayments.

The app’s interface gives access to its cash advance service. This is loved by the youth, who prefer quick and efficient app transactions.

11. Empower

Beyond cash advances, Empower offers various financial tools designed to help users take control of their finances. These include automatic budgeting features, personalized spend tracking, and tailored financial recommendations. Using these tools, you can build a healthier financial future.

Pros

- Empower does not require a credit check, making it accessible for individuals with varying credit histories.

- There are no interest charges on cash advances, a significant benefit over traditional payday loans.

- Users gain access to a suite of financial management tools, providing value beyond just cash advances.

- Depending on individual eligibility, the $250 cash advance limit may be more substantial than what MoneyLion offers.

Cons

- Empower requires users to have a linked checking account to qualify for cash advances.

- The service is only sometimes available; users must meet specific criteria to qualify for advances.

- Though there is no interest, Empower does charge a small fee for its cash advance service.

User Experience

The Empower app is known for its intuitive design and ease of use. Users can navigate through various features with ease, making the process of managing finances less daunting. The app’s user-friendly interface is especially beneficial for those new to personal finance apps.

12. Earnin

Earnin is unique among cash advance apps because of its community-focused approach. It allows users to access up to $500 from their paycheck before payday and operates on a voluntary tipping model, meaning users pay what they believe is fair for the service.

How it Works

To utilize Earnin’s cash advance feature, users must have a job where their paycheck is directly deposited into their checking account. After verifying their employment and income, users can withdraw a portion of their earned wages before payday. The process is transparent, with no hidden fees or interest rates.

Balance Shield Alerts

Earnin provides a “Balance Shield Alerts” feature that notifies users when their bank account balance falls below a specified threshold. This proactive alert system can help prevent overdraft fees and encourage timely cash advances only when necessary.

Pay It Forward

Earnin’s “Pay It Forward” system allows users to leave optional tips for others, fostering a sense of community and support. This tipping mechanism is entirely voluntary, and users can choose to contribute as much or as little as they like, depending on their experience with the service.

Pros

- Earnin does not charge mandatory fees or interest on cash advances, making it a cost-effective option.

- The app offers a higher cash advance limit than MoneyLion, providing more flexibility for users with more significant financial needs.

- Earnin’s “Cash Back Rewards” feature incentivizes users by offering cash back when using their debit card at participating merchants.

Cons

- Earnin requires users to have a checking account with direct deposit, which may only be feasible for some.

- A daily cash advance limit can be restrictive for users needing more significant amounts at once.

- The eligibility for cash advances is tied to users’ pay rate and employment history, potentially excluding some individuals.

Community-Driven Model

Earnin’s community-driven model sets it apart from other cash advance apps. It promotes a pay-it-forward culture and trust among its users, making the experience more personalized and socially conscious.

13. Possible Finance

Possible Finance is an app that provides short-term loans that can act as cash advances. It’s designed to offer financial assistance without the stringent requirements of traditional lending institutions.

How it Works

To use Possible Finance, users must link a checking account and meet specific criteria. After approval, users can receive a cash advance of up to $500. The app prides itself on its quick approval process and rapid fund disbursement, often within minutes.

Flexible Repayment Options

Possible Finance stands out with its flexible repayment plans. Users can repay their advances in instalments over up to eight weeks, which can be more manageable than a single lump-sum repayment.

Credit Building

While providing cash advances, Possible Finance also offers an opportunity for users to build credit. By reporting repayment behaviour to major credit bureaus, users can improve their credit scores by using the app’s services responsibly.

Pros

- No credit check is required to qualify for a cash advance, opening the door for a broader user base.

- The app integrates with a debit card and savings account, offering a comprehensive financial management experience.

- Finance’s cash advance limit of $500 may exceed what MoneyLion and other competitors provide, depending on the user’s eligibility.

Cons

- Cash advances are limited to those with a linked checking account, which may not be available to all potential users.

- There are eligibility requirements that users must meet to qualify for cash advances, which could exclude some individuals.

- Each cash advance has a fee associated with it, though it is generally lower than overdraft or late payment fees from traditional banks.

Additional Financial Services

In addition to cash advances, Possible Finance offers various financial services, including a debit card and a savings account. This makes it more than just a cash advance app; it’s a tool for overall financial wellness.

14. Ingo Money

Ingo Money is a versatile financial app that provides cash advances and additional services like check cashing and money transfers. It’s designed for users who need a multifaceted approach to economic management.

How it Works

To access Ingo Money’s cash advance feature, users must have a bank account or prepaid card and meet specific criteria. Upon approval, users can receive up to $500 in cash advances, with funds deposited quickly into their accounts.

Check Cashing Services

One of Ingo Money’s unique features is its ability to cash checks through the app. Users can take a photo of their check, and Ingo Money will process it, providing immediate access to funds without needing a bank visit.

Money Transfer Capabilities

Ingo Money allows users to transfer money to others, pay bills, and reload prepaid cards. These services make it a valuable app for users who require more than just cash advance functionality.

Pros

- No credit check is required to use Ingo Money’s services, making it accessible to many users.

- The app offers a higher cash advance limit than MoneyLion, which can benefit users with more significant financial needs.

- Ingo Money’s various financial services provide users with a one-stop solution for their financial transactions.

Cons

- Access to Ingo Money’s cash advance feature is limited to those with a bank account or prepaid card.

- Users must meet specific eligibility requirements to qualify for cash advances.

- A fee is associated with cash advances, although it is competitive with other services.

Comprehensive Financial Services

Ingo Money’s comprehensive suite of financial services makes it more than just a cash advance app. It’s a versatile tool for users who need to manage multiple financial tasks in one place.

15. Avant

Avant is primarily known as a personal loan company but also offers cash advances through its mobile app. It caters to users seeking considerable cash advances to cover unexpected expenses.

How it Works

Avant requires users to have a checking account and meet specific eligibility criteria to access its cash advance feature. Approved users can request up to $1,000, and the funds are deposited into their checking accounts within one business day.

Higher Cash Advance Limits

Avant distinguishes itself by providing higher cash advance limits than many other apps, including MoneyLion. This feature can be particularly advantageous for those facing sizable unforeseen costs.

Additional Financial Products

Avant offers various financial products, such as personal loans, credit cards, and debt consolidation services. This makes it an all-encompassing platform for users looking to manage multiple financial needs.

Pros

- Users are not required to undergo a credit check to access cash advances, making the service more inclusive.

- Avant’s array of financial services offers users more than just cash advances; they provide solutions for long-term financial planning.

- Avant’s cash advance limit is among the highest on the market, and it allows customers to receive up to $1,000.

Cons

- Avant’s services are only available to users with a linked checking account, potentially excluding some individuals.

- Eligibility criteria must be met to access cash advances, which may only be achievable for some users.

- Each cash advance comes with an associated fee, which is standard across the industry but still an additional cost to consider.

User-Centric Features

Avant’s mobile app is designed with user convenience, offering features like easy loan management, payment scheduling, and real-time alerts. These features enhance the user experience and provide high control over financial matters.

Must-Have Features of Cash Advance Apps Like MoneyLion

When developing apps like MoneyLion, it’s crucial to go beyond just the instant loan feature to capture your target audience’s attention. Incorporate a range of innovative features to outshine the competition.

Here’s a list of features you can ask your mobile app company to integrate into your payday advance mobile app:

1. Credit monitoring

Credit monitoring is a crucial component of any payday loan app. This feature empowers users to access their credit reports, scores, history, and more through a single mobile app.

It also serves as a security measure, notifying users of any suspicious activities, such as new account creation, through push alerts and emails.

2. Financial tracking

Many users turn to cash advance apps due to challenges in managing their finances . You can assist them in tracking expenses and offer insights to help reduce excess spending and increase savings.

You can introduce this as a premium feature providing expense tracking and personalized financial advice.

This will help you generate revenue for your business.

3. Financial education

Improving financial literacy is pivotal as many users struggle due to limited financial knowledge.

You can offer premium users access to financial education, covering topics like budgeting, money management, investments, debt management, etc.

This empowers users to make informed financial decisions and minimize futile expenses. And it will improve your brand image in the market.

Want to Build a Successful Cash Advance App like Moneylion with Advance Features?

Pooja Upadhyay

Director Of People Operations & Client Relations

4. Online banking services

You can streamline the user experience and access their banking details with your app by offering bank account management features. Make it easier for them to check their account balance, make transfers, generate online statements, etc.

This brings their banking activities within a single, efficient app. When your app becomes the go-to option for users for payments and finance management, it helps your business grow.

5. Personal loans

In addition to instant loans, enable users to obtain personal loans through the mobile app. Cover various personal loan purposes, such as paying off debt, home decor, medical bills, and more.

Work with reliable fintech mobile app development companies to create algorithms for interest rates, repayment periods, and application process.

6. Cashback rewards

Attract users by giving them cashback rewards, which is an enticing feature.

Reward actively engaged users with cashback and other incentives based on their transactions. Everyone likes a little extra money in their wallet, making this feature appealing.

When they get rewards for payments, they are more likely to use your app.

7. Credit building

You must understand that not everyone has a good credit score, which can hinder them in various situations, including loan applications.

Add a feature to help users enhance their credit scores.

You can also offer personalized help to improve credit score and secure loans directly from your app.

8. Personal finance tools

For an inclusive offering, integrate third-party tools into your mobile app to provide advanced features.

This minimizes resource management concerns and ensures accurate, interactive services with minimal errors.

Choosing a top-tier finance mobile app development company can reduce the risk of app failure.

How to Make Money with Cash Advance Apps

As you move forward with your fintech app development venture, you must explore strategies to enhance your cash advance app.

Here are the most popular ways to generate income via your app.

1. Transaction Fees

You can opt for a small fee per transaction or charge more for smaller transactions, allowing users to make significant payments for free. Debit a commission from their loan amount and transfer the remainder to their account.

2. Subscription Plans

Giving fixed-cost subscription plans with monthly charges is another option. Create different subscription tiers with varying features to cater to diverse user needs.

3. Freemium Model

The Freemium model is a popular choice for monetization. You can provide essential features for free and charge for premium functionalities. This lets you penetrate the market quickly and then start selling premium services.

4. Premium Support

Most fintech app users often seek professional assistance related to finance, investments, asset management, etc. You can offer advisory services from finance experts for a fee.

5. Sponsored Content

This is another popular model. You can work with financial institutions to list their services or content on your platform in exchange for a fee.

This can be a revenue source but may require industry experience for optimal results.

Costs to Develop a Cash Advance Apps like MoneyLion

Deciding the precise cost of developing a cash advance app like MoneyLion involves several factors that influence the overall cost. A deep understanding of these factors is essential for making well-informed budgetary decisions.

Here is what we do at AddWeb Solution As a mobile app development company when developing an app like MoneyLion to determine its cost.

The Platform.

The selection of the platform constitutes a pivotal factor in learning the development cost of an app like MoneyLion. While the difference in cost between developing iOS and Android apps is marginal, starting with Android is often useful due to its extensive user base.

UI/UX Design.

Another crucial factor is the quality of the app’s user interface (UI) and user experience (UX) design. The smoother and more visually appealing the app is, the higher the user retention rate. The budget allocation for cash advance apps like MoneyLion may change based on your app’s UX goals.

Development Team Size.

A dedicated team skilled in building apps like MoneyLion is another factor influencing the overall cost. Hire a mobile app development company rather than freelancers offering mobile app development services to ensure the necessary professional expertise and experience.

App Maintenance.

App maintenance expenses are an inherent cost element in any app development project. It ensures that the app performs well and stays up to date as per changing technologies. Check with your mobile app development company about the terms before hiring them.

App Development Company’s Location.

The location of the selected loan app development company also affects the overall cost a lot. Hourly developer rates in regions such as Asia and Africa are typically more efficient than those in the UK and the US, while the expertise remains the same.

Features and Functionalities

The app’s features and functionalities greatly influence the development cost. A budgeting app with a simplified feature list will be less costly, and the cost may increase with more features. However, the investment is justified in delivering an app enriched with diverse abilities.

Why Choose AddWeb Solution to Develop an App Like MoneyLion?

When it comes to selecting the right app development partner, AddWeb Solution stands out as a compelling choice.

Here’s a breakdown of the key factors that make us your ideal partner:

1. Team of Qualifie Professionals

With diverse skill sets and a commitment to staying ahead of industry trends, our team is well-equipped to create mobile apps like MoneyLion.

2. Customized Service Plans

We understand that every app is unique, and so are its Custom Web App Development Services requirements. Hence, we offer customized development plans tailored to the specific needs of your project, leaving no room for unexpected glitches or issues that could compromise user experience.

3. Advanced Development Tech Stack

AddWeb Solution uses advanced development tools to create the best apps for our clients. This is to ensure that your app meets the highest standards for functionality, security, and performance.

4. Timely Customer Service

We understand the value of keeping you in the loop and solving your concerns promptly. That’s we have a responsive customer service team to keep you informed about the project’s progress and solve your issues quickly.

5. Affordable Services

We believe that budget constraints should not stand in the way of achieving your app development goals. Our services are designed to adapt to any app development budget. We believe that top app development must be accessible to all.

6. Top Mobile App Development Quality

When you partner with AddWeb Solution, you are choosing top-tier mobile app development quality. We hold ourselves to the highest standards, ensuring that your app not only meets but exceeds your expectations. Our internal processes monitor the quality of the mobile app development services we offer.

Conclusion

Developing a cash advance app like MoneyLion requires great care and planning. Because such apps can impact users’ lives, businesses that want to hire mobile app development services must work with expert app development agencies like AddWeb Solution.

With years of experience and expertise to rely on, we have made a name for our services. You can check our portfolio to learn more about our services. In addition, we can also work with established and startup businesses like their primary mobile app development company.

If you are a business looking to develop such an app, speak to our client service team to build your strategy.

Top FAQs – Best Cash Advance Apps like MoneyLion

The time taken to develop a cash advance mobile app overdraft fees depends on factors such as the complexity of the app, the features of the app, whether the app is native, hybrid, or cross-platform, etc. Hence, the time taken can change from one project to another. The best way to understand the time is to check with our customer service team about your expected app features requirements.

Our mobile app development team at AddWeb Solution can help you with developing apps like MoneyLion. We have years of experience in the industry creating numerous apps for businesses from diverse industry sectors. And we also have the infrastructure and insights to develop apps like MoneyLion.

There are different means for cash advance apps like MoneyLion to make money. One of the popular ways is to charge a nominal fee for the services and transactions. Apps also charge fees to provide premium services to their users. Subscription plans are another popular option. You may also publish sponsored content from other businesses to make money via the app.

There are different types of apps like MoneyLion and Dave. While one app cannot replace another, some alternatives to these apps are Brigit, Chime, Klover, etc.

The most convenient application for obtaining a cash advance may differ based on your specific location and financial circumstances. Nevertheless, several popular delivery fee apps provide cash advance services, such as Earnin, Dave, and MoneyLion.

There are various online apps specifically designed for young professionals to meet their instant personal loan needs. These loans are typically given as cash to fund short-term financial requirements, providing a quick solution for unexpected expenses. Terms like payday loan or advance loan are commonly used to refer to these services.

These apps, such as MoneyLion and others, offer a seamless and efficient way for users to access funds without the lengthy approval processes of traditional banks. By simply downloading the app, creating a profile, and providing necessary details like banking information and employment status, users can quickly determine their eligibility for a loan. Once approved, funds are usually disbursed within a few days, allowing users to cover expenses like bills, emergency costs, or other financial needs. The repayment process is straightforward, often with flexible terms and manageable interest rates, ensuring that young professionals can handle their financial obligations without undue stress. These apps are a valuable resource for anyone needing a quick financial boost, providing a practical and user-friendly solution for short-term cash flow issues.

Cash App, which is owned by Square, is widely recognized as one of the most popular credit builder applications that enables users to borrow funds. Through Cash App’s Cash Advance feature, individuals have the opportunity to borrow money from their Cash App account within business days, with the amount being determined by their transaction history and various other factors.

There are several ways to obtain cash without a cash advance budget tools. These include withdrawing money from your bank savings account using an ATM, using a credit card for purchases and requesting cash back, or seeking a loan from friends or family.

The duration required to develop a cash advance mobile application can vary based on factors such as the app’s complexity, desired features, and the development team’s expertise. On average, the development process for a cash advance app typically spans several months from initiation to completion.

Numerous app development companies focus on creating financial apps similar to cash advances like Moneylion. It is crucial to select a reliable development team that possesses expertise in fintech app development and a proven history of delivering successful projects.

Cash advance apps can help you get short-term loans. Some such apps do not require a guarantee or look into the credit scores of the borrower while offering loans like MoneyLion. However, the borrowers need money to meet certain criteria for getting loans. A few examples of such apps are MoneyLion, Chime, Dave, etc.

Different apps let you take loans from them. Different apps have different criteria for processing loans. And the processing depends on the person who’s applying for the instant credit. Hence, it is hard to conclude that one app is faster than another. However, some of the apps that process loans faster are MoneyLion, Dave, Klover, etc.

Do You also want to develop Cash Advance Apps Like MoneyLion?

Pooja Upadhyay

Director Of People Operations & Client Relations