The world of investment and finance has seen a significant change due to the introduction of mobile-based trading apps. Apps such as Robinhood have changed how people invest through users with a simple platform allowing users to trade ETFs, stocks, and cryptos easily. If you want to build an app for trading similar to Robinhood, this guide will provide the most critical actions and factors to ensure your business is booming.

The demand for trading applications has increased dramatically in recent years in the constantly evolving world of financial services technology. Robinhood is a leading example of democratizing access to financial markets. The need for accessible and user-friendly trading platforms increases the main question that comes to entrepreneurial minds: “How can we build a trading app like Robinhood?”

According to a Robinhood report, the app has generated a net revenue of approximately 1.82 billion for 2021. Compared to the period from December 2020 to 2019, Robinhood recorded an increase of 89. Robinhood also boasts 22 million-plus users.

It is undisputed that launching a fintech business has financial benefits. Numerous companies seek to seize this lucrative investment opportunity in developing trading apps. If you’re one of the majority, you should read this article, which is ideal for you.

How do Stock Trading Apps Work?

Trading apps function as investment platforms and let users buy and sell financial investments such as mutual funds, stocks, ETFs, crypto, etc. They assist customers with all the steps, from account creation to trading and order execution.

They also display the latest market information, such as stock prices, indices, and other financial data. They provide tools for technical analysis, charts, research reports, and portfolio management to help investors make educated choices.

App users can make orders such as market orders, limit orders, stop-loss orders, etc., which define the amount they can purchase and sell their assets for.

However, the functions of online trading applications are vast and varied. You can design them for various purposes and increase or restrict their functionality per your intended services, users, and business needs.

Robinhood’s Revenue and User Base:

- Robinhood’s impressive revenues, which reached $565 million during the 2nd quarter of 2021 and $380 million during 2022, are proof of Robinhood’s financial strength.

- The large number of users and 15.9 million active users shows the broad acceptance of Robinhood among investors.

Market Size and Growth:

- The worldwide market for online trading platforms, which will reach $9.32 billion in 2022, demonstrates the immense worth of this business.

- The projected growth of $9.94 billion in 2023 and $15.34 billion by 2030, and an estimated CAGR of 6.4 per cent, hints at continued growth and potential shortly.

Accessibility and Market Demand:

- The rise of trading applications has opened up investing to the masses, allowing people with no experience in trading to take part in the market for financial instruments.

- The rising demand for these platforms, which both people and companies drive, highlights the potential of these sites.

Competitive Landscape:

- The market for trading applications is incredibly competitive and includes both reputable financial institutions and innovative startups.

- Established broker banks recognize the importance of trading applications and have launched their platforms to reflect the evolution of the industry and the necessity for traditional establishments to change.

Customized Trading Platforms:

- The increasing demand for custom trading platforms, fueled by government and non-profit organizations, highlights the necessity for custom solutions to meet specific clients’ needs.

Broader Market Trends:

- The data aligns with mobile app developers in fintech, changing how technology shapes traditional financial services to make them more accessible, efficient, and easy to use.

- The popularity that Robinhood has enjoyed Robinhood and the general market growth suggests that people are changing the way they take a look at financial and investment management.

Future Prospects:

- The rising growth rate and the growing volume of market participants suggest an optimistic app market outlook.

- Continuous innovation, regulatory developments, and evolving consumer preferences will likely influence the future direction trading platforms will shape.

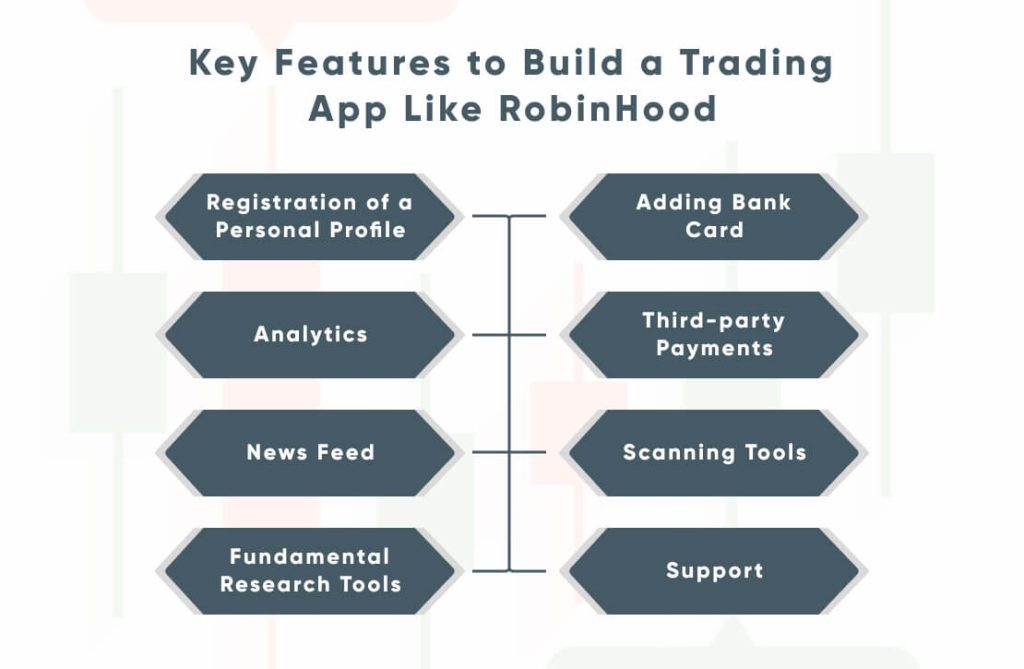

Key Features to Build a Trading App Like RobinHood

It is essential to understand that building trading apps like Robinhood requires careful analysis of the most critical features to ensure a pleasant user experience, adherence to rules and regulations, and a position of strength in the marketplace. These are some essential features to integrate into your app with the assistance of a development firm.

Registration of a Personal Profile:

This should be the most straightforward stage. It’s a good idea to offer a variety of ways to sign up (e.g., through Facebook, Google, or Apple ID). You can sign by phone or email using a password. Whichever option you select, make sure they are safe.

Include a feature in your application that permits users to create profiles. This will enhance their personal experience. Users must be able to upload their images or data and perform the tasks.

Adding Bank Card:

Users can include their bank details in this area of the Robinhood-like app. This is a vital feature of the online trading applications. The section you are using should be simple to use and secure. Integrating this feature into your app with the assistance of Fintech Web Application Development Services is essential.

Analytics:

Charts are often employed to incorporate analytics into Robinhood-like applications. These advanced techniques include AI/ML, data science, and other sophisticated technologies. To use this feature efficiently, you’ll need an experienced partner with experience in data analysis and visualization.

Basic charts include Bollinger bands as well as moving averages. More advanced charts could include break charts with lines, Fibonacci plots, and other advanced features.

Third-party Payments:

Secure payments are also essential—link secure third-party payments to your preferred stock trading application, like the stock trainer. For instance, you can incorporate your service with big names like PayPal, ApplePay or Google Pay.

News Feed:

This is a must-have feature, mainly if you aim to build an application for trading stocks that cater to novice and day traders. Users of the Robinhood alternative depend on reliable sources such as the Reuters Newswires, Dow Jones Newswires, PR Newswire, etc.

It’s a brilliant idea for apps such as Robinhood to integrate the latest information from these publications into your news feed with the help of an iOS app development company that uses the iOS platform.

Scanning Tools:

AI-powered scanners scan for potential trades on the market for shares. Similar to analytical tools, scanners can come with different levels of sophistication. Simple scanners provide insight into the most profitable investments and those on the rise or decline. A sophisticated scanner can identify patterns to aid your clients in making better decisions regarding investments.

Fundamental Research Tools:

These tools allow your customers to quickly access information about the companies they plan to invest in. Tools for research that offer insight into financial statistics, the latest news, and other important trading information. Instead of scouring the internet, users can use your app to search for data.

This allows the trading app to function as a complete shop, increasing users’ time. If you plan to build an application like TradingView, you must know that these features must be included to increase user engagement.

Support:

When building trading apps, reliable support is crucial. How you support users is essential to the overall success of your Robinhood stock application. In trades, speed becomes vital. Make sure that the users can access any assistance, such as technical, administrative, or trade-related, suitable via the platform.

How Much Cost to Build a Stock Trading App Like Robinhood?

The price of Mobile App Development Costs for trading stocks like Robinhood will vary depending on various variables, including the app’s features, its complexity and the technology platform, team development rate, and the geographical place of operation.

Features and Functionality:

The complexity and the number of features in your application will influence the development costs. Features like real-time market information, various orders, and sophisticated analytics can increase your total cost.

Development Team:

The size and expertise of your development team can affect the costs. This can include roles like developers, project managers, designers, UI/UX developers, testers for QA, and possibly data scientists who work on advanced analytics.

Technology Stack:

The choice of the technology stack (backend or frontend and so on.) can impact development costs. Utilizing popular and well-supported technology can be more affordable than specialized or less popular ones.

Design and User Experience:

A well-designed and user-friendly interface is vital for any trading application. Prices will differ based on the complexity of the design, customizing, and considerations for user experience.

Security Measures:

Implementing robust security measures is crucial for financial apps. Costs will vary depending on security and encryption methods and compliance with industry standards.

Testing:

Rigid testing ensures the app’s functionality, security, and performance. The cost of testing will be based on the quantity required.

Regulatory Compliance:

Ensuring compliance with financial regulations and the laws governing data protection will require experts in regulatory and legal matters and experts, which adds to the total expense.

Integration with external Services:

If you plan to integrate additional services like payment gateways, market data feeds, and analytics tools from third parties, the cost of integration and the associated costs are to be considered.

Maintenance and Updates:

After launch, regular updates and maintenance are required to ensure security updates, bug fixes, and new features—plan for these ongoing costs.

Geographical Locality: Development costs can vary according to the location of your team of developers. Rates are typically higher in areas with higher costs of living.

License and Legal Fees Legal costs for obtaining required licenses, compliance, and conditions of service agreements should be included in the budget.

Promotion and Launch Marketing expenses will be crucial for promoting your app and acquiring new users—budget for social media advertising and other promotions.

Infrastructure and Hosting Costs associated with hosting your application, server infrastructure, and cloud-based services must be considered, particularly in the event of significant user growth.

Customer Support: Allocating resources to support customers, including chat support, email support, and even phone support, is essential for user satisfaction.

Compliant in Industry Standards: Costs related to ensuring compliance with industry standards, certifications for data security, and financial regulations need to be considered.

Contingency: You should include contingency funds in your budget to be prepared for unexpected costs or changes to the scope of your project.

How Does Stock Trading App Make Money?

Robinhood was one of the first leaders in commission-free trading. Its no-commission model attracted young potential investors who wanted to earn cash through investing and trading. Robinhood does not charge to maintain or open accounts, and investors can transfer funds without incurring any costs.

You’re probably wondering about this: even if Robinhood is available for free and is free to use, how can it earn profits? The fintech business employs various revenue stream models to earn profits and revenues. These models are the most well-known models.

Payment for Order Flow

Payment for Order Flow is an accepted usage in the brokerage sector that fintech applications use to earn money. According to PFOF, or the PFOF system, trade apps offer their customers’ trading orders directly to market makers on behalf of the users. These market makers pay brokerages for the flow of orders to trading applications. Market makers make the trade and earn tiny spreads on the bid price and ask of the securities traded.

Stock trading apps and market makers receive a tiny amount of money through the PFOF model. However, when they complete many orders, they generate a significant amount, generating more revenue.

Premium Services or Subscriptions

Fintech apps provide Premium services, or even subscriptions, at hefty prices and charge users monthly or annually. Premium services offer additional advantages such as investment tools, including market research reports, research reports, investment tips, and margin investment options at a low cost.

Interest on Securities and Margin Loans

Trading apps such as Robinhood pay interest by offering collateral and securities. They charge a significant interest rate on loans to a margin that exceeds $1000. They earn money by protecting exchanges with their counterparties.

Revenue Generation From Unused Amount

Trading platforms use the funds stored in investors’ accounts and put them into savings banks. They earn interest, which is added to their earnings. However, the amount is smaller compared to the other revenue models.

Current & Future Scope of the Trading Industry

The number of traders who want to make money from investment opportunities is increasing daily and will continue to grow in the coming years. The trading industry is evolving to incorporate new technology and advances to meet the market’s demand. Here are some glimpses of trends that are both current and upcoming:

- The growth of cryptocurrency has triggered demand for cryptocurrency trading platforms. They are expected to gain widespread acceptance soon.

- Fractional share investment allows investors to purchase shares using small funds. Platforms that enable fractional trading in shares are growing popular with retail investors.

- Trading platforms have launched robotic advisors to assist investors in creating and managing investment portfolios based on their profiles, budgets, finances, and objectives.

- Social trading platforms let users track the trading patterns of successful investors. This method combines social media with investing and helps novices make better choices.

- Fintech companies will also use Artificial Intelligence and data analytics to create sophisticated trading strategies and algorithms.

- The Decentralized Finance (DeFi) space web 3.0 and blockchain technology are set to disrupt traditional finance and open up new opportunities in decentralized platforms for trading and sophisticated financial products.

- The trading apps will allow investors to gamify their investments using virtual reality. They will also introduce virtual trading games, interactive features, and rewards.

- Fintech applications that provide access to markets across the globe and emerging economies are sure to

- Attract investors who want to diversify their portfolios while capitalizing on global growth opportunities.

Conclusion

Developing a stock trading application is a challenging but rewarding endeavour that requires the right approach, a comprehensive understanding of the industry, and technological know-how. The popularity of apps such as Robinhood has shown the fintech sector’s enormous potential, allowing businesses to capitalize on the increasing need for a user-friendly and accessible trading platform.

The financial sector isn’t an exception because businesses must embrace technology to remain competitive in today’s marketplace. For already operating trading companies, it is possible to implement an app for trading like Robinhood to expand your client base.

You must know the external and internal processes to build an online trading platform. The right mobile app development firm will allow you to develop the most valuable value for your app. Choose the area where your app has more chance of success, and select the features you want to use carefully.

You need to conduct market research and competitor analysis to determine the preferences and needs of the audience you are targeting and the current environment of apps similar to yours. In addition, it is crucial to understand the fundamentals involved in developing apps.

Frequently Asked Questions

Stock trading applications allow users to purchase, sell, trade, and manage financial instruments. They offer specific features such as creating accounts and managing portfolios, stock trading, order placement, fundamental market analysis, and fractional share investments. They also allow paper trading, transactions, and much more.

To safeguard your information, select reliable apps, activate two-factor authentication, protect your device, avoid logging in via public wifi, use secure payment methods, and secure your personal information. Also, keep financial information private from unapproved calls or online forums.

The expected time frame for developing trading apps is 3 to six months. But, it can differ based on project needs, requirements for technology stack, length, budget, hiring of resources, and various other variables. Contact the Addweb team to chat about the project. The team responsible for execution will give you an exact timeline upon obtaining your specifications.

The most common features within stock-trading apps are user profile creation, user onboarding newsfeeds, dashboards sec, ured payment gateways, and more. To learn about these essential features, read the previous article about building trading apps.

Your team must adopt advanced protocol and security safeguards to secure customer data in trading platforms. Additionally, they should ensure that your app complies with all laws, including data security and protection regulations.