Banking was long known for its traditional brick-and-mortar business model; today, banks are at the cutting edge of digital innovations. Customer demands and seamless, personalized experiences continue to increase rapidly, and it has become clear that now is indeed the time for banking’s complete digital transformation.

Financial institutions that employ cutting-edge technology and solutions tailored to users can use cutting-edge tech to enhance service offerings, streamline processes, and remain relevant in an ever-evolving market.

Implementation of digital transformation banking strategies isn’t only driven by catering to tech-savvy customers; it is also necessitated by the rapid proliferation of disruptive fintech start-ups that pose innovation threats.

What is Digital Transformation in Banking?

In general, digital transformation banking means integrating new digital technology and novel strategies within the financial sector to enhance operational efficiency, improve customer experiences, and adjust to changes in the market environment.

This transforms traditional bank processes, systems, and business models, enabling banks to offer smooth, easy, secure services via numerous digital channels.

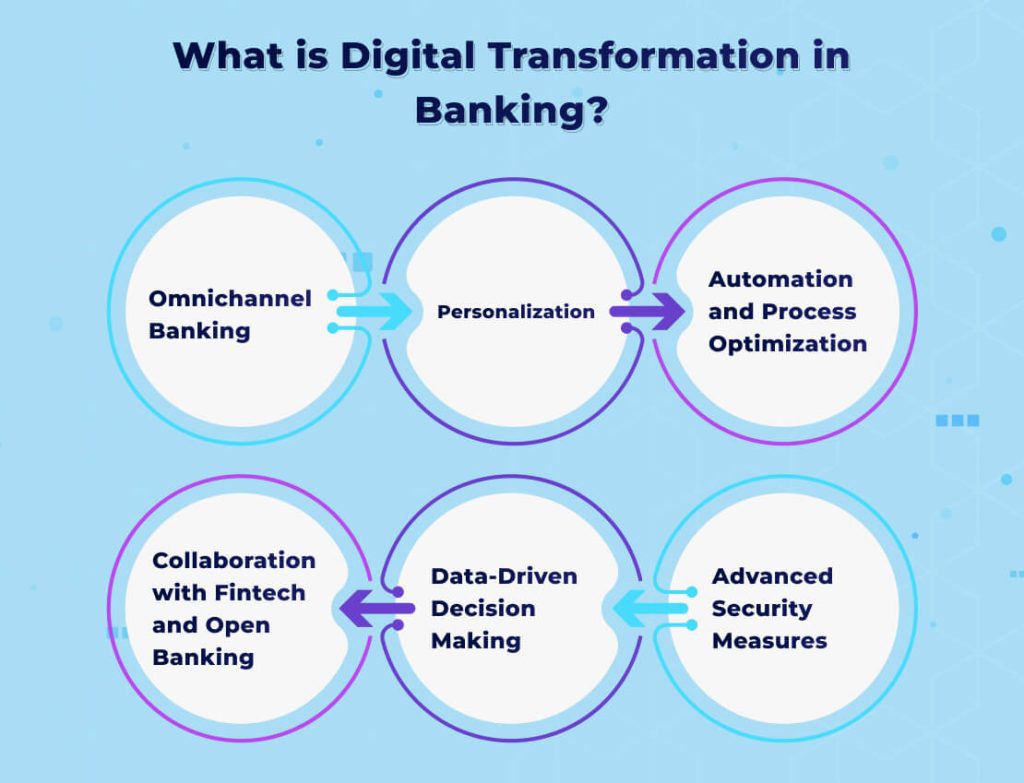

The most critical aspects of digital transformation within banking include:

Omnichannel Banking

We aim to provide customers with a seamless experience accessible across many channels, including online banking ATMs, mobile apps, and physical branches.

Personalization

Utilizing data analytics, Artificial Intelligence (AI), and machine learning (ML) to customize services and products to meet individual customers’ wants and needs.

Automation and Process Optimization

Implementing technologies such as robot process automation (RPA) and AI to improve internal processes, reduce costs, and increase efficiency.

Advanced Security Measures

They are implementing new methods and solutions to safeguard customer data, prevent fraud, and protect customers from identity theft while ensuring compliance with pertinent laws.

Data-Driven Decision Making

We use big data analytics and sophisticated algorithms to make intelligent strategic choices, maximize risk management, and spur innovation.

Collaboration with Fintech and Open Banking

We are working with fintech start-ups and accepting open banking initiatives to encourage innovations, enhance customer experiences, and broaden services.

The overall digital transformation of banking is a constant process aiming to change the landscape of financial services by using new technology, new business models, and customer-centric strategies to meet the changing requirements of the digital age.

Digital Transformation in Banking Evolves the Customer Journey

All banks have websites, and most have some digital applications, as well as online services and features. These digital services encompass most of what we think of in the term “digital services” but don’t in any way include the digital transformation of banking. However, they can permit you to move towards a bank’s digital transformation, transforming the customer experience. How? What is it?

The typical sales pipelines, or customer journeys, usually begin with marketing, building leads, and then passing these leads over to sales, and the sales are transferred onto customer care. The customer must traverse many departments before they get their hands on a product or service that results in cluttered, disjointed, or sometimes unreliable results.

Consumers expect seamless digital experiences everywhere, including with their bank or credit union. Are you up to date with digital technology’s demands?

Digital transformation in banking enables you to build a more connected and personalized digital customer experience. Making a digital customer experience is about integrating everything onto a single platform to ensure that customers are dealt with using the same tools, sometimes by the same team, and with identical information during the entire process. In this case, changes to the structure of teams, as well as integrating technical staff with sales team members or merging retail and marketing within the same team, could assist in a significant way.

The most significant aspect of digitizing the customer experience is that customers are effortlessly moved from sales to marketing through an online application to finance through in-app bill payment and customer support directly from the application.

To achieve this, you must map the customer’s journey, create tools and apps around it, and focus on certain crucial factors. For instance, a digital customer’s journey allows customers to click an ad and create an account on their own, get tutorials and information on how to use their application, receive automatic loans, pay bills, or transfer funds online.

Secure and Efficient – Upgrade to Our Banking Web Solutions Today!

Pooja Upadhyay

Director Of People Operations & Client Relations

Transition from Traditional to Digital Banking

Despite many challenges, most banks started their digital banking journey a few years ago with a clearly defined strategy. The movement towards digital banking began when bankers realized that most customers use digital channels.

In the wake of top-down implementations of digital strategies, the banking industry is becoming more inclusive and technologically savvy. What does the transition from traditional banks to digital ones appear like? Let’s review the top highlights of this journey.

When more customers accessed their mobile apps and websites to conduct transactions, omnichannel became a reality in banking and financial services. Therefore, mobile banking has become an integral part of the online banking experience.

To stay ahead of the constantly changing market, traditional banks had to keep up with new techniques and operating models, which kept their customers informed throughout a customer’s entire journey.

However, the growing need for Artificial Intelligence (AI), blockchain technology, and technology like the Internet of Things (IoT) has accelerated the process of modernizing the banking sector.

Today, banks are heavily dependent on the omnichannel strategy that breaks the data silos across all channels to enhance customers’ experience.

The digital transformation of banking has enabled financial service providers to enhance efficiency and increase convenience while also providing the possibility of bringing in new customers. This leads us to our next discussion topic: The key elements that make the digital revolution in financial and banking services feasible.

Key Factors Driving Digital Transformation in Banking

Increased use of smartphones, improved connectivity, and the demand for an exceptional end-user experience are the main factors driving the digital transformation trend of banking services to customers’ doorsteps. In addition, six key factors affect the effectiveness of digital banking.

Importance of Customers

Why do banks choose to move their businesses towards digital channels? Because they are where their customers are. The digital strategy is about meeting the requirements and needs of its clients. Banks now offer personalized service, seamless query disintegration security, and transparency. These are at the centre of customer satisfaction through modern-day solutions. In short, the change has forced banks to take a “customer approach,” bringing the best customer service.

Operating Model

Customers today require a hybrid experience that combines speed and ease of use with an emotional connection to the product. This is why the evolving banking industry follows three distinct operating models.

- Digital as an enterprise: This is generally at the managerial level.

- Digital is the new branch of business: This includes working at the next level, an entirely separate division for digital to handle digital tasks.

- Digital Native: This new configuration includes the company’s tech stack business, which is focused on the consumer.

Modernized Infrastructure

The digital transformation in the financial sector has been accelerated due to the underlying infrastructure that allows data transfer to front-end operations. Modernizing the existing infrastructure has played the most considerable role in accelerating digital transformation in banking.

The Power of Data

Banks and financial institutions are aware of potential consumers’ data. This requires implementing a more significant number of methods to analyze and observe patterns in customer behaviour. This has allowed the banking industry to develop more relevant products and services aligned with customers’ needs. This is likely why major fintech firms outsource the requirements of data analytics solutions to development firms.

Complete Digitally-Driven Market

We must remember that it isn’t only banking; all sectors, including eCommerce, industrial agriculture, IT, etc., are advancing using digital capabilities. This encompasses business culture, technology strategies, tactics, and skills, all part of the digital transformation. Thus, the whole consumer market is at the cusp of digital transformation. This is one of the primary reasons behind the digital transformation of banking.

We have been discussing digital location in banks and other financial institutions. But we’re still waiting to discover what technology leads to this shift in the banking industry. Review some principal tools and techniques banks use to enhance the customer experience.

Importance of Digital Transformation in Banking and Financial Services

Digital engagement is essential to improving the customer experience. Some banks have resisted moving away from their tried and true strategies, but most recognize the benefits of digitization in their offerings. From process efficiency to more excellent customer service and satisfaction, Digital transformation within the banking sector has continuously improved the efficiency of operations.

Based on a survey by Cornerstone Advisors, 42% of institutions claimed to have achieved a 5% improvement in the productivity of opening a deposit account, and 33% stated they’ve increased loan efficiency by 5 percent or more.

Digital transformation is about eliminating the barriers that hinder banks’ ability to provide innovative customer experiences and business capabilities. The complete transformation will embrace modern technologies that allow for the creation of an integrated and customized customer experience.

While some institutions may think they’ve made it quite far on the digital transformation path, they’re yet to adopt new technology such as machine learning (ML), cloud computing, or automated robotic processes (RPA).

Due to technological advancements and the increasing use of digital platforms, customers’ expectations will likely change. If banks can comprehend the changing requirements and adapt accordingly, they can provide an enjoyable experience for their clients. In the background, they can help their employees by implementing automation to reduce repetitive manual tasks, allowing them to focus on creating connections.

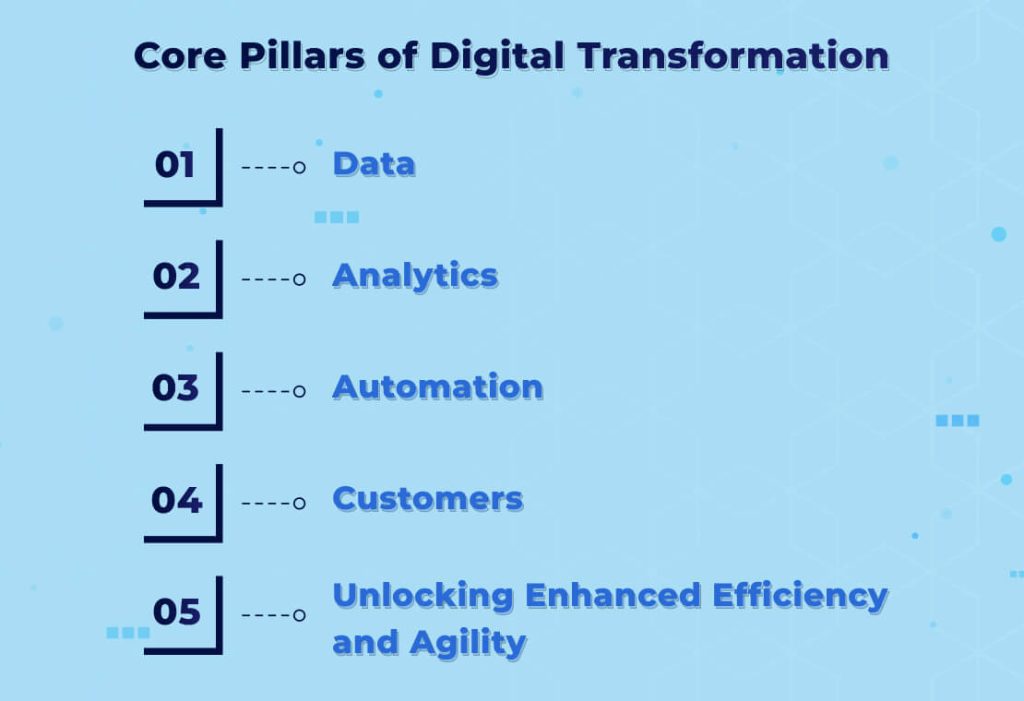

Core Pillars of Digital Transformation

Many foundational pillars are required to achieve an effective digital revolution. Each should be incorporated into a unified strategy that views the entire transformation as a single process rather than an individual project.

Banks frequently make mistakes when they upgrade their digital infrastructure and offerings by not coordinating digital initiatives. Digital transformations are comprehensive and result in applications, the infrastructure of digital platforms, and a platform for customer experiences that’s integrated into a consistent single method of operation.

Data

Data is at the core of the digital revolution. Financial institutions can effectively improve their ability to connect with their customers by making the most of usable information. Responsibly utilizing data involves prioritizing privacy and security and maximizing opportunities to enhance consumer targeting, engagement, and personalization of offerings.

Analytics

Data can only perform its function if understood in a manner that benefits your company. A high-quality analytics tool and a thorough analysis turn the collection of disparate data points into actionable information that helps make smarter decisions and enhances KPIs.

Automation

Machine learning is growing exponentially and will only become more beneficial for companies trying to boost the effectiveness of their marketing, sales, and engagement strategies. AI tools aren’t just marginal tools; they are rapidly becoming mainstream and crucial to digital strategy.

Customers

With the variety of tools and digital applications available today, it’s easy to overlook your company’s primary goal: connecting with customers. Customers today want personal and real digital engagement experiences. That’s why having a consistent and appealing digital experience for customers must be a top priority when implementing any digital transformation plan.

Unlocking Enhanced Efficiency and Agility

Every minute spent dealing with papers and waiting for transactions that require manual processes to be processed takes away from your primary business tasks. Digital banking solutions are an efficient way to save time. Imagine the ability to pay bills, process invoices, and instantly transfer funds with the ease of your phone or laptop. There’s no need to go to the bank and no waiting in line – just one click, and your financial chores are complete.

However, the magic doesn’t end there. A recent study discovered that Digital transformation can improve operational efficiency (40%), speed up the time to market (36%), and enhance the capacity to meet consumer demands (35%). That’s much time you could devote to strategic planning, acquiring clients, or just taking a relaxing coffee break!

Automation is yet another game-changer in the world of digital transformation. Automating the repetitive tasks of data entry and reconciling could free valuable human resources to focus on other strategic projects.

Key Drivers of the Digital Transformation in Banking

What has driven the digital transformation of banking? Innovative technologies, innovation, and shifts in customer expectations all contribute to this.

Here are a few of the top ones

Rise of Fintech

Fintech (Fintech) refers to the connection between modern technology and finance. Fintech companies enable banks and other financial institutions to provide high-quality financial services for their clients.

Here are a few ways they accomplish this:

- AI Automation: Artificial Intelligence allows computers to handle vast quantities of data, identify patterns in customer behaviour, and create automated workflows. In general, AI fuels banking services and makes them easy to utilize.

- Security: Fintech uses advanced security protocols, such as 2-factor authentication (2FA) and multi-factor authentication (MFA), and knowing your customer (KYC).

- Big Data: Financial institutions and banks deal with vast amounts of data. Banking software must analyze this data, develop precise interpretations, and protect it from unauthorized access.

- Blockchain Technology: Blockchain provides safety and security transactions while ensuring transparency, reducing fraud, and encouraging tamper-proof recordkeeping.

- Personalized Tools for Financial Management: Fintech services use data analytics to give customers more insight into their spending habits, helping them make better informed financial decisions (including investment and budgeting) according to their financial objectives.

Blockchain Technology

Blockchains are unchangeable public ledgers distributed over a secure network. The public database is shared among several anonymous computers and has gained popularity in its application to cryptocurrencies.

Financial institutions use blockchain technology to improve their primary initiatives’ efficiency, transparency, and security. Certain banks, for instance, utilize blockchain technology to speed up transfers and increase customer satisfaction.

In contrast to banks that rely upon custodial services to process transactions, a public blockchain could allow them to complete transactions faster.

Data Analytics and Artificial Intelligence

Data analytics, driven by AI, can enable banks to provide customized services and real-time, intelligent decision-making.

Certain personal finance firms, such as those above, use chatbots and Robo-advisers to assist people in making wise investments. These robots collect data from clients’ financial bandwidth and risk tolerance, giving them recommendations or making automated investments.

Cloud Computing

Cloud computing means operating digital processes on the cloud rather than physically located warehouses. Banks and financial institutions most often utilize cloud computing with data warehouse development services to obtain affordable, scalable, and secure solutions for managing data.

Cloud computing is highly reliable and secure because it doesn’t require costly physical infrastructures affected by natural catastrophes. Cloud computing is also advancing as many service providers use blockchain technology to improve data privacy.

Changing Customer Expectations

The transformation of banking to digital connects directly to modern consumer expectations regarding financial services. 87% of millennials and Gen Z customers value convenience when using technology.

To keep up with current customers, banks must implement modern banking systems that simplify banking.

Competitive Landscape

This shift in traditional digital banking has forced traditional banks to change to ensure their market share and control.

Large banks like Chase and Bank of America have embraced the latest financial instruments, such as cryptocurrency. This creates a competitive environment that encourages technological innovation that will benefit customers.

Inflation

The rising cost of inflation makes investors wary of traditional financial investments. Many are turning towards digital assets as insurance against increasing inflation.

Exchanges for cryptocurrencies, such as Coinbase and Binance, have also attracted millions of users looking to buy digital currency that the federal government does not manage.

Benefits of Digital Transformation in Banking

Digital transformation provides several key advantages to banks as well as their customers. These advantages include:

Enhanced Customer Experience

Digital banking transformation will ultimately enhance customer experiences by offering personalized digital services and the convenience of digital channels.

Customers, for instance, can use mobile banking to better access their financial accounts and connect with their preferred third-party apps.

Increased Efficiency and Productivity

Another benefit of digital transformation in banking is its effectiveness. Financial institutions relying more on customer data analysis can use AI to streamline workflows, ensuring seamless omnichannel operation.

For instance, a few banks are currently experimenting with offering peer-to-peer crypto services. These services let customers purchase, sell, and store cryptocurrencies in their digital wallets.

Improved Risk Management

Banks are also being subjected to greater scrutiny from consumers and the government due to how they handle money and financial assets.

Certain banks employ blockchain technology that cannot be altered to manage these risks effectively. This technology provides precise transaction information and allows banks to combat fraud and laundering inside and outside the bank.

Digital Transformation Solutions You Can Leverage

What can you do to get the most value from your business? By leveraging digital transformation solutions. Companies that can adapt to the latest digital technologies instantly gain an advantage in the market. Digitalization gives your business complete control over the entire front-end and back-end development operations with sameness and scalability.

What digital technologies could you use to improve your company? Here are some examples.

Mobile Applications

Mobile apps are made to aid companies in many different ways. Through banking apps, one can access their financial data, customized options, access to banks, and personal finance management. However, this isn’t only restricted to the banking industry; any application for business assists an organization in comprehending and providing personalized service to its customers. This is likely why over 82% of companies with an online web presence own their application that utilizes app development services.

Data Analytics Solutions

The most critical factor in success is getting the most value out of the company data. If your company deals with vast amounts of data from various sources, data analytics tools and services will help transform your data from day-to-day use into business-relevant information.

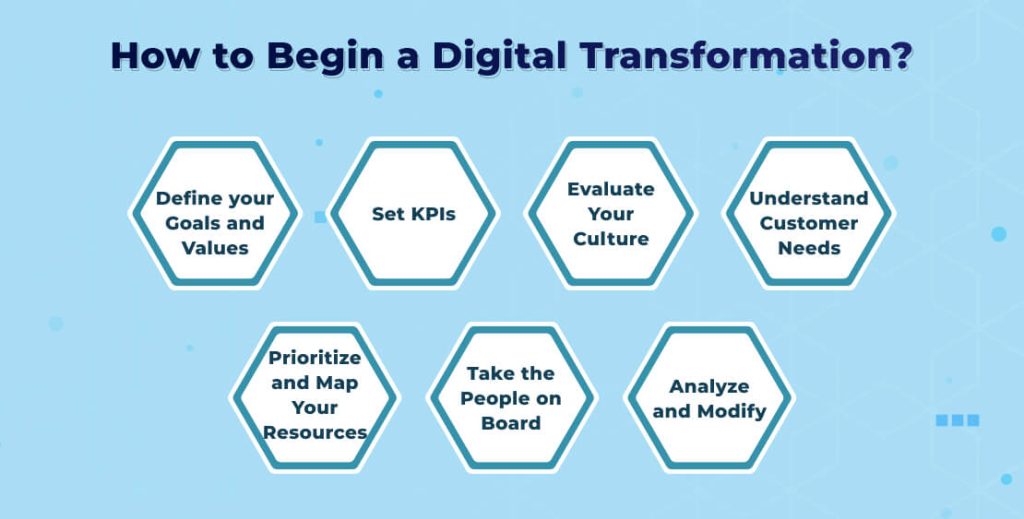

How to Begin a Digital Transformation?

Finding the right web application development company and the resources you need to start your journey to digital transformation will be a challenge. However, the good news is that you’re not alone. Numerous financial institutions that have begun digital transformation have encountered this obstacle, and let’s find out what they’ve learned from this process.

Define your Goals and Values

Before you begin this journey, you must be aware that you know the goal. Write down what you wish to accomplish and then develop an action plan. Review your company’s current situation and assess the technology and processes already in use.

Your team and you should ask plenty of questions at this stage. What stage of digitization are we in? Do we wish to promote a digital attitude first? Do you want to work to attract new customers through digital products? When you have an idea of your goals and values, you can lay the foundation for developing your business strategy and identifying the resources needed to carry it out.

Set KPIs

Every aspect of your plan and goals must be measurable. You must set goals and track your progress through setting KPIs or key indicators of performance (KPIs). Your strategic plans will be wasted if you don’t know your progress.

Evaluate Your Culture

One of the most challenging issues in the digital age is the transformation it’s expected to bring to your business culture. It is essential to evaluate your corporate culture to ensure that the changes help strengthen the weak points without affecting the positive aspects.

It would help if you considered factors such as whether your culture can adjust to changing conditions, whether you have leadership support, and what your structure could look like after the change.

Understand Customer Needs

When you create digital services and products, look into your current customers to determine who will benefit from the latest technology and then reach them via targeted marketing.

Perform data analysis to divide customers based on demographics, lifecycle, and product mix. Then, you can determine how your digital offerings correspond to these segments. Be aware of your customer’s preferences and behaviour to ensure that your content results in their growth.

Prioritize and Map Your Resources

Remember that digital transformation can be an extensive process, and you should begin by breaking your journey into steps. Once you’ve got a clear set of goals and objectives, review your resources and determine the best order for various tasks to maximize the use of your time, money, and other resources.

Find quick wins and try to avoid tackling everything. When you’ve identified the key areas of focus and workflow, implement changes slowly, beginning with small victories.

Take the People on Board

Following the planning phase comes implementation, which requires the company’s support. Open communication is necessary to encourage enthusiasm and participation on a large scale.

Communicate your plans and pertinent information with everyone. Also, be willing to address issues and concerns and encourage employee feedback.

By following these guidelines, you can keep your employees content and create an environment that encourages efficient collaboration and output.

Analyze and Modify

When your plan is in place, and the major transformation is completed, please take a moment to review your efforts and evaluate their effects. Are you satisfied with the success? If you achieved what you have been aiming for, Congratulations!

However, if your efforts to transform are not being appreciated and have resulted in negative results, you must continue making progress. Adjust as needed, get employee feedback, and improve your process to ensure the changes will work.

The Key Takeaway

Delivering a seamless customer experience is today’s requirement when embarking on a digital transformation journey and taking the first step towards becoming more agile, innovative, and competitive in the changing world of finance.

The digital transformation of banking can no longer be a matter of “if” but “when.” It provides a fantastic opportunity for companies to streamline processes, improve customer experience, and generate potential revenue sources. With the adoption of digital banking, companies can gain an advantage in the constantly evolving financial market.

As the digital transformation of banking continues to accelerate, companies are eager to improve customer service. However, making quick and significant changes to the customer experience requires an alliance with a trusted technology company like AddWeb Solution.

Experience Next-Gen Banking – Engage with a Trusted Banking Software Solutions Provider Now!

Pooja Upadhyay

Director Of People Operations & Client Relations