People have always lent money to each other. In recent years, the industry has experienced a major boost, opening up many new business opportunities. COVID-19 has caused a crisis that has affected millions of people who have lost their jobs and income. They started searching for safe methods of borrowing money. Peer-to-peer platforms are one of the most attractive options for these people.

Only some people know how this works or if it is worth investing for long-term gains. It is best to look at the facts and figures to understand better how this segment is performing today and what to expect in the future. According to a report by Research and Markets, the global P2P market grew strongly between 2015 and 2020 and is expected to grow at an annual CAGR of 31% from 2021 to 2026. The market could reach $558.91 Billion in 2027. The global market was valued at $115.61 Billion in 2021.

P2P lending software development became mainstream as a result. Even though there are many such apps on the market, only a few of them have been able to gain traction and remain in demand through market challenges. Many people wanted to enter this booming space a few years ago but needed to learn more about it.

Defining P2P Lending Applications

People look for loans at banks or other financial institutions when they need money. However, only three out of ten people can get a loan. The lending system is old and requires much information. Banks and non-financial institutions usually reject loan applications based on various factors such as income, insufficient paperwork, bad credit scores, etc.

When a bank refuses to accept a loan application, the only option is to ask family or friends. Most people who can lend money do so when they are 100% sure that the borrower will repay the money within the agreed time frame. It is also a problem that not everyone can lend large sums.

Peer-to-peer lending (P2P), or peer-to-peer lending, is a great solution for people who can’t get loans from banks and those who want to bypass all the hassles of getting money. P2P lending allows people with money to lend it out, and those who need it can easily connect. It’s like a bridge that connects both parties. In many cases, the lender will earn interest; in most cases, the borrower will pay interest.

These products do not require a third party like a bank because the lending is done between two parties in one application. P2P loans allow borrowers to pay off their debts, fund an education, start a new business, or do anything else they desire. P2P platforms are a great option for people whom banks have rejected.

Working Process of P2P Lending Applications

This app works on the same principle as credit cards.

A loan lending app involves a few simple steps.

Onboarding

You will be taken to the app’s home page after you have installed it from the app store.

You (the app user) must now register and create your account. You must enter your contact information, social media handles, email address, and name.

You can then login and use the app.

Select the Loan Detail

You will then be given a list of various loan options. You can now check out this app’s different categories of loans.

Choose the category of loan that you prefer. Then, add the interest rates on the money you want to borrow. Select the rate that seems best. Finalize the length of the loan.

Verification and Validation

This step involves checking your loan eligibility, credit score, and financial details.

Then, you will be taken to an additional screen, where you can enter details such as your address, education level, work history, and income.

Connect Bank Account to the App

The app will notify you when the loan amount has been transferred to your bank.

A fixed amount can also be automatically deducted on your due date from your account at the time of repayment.

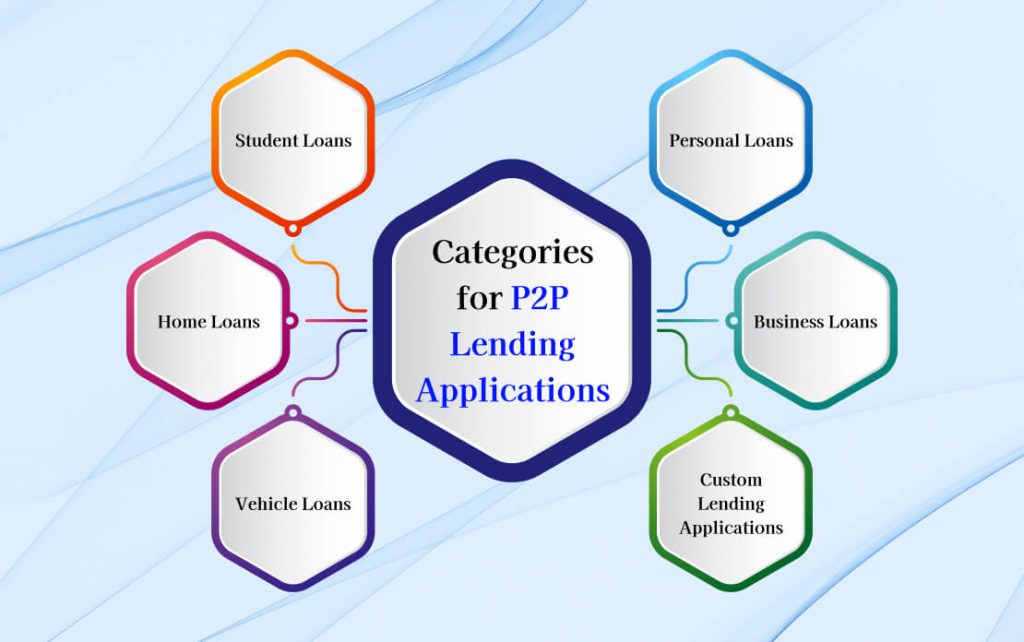

Categories for P2P Lending Applications

The target audience is what affects the development of a loan lending app. Many users opt to take out a variety of loans. Partner with the top loan lending app developer that offers a variety of loans.

Student Loans

If you are interested in offering these services, consider that the group significantly influences the loan lending mobile application development services. Students borrow money for their graduate education. The loan is approved when you admit your identity and present your credentials. Our loan lending app developers can deliver such apps to you easily.

Home Loans

If you’re willing to assist with mortgages, then all you need to do is focus on the process of submitting a loan. AddWeb Solution offers mobile app developers who can provide creative, practical, and easy-to-use solutions. These apps allow you to reach more people; because they are user-friendly, your users will likely share the news about your app.

Vehicle Loans

You can allow your customers to enjoy life’s little pleasures by offering fast loan services. You can get fast car loan services by finding the most affordable mobile app development for loan lending. It will enable you to set foot in the market and create a product that may simplify your life.

Personal Loans

They are loans specifically obtained for personal purposes. Because they are unsecured, these loans usually have higher interest rates. You can charge higher interest rates if you want to offer personal loans.

Business Loans

If you want to help entrepreneurs and startups become better, bigger, and stronger but need help creating a loan lending application, this is the right place for you. All you need to do is contact the developer of the lending app and give him the necessary information. He will handle everything else, including designing a lending application that meets your needs.

Custom Lending Applications

If you are a FinTech startup and intend to invest, then not having a custom-built lending app could be a loss of opportunity for you to gain a stake in this fast-growing sub-sector.

Here are some stats that support our view on investing in an app for loans:

- FinTech firms are the largest providers of personal loans for Americans.

- Digital lending platforms are expected to grow 24% annually from 2021-2028.

- Over 30% of online banking enthusiasts use customized loan apps at least once per month.

FinTech investment by venture capitalists is a great reason to have a custom lending app. Here are some statistics that show how lucrative the industry is:

- FinTechs based in the US raised $98 billion during the first quarter of 2021.

- Ant Financial has raised $14 billion, which market observers have dubbed the largest single fundraising by a private firm in history.

Now that you know the benefits of having one, let’s talk about the costs of creating a digital lending solution.

P2P Lending Platforms and Traditional Lending Differences

The main differences between peer-to-peer and traditional loans are their intermediaries and approval processes.

P2P platforms create direct connections between lenders and borrowers, removing the need for traditional financial institutions. These platforms can quickly assess risk by leveraging technology. This makes them more inclusive and accessible to a wide range of borrowers.

Traditional loans, on the other hand, are usually approved by banks or credit unions and have stricter criteria. Traditional loans are restricted to financial institutions, while P2P lending allows private investments.

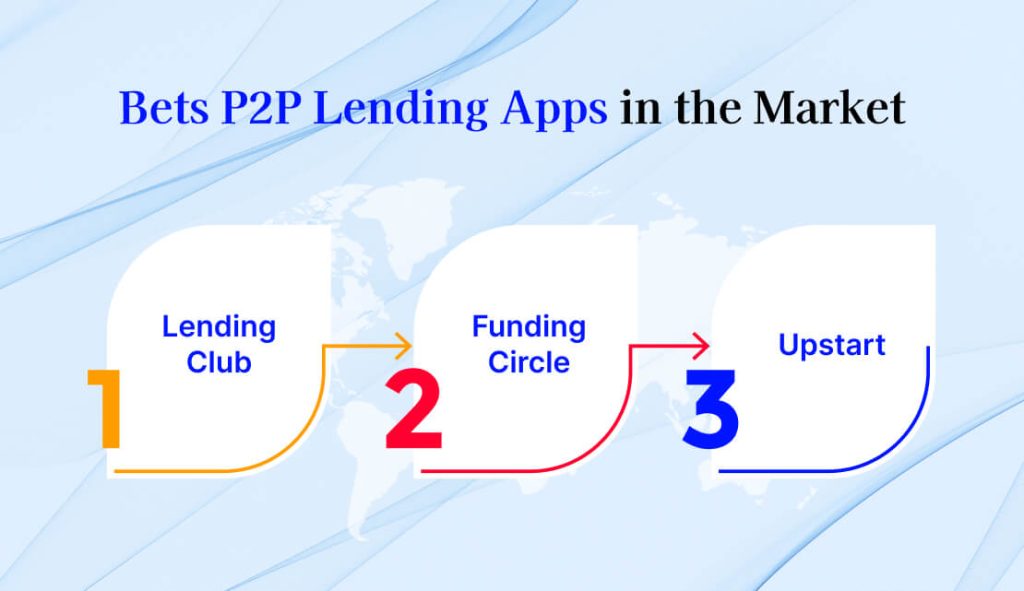

Bets P2P Lending Apps in the Market

You should conduct a competitor analysis before you enter the P2P lending software development market to determine what other financial services you’ll be up against. This will help you to know more about your target audience’s preferences, which features they prefer, and what existing solutions need to be improved.

These peer-to-peer lending apps have earned the trust of users.

LendingClub

LendingClub was founded in 2007. It was released in 2007 and has web-based and mobile versions. This service is available if you are looking for a personal, business, or medical loan or a car loan refinancing. LendingClub has approximately four million members (!) This number is impressive. Platform also protects lenders against late repayments with a 5% fee.

The app’s mobile version is available for both iOS and Android platforms. This allows a large number of people to have access to easy borrowing options.

Funding Circle

This is an excellent example of a P2P niche loan app. Funding Circle’s primary goal is to assist small businesses in raising the funds they need to grow and prosper. The rate of interest ranges between 11.29% and 30.12%. The term can be anywhere from six months up to seven years. Funding Circle helped over 130,000 businesses achieve their financial goals.

App users can use a prequalification tool to determine their eligibility for loans. Funding Circle does charge an origination fee ranging from 3.49%-6.99%.

Upstart

Upstart is another interesting P2P loan solution. Upstart examines borrowers’ educational credentials and employment status to determine if they can repay the loan. This allows people with low credit scores to get the funding they need. The minimum loan amount is $5,000 and co-applicants are not allowed.

Steps to Build a P2P Applications

It is essential to define your requirements and formulate a concept before you begin the development of a digital wallet. Here are the universal steps to a successful peer-to-peer money transfer app tailored for your business.

Select the P2P App Type

You must choose the type of P2P app you want from the available services, such as standalone solutions and banking. You can also design apps that support real-time payment.

Prioritize Mobile Platform

You can select iOS or Android app development if your budget is limited. You can benefit from prioritizing your mobile app development platform in two different ways.

You will first need to understand what platform your users prefer, and then you can analyze which features they like and which functionalities require modification. You will have the space to create an additional app version compatible with multiple platforms later.

Define Features

The features that your P2P application offers will determine its success. Start with the basics and add the USP’s key elements. To ensure you’re getting everything, research your target audience and design a portrait of the user. Also, study the flow. You should also include details about the user’s journey when interacting with your app.

Choose the Right Technology Stack

The right technology choice is crucial to making your P2P app more interesting and functional for your users. FinTech has been a hotbed of innovation, with NFTs (Non-Fungible Tokens), face ID, biometrics, and more. Be open to more than just these features.

Feel free to use convenient tools and technologies to give your P2P application a better chance at success. You should also follow the latest FinTech trends based on blockchain and incorporate crypto technologies that will allow your app to stay at the forefront of the mobile payment market.

User-friendly UX Design

Your P2P app’s user interface and UX must be simple and intuitive. If you wish for your users to spend less time figuring out how things work, make sure that all features are easily readable.

Security

It is essential to integrate security protocols into your P2P app development process. Simultaneously, your P2P application should incorporate cyber security and data protection features like face recognition, fingerprints, scanners, etc. For maximum compliance, ensure that a two-way verification feature is implemented.

Testing

Testing and quality assurance are also crucial phases in developing P2P payment apps. Quality assurance professionals should perform all possible tests to find bugs in the early stages. You may need to hire experts to oversee the beta testing for your app, including its payment gateways.

FinTech Legal Compliance

PCI-DSS is a protocol you must follow when developing a mobile application. Remember to get a PCI DSS certificate to build trust and transparency in the market.

Launch of App

The application is then released on the app store after extensive testing. Parallel to this, a well-thought-out marketing strategy will be implemented to attract users and create app awareness.

Support for Post-Launch

After the launch of an app, maintenance, and support begin; this phase includes bug fixing, user support, and ongoing monitoring. This phase ensures the software runs well and responds to user issues or changes in time to maintain the P2P solution’s trustworthiness and safety.

Features of P2P Lending Applications

This has helped you to understand how to create a P2P app. Let’s move on to the next stage, an important factor to consider for lending software development service.

Documentation

Lenders could manage their leads’ documents in a single place. Borrowers should be able to store all their documents and quickly revise them.

Loan/EMI Calculator

The loan calculator can calculate the monthly installments and the total amount by entering the loan amount and tenure.

Lead Management

They should be able to track leads that have been lent money. The lenders could create leads, track leads, and obtain details such as the amount borrowed, the tenure, the next payment, and the balance.

Automated KYC/AML Verification

KYC provides the admin with all the details about the user via government identifications. AML prevents illegal income from being generated.

Refinance Management

When the borrower pays half the loan amount, he can refinance the loan with another lender based on his profile.

Calculation of Credit Score

Credit score calculators can determine how much debt you have, your credit history, and the types of accounts you hold.

Payment Schedule

This schedule helps lenders and borrowers be aware of the next installments.

Interest Amount

You can use the functionality to apply interest only to the borrower’s borrowed amount.

Repay Options

Both the borrower and the lender should have a variety of repayment options.

Call, Chat, & Camera

The three Cs are essential for mobile applications today. The camera can be used to upload images of documents. Call and chat features connect lenders with borrowers.

Document Scanning

Document scanners can be used to upload files into the Portable Device Format (PDF).

Chatbot Support

Chatbot support is available to answer any questions about the features and functionalities.

Legal Aspects of Creating an App for Money Lending

While developing an app for money lending, many legal considerations must be remembered. We want to focus on privacy legislation for now, as your app will be processing your clients’ sensitive data. You must make sure that your data handling practices comply with privacy legislation.

GDPR Legal Compliant

GDPR (General Data Protection Regulation) is a legal document that protects the fundamental freedoms and rights of individuals, particularly their right to the protection of personal information. Its territorial scope is the EU. Ensure that EU residents’ collection and processing data is compliant with GDPR.

CCPA Legal Compliance

California Consumer Privacy Act is a legal act protecting the rights of Californians. The California Consumer Privacy Act (CCPA) gives consumers greater control over the personal information businesses collect. If your target audience is located in the USA, make sure that your app is CCPA compliant.

Be aware that laws can vary from country to country, so be sure to pay attention when reading the legislation.

The Key Takeaway

Developing peer-to-peer loans is a multifaceted undertaking that requires a strategic approach. This includes everything from market analysis to technology selection and onward optimization. The promise of high returns and the chance to gain a foothold within the rapidly growing fintech sector make it a worthwhile investment.

You need the right lending app software development company that can help you navigate the complexity of the development process.

To create a successful P2P app, you will need time, expertise, and effort. Businesses can earn much money in the finance industry using P2P lending platforms.

This blog will help you understand ‘How to Create a P2P Loan Lending App?’, including its features and app development cost. You now have a good idea of how to start the process.

If you need the right team, hiring an experienced company that develops loan lending apps would be best. You can share all your requirements, and the mobile app developers will create a masterpiece that meets your business needs.

FAQs

Depending on the type and size of the mobile app, P2P lending apps can cost as little as $20,000 or even more. To get an accurate cost estimate, you should first clarify your app needs and then create an app that meets those requirements.

Sign up/sign in is a must. Other features include bank account integration and lender/borrower match, credit score calculators, approval/denial of requests, analytics, payment histories, and payment schedules.

Choosing a bank partner, adhering to all legal requirements and GDPR, performing robust onboarding, verifying and building a solid technical infrastructure, and being prepared for multiple integrations.

To develop a secure and convenient app for P2P lending, you will need a team that includes the RD team and DevOps specialists, designers, developers, React, NodeJS, and Quality Analysts.

Consumer Lending, SME Business Lending, and Property Lending are the three main types of P2P platforms that lend.