Look, I’ve seen it happen time and time again. A Shopify store is absolutely crushing it in the US market, maybe pulling in $50k a month, everything’s smooth sailing. Then the owner gets ambitious. “Hey, let’s go international!” they think. “We’re killing it here, so Europe should be easy money, right?”

Wrong. Dead wrong.

Here’s the brutal truth: roughly 90% of Shopify stores crash and burn when they try to expand internationally. And I’m not talking about a gentle decline, I’m talking about full-on disasters that can sink businesses that were previously profitable.

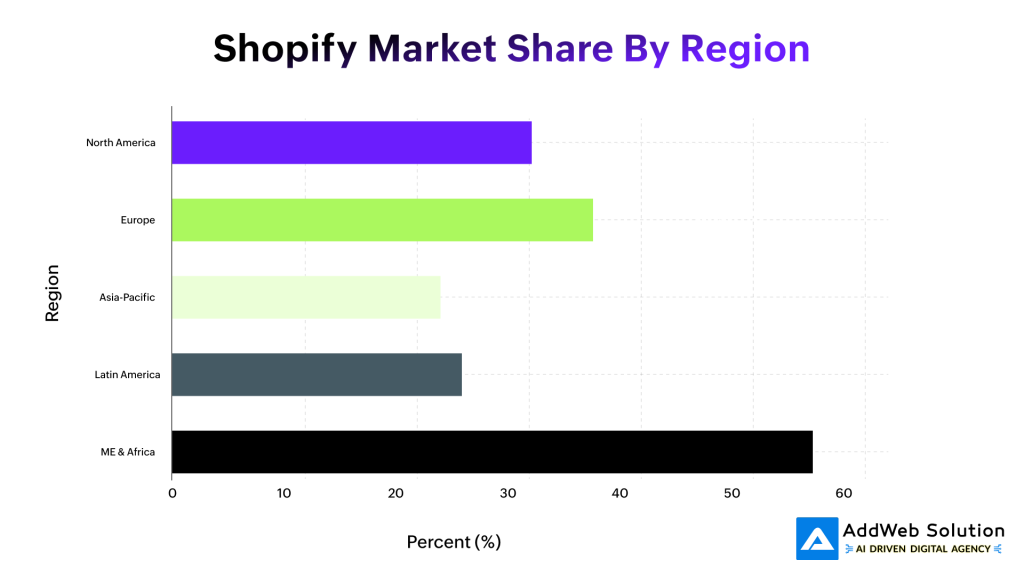

The global ecommerce market is massive, we’re looking at $7.9 trillion by 2030. That sounds incredible, doesn’t it? But here’s what nobody tells you: while Shopify has facilitated about $1 trillion in global sales and holds a solid 10.32% market share, most of their merchants are still playing it safe in their home markets. In fact, 62% of all Shopify stores are concentrated in North America.

Why? Because going global is a minefield that most entrepreneurs are completely unprepared for.

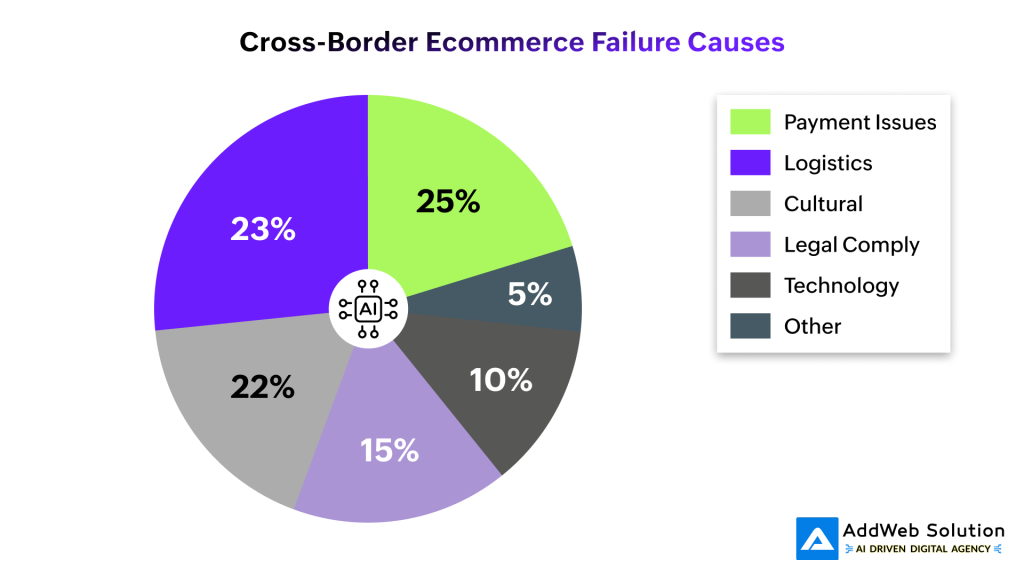

Primary Reasons for Cross-Border Ecommerce Expansion Failures

The Real Numbers Behind International Ecommerce Disasters

Let me hit you with some statistics that’ll make you think twice about that European expansion you’ve been dreaming about.

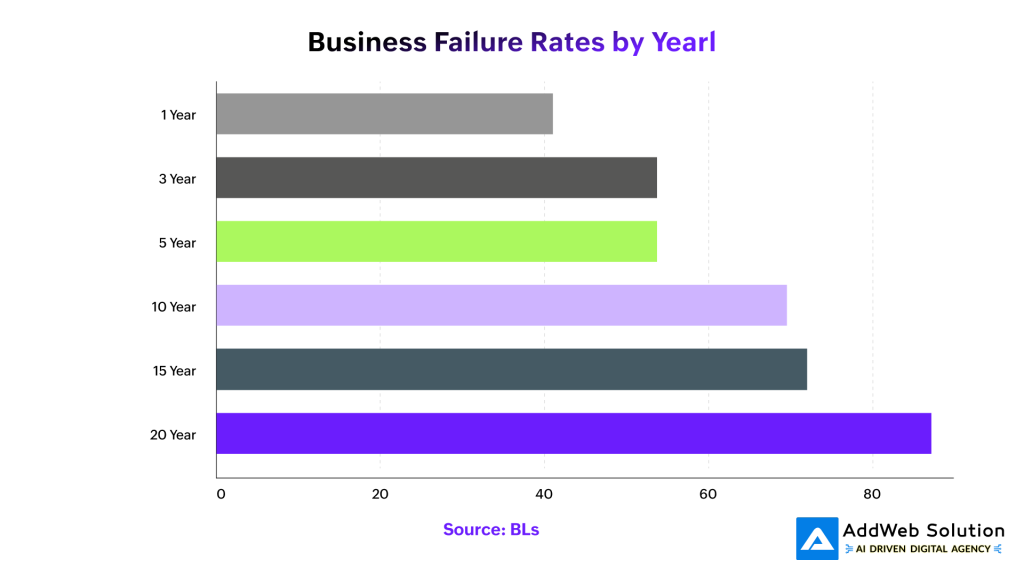

Business failure rates are already pretty scary. Only 34.7% of businesses survive beyond 10 years.

Business failure rates increase with time, reaching nearly 80% over 20 years according to BLS data.

But when you throw international expansion into the mix? The numbers get even uglier.

70% of cross-border ventures fail because they don’t understand their target markets. That’s not a typo; seven out of ten businesses fail simply because they didn’t do their homework.

And get this: 55% of businesses find cross-border operations difficult. More than half! These aren’t small mom-and-pop shops we’re talking about; these are established businesses with resources and experience.

Why Shopify’s Success Story Doesn’t Tell the Whole Picture

Sure, Shopify looks amazing on paper. They’re available in over 175 countries, they’ve got all these fancy international features, and their overall platform facilitates massive sales volumes. But here’s the kicker: the actual merchant success rate on Shopify hovers between 5-10%.

Think about that for a second. Even domestically, most Shopify stores fail. Now imagine trying to navigate foreign markets, different currencies, international shipping, and cultural barriers on top of that.

Shopify Store Distribution by Global Region

This chart shows exactly what I’m talking about. Shopify’s global footprint looks impressive until you realize it’s incredibly lopsided. The platform dominates North America but struggles everywhere else. That’s not because Shopify is bad; it’s because international expansion is that hard.

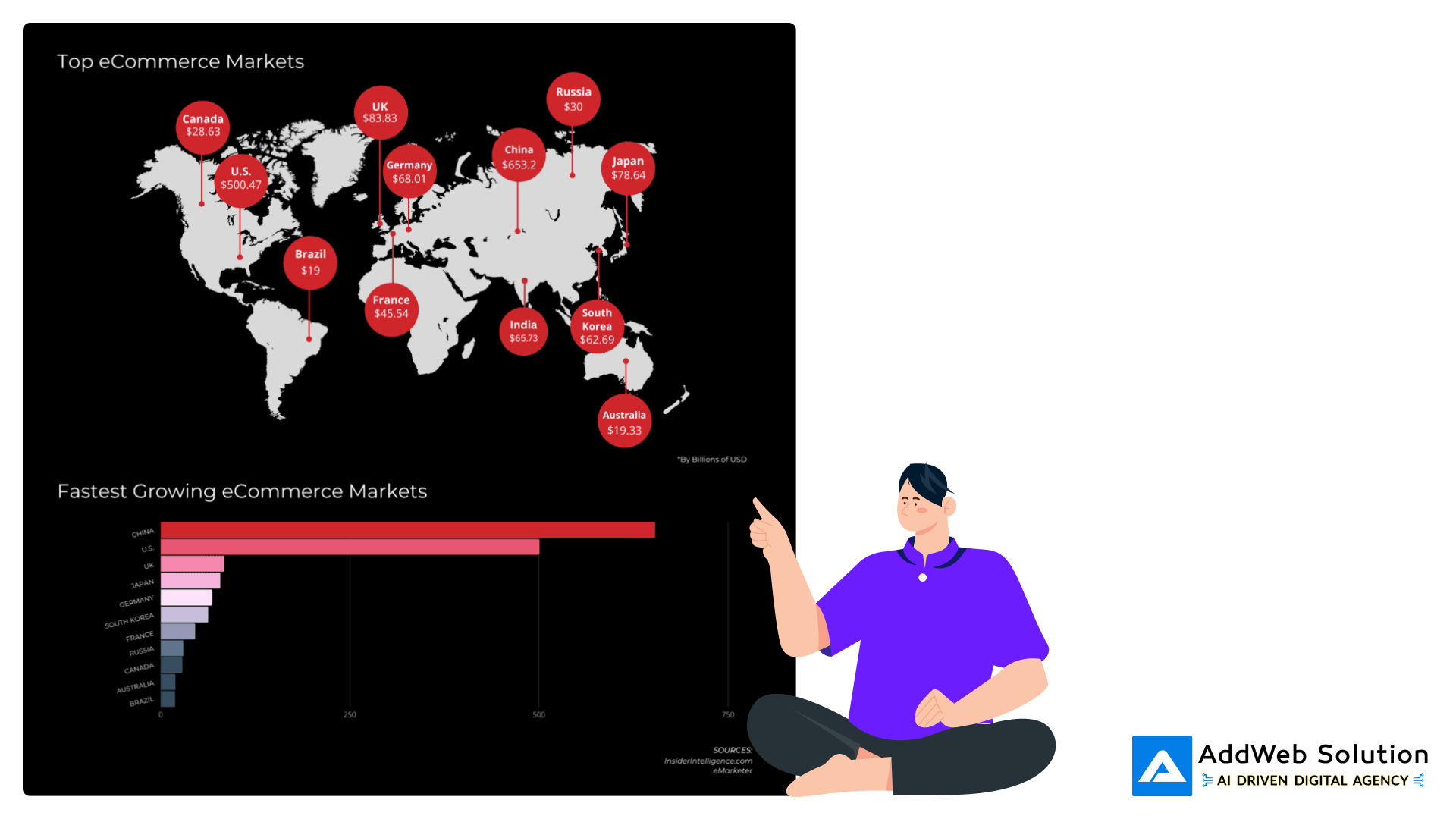

Top global eCommerce markets by size and growth highlight China and the U.S. as dominant players in international expansion.

Payment Problems: The Silent Store Killer

Here’s something that’ll shock you: around 15% of cross-border payments fail. Just fail. Completely.

I once worked with a client let’s call them “TechGadgets Plus” who was making $35k a month selling phone accessories in the US. They figured the UK would be easy money. Same language, similar culture, right?

Three months in, they were hemorrhaging cash. Why? Payment failures.

Their conversion rate in the US was a solid 3.8%. In the UK? 1.2%.

Here’s what was happening:

- Double currency conversion was adding 3-4% to every purchase

- British customers expected payment options that weren’t available

- Their fraud detection system was blocking legitimate UK transactions left and right

- 13% of customers just walked away when they saw prices in dollars

The worst part? 40% of consumers abandon their cart when a payment fails. Not “try again later” they’re gone forever.

After burning through $45,000 in six months, they gave up on international expansion completely.

Isometric illustration of a mobile payment error with a failed transaction message and a retry option.

The Payment Method Maze

There are now 140 different payment methods used around the world. Germans love invoice payments. Chinese customers want Alipay and WeChat Pay. Japanese consumers use Konbini payments for one-sixth of all their online purchases.

Miss these preferences? You’re toast.

One electronics store I know spent $30,000 setting up their German expansion, only to discover that their payment gateway didn’t support the invoice payments that 40% of German consumers expected. By the time they fixed it, their ad budget was gone and they’d lost momentum.

Shipping Costs: The Conversion Rate Destroyer

Want to know the fastest way to kill your international sales? High shipping costs.

63% of shoppers abandon their cart because of high shipping costs. 62% won’t buy without free shipping. And here’s the killer: international shipping often costs $25 or more, which drops conversion rates to just 1.5%.

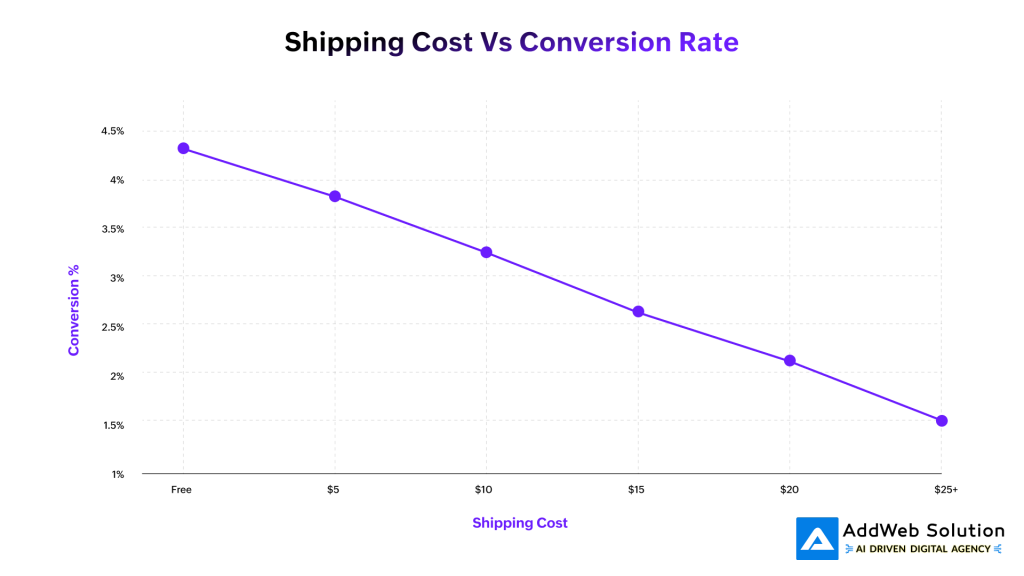

Impact of Shipping Costs on Ecommerce Conversion Rates

Look at this chart. It tells the whole story. Free shipping gives you a 4.2% conversion rate. Charge $25 for shipping? You’re down to 1.5%. That’s a 65% drop in conversions.

I know a Canadian home goods store that learned this lesson the hard way. They were selling kitchen accessories and doing great domestically. Decided to expand to Australia.

Their average shipping cost? $35 CAD.

Their cart abandonment rate? 68%.

Even after negotiating better rates and getting shipping down to $22 CAD, they were still seeing 41% abandonment. Their domestic rate was 18%.

The math just didn’t work. They shut down the Australia operation after losing $85,000.

The Logistics Nightmare

According to Deloitte’s cross-border eCommerce research, inconsistent pricing across channels, lagging website performance, lack of responsive design for mobile devices, and outdated seasonal campaigns are common issues for companies that have expanded to foreign markets.

These aren’t minor hiccups; they’re business killers. Imagine telling a customer their order will take “5-7 business days” and then having it stuck in customs for three weeks. Good luck getting repeat customers.

Cultural Misunderstandings: More Than Just Bad Translations

Everyone talks about translation, but cultural failures go way deeper than language.

Take Starbucks in Australia. Massive brand, tons of money, experienced international team. They still closed 61 of their 85 cafés by 2008.

Why? Australians were used to high-quality coffee with little sugar. Starbucks’ sweet, milky drinks just didn’t fit. They also expanded too fast without understanding the local market.

Or look at Walmart in Germany. They lost $1 billion because:

- Germans prefer smaller, specialist shops

- Their business practices violated local employment laws

- They completely misunderstood supplier relationships

McKinsey research reveals that fewer than 40 percent of senior executives at global companies believed that their employers were better than local competitors at understanding the operating environment and customers’ needs.

Ecommerce Cultural Disasters

For online stores, these mistakes are subtler but just as deadly:

German translations need 30-35% more space than English. Ever seen a beautifully designed product page turn into a hot mess because the German text doesn’t fit? It happens all the time.

Shopping behaviors vary wildly. Americans bulk buy for weeks. UK consumers shop more frequently from local retailers. Design your store for American behavior and watch your UK conversion rates tank.

Payment preferences differ dramatically. Cash is still king in many regions, while others have gone completely digital.

Harvard Business Review case studies show that “Walmart is a typical example of a global giant who has failed to localize its operations”, with analysts pointing to fundamental misunderstandings of local market dynamics.

Technology Problems: When Shopify Isn’t Enough

Don’t get me wrong; Shopify has solid international features. But most merchants either don’t use them properly or discover they’re not enough.

I’ve seen stores try to go international with basic Shopify plans. Big mistake.

Multi-currency display isn’t the same as proper currency handling. You need dynamic pricing, tax calculations, and currency hedging.

Performance optimization is huge. International customers expect fast loading times, but serving content globally requires CDN investments of $500-$2,000 monthly. Most merchants aren’t prepared for that cost.

Integration complexity multiplies exponentially. 90% of Shopify merchants use multiple channels. Managing these across different international markets? It’s a nightmare.

Turn Shopify expansion challenges into global opportunities

Pooja Upadhyay

Director Of People Operations & Client Relations

The Migration Disaster Story

A European fashion retailer I knew tried to upgrade from regular Shopify to Shopify Plus during their international expansion.

Result? Six weeks of downtime. $125,000 in lost sales. They ended up abandoning three target markets completely.

Legal and Regulatory Nightmares

Every country has different rules. Miss them, and you’re looking at fines, legal trouble, and costly back payments.

GDPR compliance alone can cost:

- Legal consultation: $25,000

- Technical implementation: $18,000

- Ongoing monitoring: $3,000/month

- Data protection officer: $60,000/year

That’s $139,000 in the first year. For many stores, that exceeds their entire international revenue projection.

Deloitte’s cross-border M&A research highlights three types of issues that are common: labor issues, minority investment issues, and antitrust and tax issues.

Success Stories: What Actually Works

Not everyone fails. Netflix cracked the code by starting with culturally similar markets (Canada first), then gradually expanding.

They invested heavily in local content; 45% of Netflix’s US library is now foreign-language content. They prioritize dubbed content in countries like Japan, France, and Germany, where audiences prefer it.

The Shopify Success Blueprint

The stores that make it internationally follow these principles:

Start small. One market at a time. Get profitable there before expanding further.

Invest properly. Budget 2-3 times your domestic expansion estimates. Account for compliance, localization, and extended break-even periods.

Local partnerships. Find distributors or partners who understand the market and regulations.

Payment localization. Offer the payment methods locals actually use.

Real customer support. Multilingual support during local business hours, not chatbots.

Harvard Business Review research emphasizes that success rests on developing a deep understanding of the target market, tailoring products and services to meet local needs, and ensuring that you have the right capabilities in the right place.

Average annual return on assets over 10 years, comparing companies staying local versus going global, showing local companies generally outperform global ones.

The Bottom Line

International expansion isn’t just “translate your website and ship overseas.” It’s a complete business transformation.

The 90% failure rate isn’t because the opportunity isn’t there; it’s because most people are completely unprepared for what international expansion actually requires.

You need proper funding, extensive research, local expertise, regulatory compliance, payment localization, shipping solutions, customer support infrastructure, and the patience to treat each new market as a separate business venture.

Can’t commit to all of that? Stay domestic. There’s no shame in building a solid, profitable business in your home market.

But if you’re serious about going global, do it right. The 10% who succeed aren’t lucky; they’re prepared.

For AddWeb Solution clients considering international expansion, remember: the question isn’t whether you can afford to invest properly in international expansion; it’s whether you can afford not to. Because cutting corners in international markets doesn’t just mean missing opportunities; it means losing everything you’ve built domestically when international failures drain your resources.

The choice is yours. Join the prepared 10%, or become another cautionary tale in the 90% failure statistic.

Sources:

- https://www.mckinsey.com/capabilities/people-and-organizational-performance/our-insights/the-global-companys-challenge

- https://hbr.org/2015/03/few-companies-actually-succeed-at-going-global

- https://hbr.org/2008/12/when-you-shouldnt-go-global

- https://www.deloitte.com/us/en/what-we-do/capabilities/mergers-acquisitions-restructuring/articles/cross-border-m-and-a-risks-rewards.html

- https://hbr.org/2024/05/a-model-for-expanding-your-business-into-foreign-markets

- https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/the-strategy-and-corporate-finance-blog/the-growth-code-go-global-if-you-can-beat-local

- https://commercetools.com/assets/resources/resources-assets/wp-on-the-road-to-cross-border-ecommerce-(deloitte)-en.pdf