The Bottom Line:: “Predictive analytics is no longer a source of competitive advantage; instead, it’s a principle of survival in the world of e-commerce. The current ROI of companies that already use machine learning stands at 250% to 775% in the first year of execution, while other companies are losing market shares through traditional means.

The market of AI-powered e-commerce can reach $22.6 billion by 2032 from the current 8.65 billion dollars in 2025. The time to react to these statistics is rapidly narrowing as December 2026 fast approaches. The companies that do not implement predictive analytics will find themselves struggling to cope with competition, personalization, pricing, and retention. “

This article will demonstrate how ML affects the world of e-commerce with a quantifiable analysis of its implementation using Laravel. Your business cannot wait!

The Market Reality: AI Adoption Is Already Here

The adoption curve is increasing at a rate much faster than most CEOs are aware of. As per the latest surveys from the industry, “89 percent of retailers are either using or testing the use of AI,” up from “82 percent in 2023.” More notably, “87 percent of those using or testing the use of AI say their annual revenues are up, and 94 percent say their operations costs are down.” In the e-commerce industry, “51 percent of companies are using AI-driven personalized commerce,” and “the market is projected to reach $51 billion by 2033.“

The global predictive analytics market will enjoy a CAGR of 21.4% in the forthcoming years, estimated to reach a market value of 94.8 billion in 2032. On the other hand, the e-commerce predictive analytics market will grow at an increased rate of 28.3% CAGR. Market value will rise by an estimated 5.54 billion between 2024 and 2029.

What’s significant is the spending pattern: today, retail organizations are allocating 20% of their tech budget to AI—up from 15% only last year. It’s as if organizations that have not yet embarked on an ML journey are giving away market shares to their competitors who have.

Use Cases for AI in the E-Commerce Industry: Market Share in 2025

Why Predictive Analytics Delivers Exceptional ROI

The Numbers Don’t Lie

As opposed to many other investments involving new technologies that claim unclear competitive benefits, the benefits of predictive analytics are clear and quantified. Here’s the ROI information from across various industries:

- Customer churning prediction: 775% ROI in first year, lowering attrition rates by 7-30% based on the industry

- E-commerce Personlization: 700% ROI, with 15-25% sales growth for individual retailers

- Fraud Detection: 566% ROI, Preventing Massive Annual Losses

- Demand Forecasting: 400% ROI with Inventory Optimization and Minimized Stockouts

- AI chatbots: 148-250% return on investment in as little as 1.4 months

These are no outliers. The case study of a Southeast Asian e-commerce firm using AI-powered product suggestions resulted in a 23% increase in the average value of orders, a 31% increase in conversion rates of suggested products, and a 17% increase in overall revenue. Case in point: An e-commerce retail site, with a $250,000 investment in a recommendation system, saw a $2 million revenue increase in a year, giving 700% ROI in the first year alone.

The payback period is also an important consideration. In high-value applications such as fraud detection or churn prediction, the ROI comes positively in 6 to 12 months, whereas in some cases, it comes in just 1.4 months.

ROI on AI-Driven E-Commerce Projects (Year 1)

Conversion Rate Multipliers: The Real Value

ROI considerations or not, the practical implications of predictive analytics are where the power of competitive differentiation lies. This is what the information tells us:

AI chat leads to a conversion rate increase of 4X when compared to unaided shopping (12.3% vs. 3.1%), with customers completing their purchase tasks 47% faster when aided by AI. When it comes to return business, the difference is even more striking, with return customers spending 25% more while using AI.

Think of the ripple effect: 15% conversion lift for the e-commerce business generating $1 million in monthly revenue translates to $15,000 in extra profit per month or $180,000 on an annual basis. That has a payback period of 1.4 months on the typical $250,000 implementation spend.

Produced Image: Aided Software for e-Commerce

Artificial Intelligence e-commerce platform with Predictive Analytics & Machine Learning dashboard visualization

The Three Pillars of Predictive Analytics for E-Commerce

1. Customer Intelligence & Retention

The role of predictive analytics brought about the proactive aspect of customer support. The most critical use of predictive analytics at this point in time is related to predicting a customer’s churn before the customer actually leaves.

Real-world impact:

- The technology has enabled businesses to realize a customer churn of 25-30%_reduction.

- Companies employing systems of predictive retention measure a 20-30% increase in customer lifetime value

- At-risk customers’ identification tools help achieve up to 30% reduction of customers’ churn when combined with personalized interventions.

The math is simple: if an e-commerce business has 10,000 active users on average each month and their lifetime value is $500, the financial impact of reducing customer turnover by 7% is essentially $350,000. The cost of predictive analytics tends to be between 5 and 15 percent of this amount.

2. Revenue Optimization Through Personalization

AI-driven personalization isn’t just recommendations—it’s a complete reimagining of how customers interact with your products.

Key performance metrics:

- Product recommendations increase average order value by 20–40%, with conversion rates lifting by 15–20%

- Dynamic pricing models boost profit margins by 10–15% while maintaining competitive positioning

- Propensity modeling (predicting which customers will buy which products) achieves 40% higher conversion rates and 47% more revenue from targeted campaigns

Practical Example:

One online fashion store introduced AI-based personalization and achieved the following:

- 20% increase in customer satisfaction scores

- 12% Increase in Repeat Business |

- 15% Average Order Value Increase

- Overall sales growth of 25% in six months

It was no startup or tech firm that had limitless budgets—it was a mid-range retailer using best practices in machine learning on their existing clients.

3. Operational Efficiency & Cost Reduction

It reduces waste on an extensive scale. It is capable of making precise predictions regarding demand. It thus enables e-commerce sites to run leaner.

Historical Improvements:

- The reduction of overstocking by 18-30% and stockouts by 20-30% can

- The use of historical sales data, climate information, and demographics boosts the forecast’s accuracy between 15% and 25% compared to the traditional approach

- Conversational Customer Service via NLP enables the answering of 93% of customer queries automatically, resulting in a 30% reduction in customer service costs

- Customer acquisition costs are reduced by 10-30% by marketing through optimal channels using marketing automation

Walmart’s use of Machine Learning tool sets an important precedent in this respect. Based on the analysis of past sales data, macroeconomic data, local demographics, as well as weather, Walmart dynamically varied the levels of inventory at different stores and distribution outlets.

Launch your AR-ML powered storefront today — book a quick consult.

Pooja Upadhyay

Director Of People Operations & Client Relations

LARAVEL: Your Competitive Edge to Leverage AI Future

In the context of those enterprises established using the Laravel (PHP) platform, getting a visible implementation edge comes with the understanding that the Laravel platform environment is optimally designed to incorporate AI without having to recreate the platform.

Why Laravel Wins at AI Integrations

1. Smooth API Integration

The http clients provided by Laravel (Guzzle) make it very simple to interact with external AI APIs. Need to implement the OpenAI API to add chatbot capabilities? Simple coded lines will implement authentication, building the request, and parsing the response. There goes the excuse, “We need to rethink our backend when implementing ML.”

2. Background Processing & Job Queues

The heavy computations in AI work should never hinder user-facing functionality. Through the scheduling and queuing mechanism in the Laravel package, there is asynchronous processing of the predictions in AI, in the form of both model training and batch inferences.

3. Database Flexibility & Eloquent ORM

Laravel’s data layer works perfectly well with vector databases like Pinecone and Weaviate and also with relational databases. This has implications with respect to the need for historic transactions (SQL databases), which are required for models, and embeddings for semantic search (vector databases).

4. Real-Time Data Processing

Laravel’s event system, combined with streaming services like Kafka or AWS Kinesis, enables real-time personalization. When a customer browses a product, recommendations update instantly without page reloads.

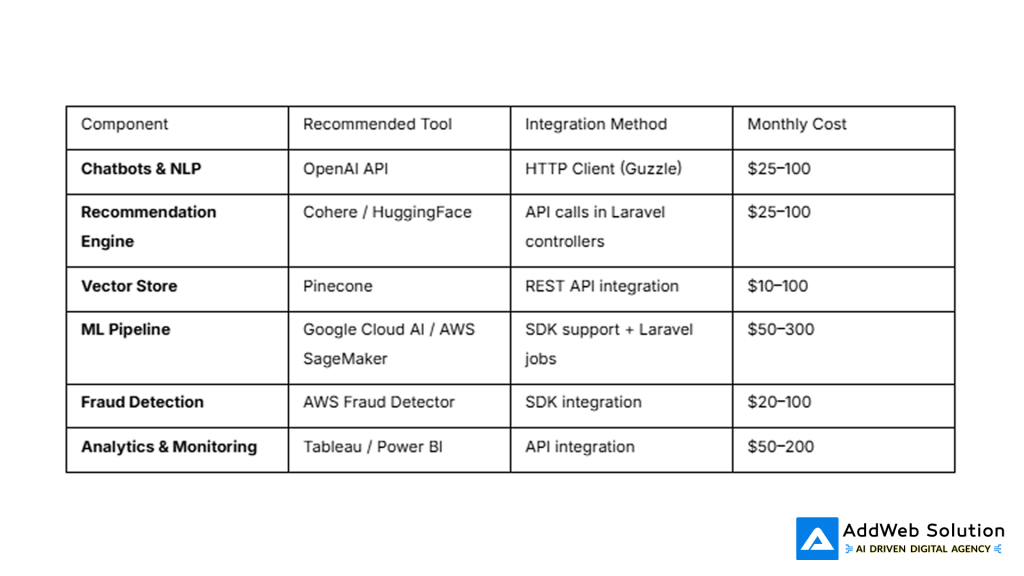

Practical Laravel + AI Implementation Stack

Cost reality: A basic predictive analytics setup (chatbot + recommendations) costs $50–150/month in platform fees, with development costs typically $10,000–$50,000 for integration. For businesses with existing Laravel infrastructure, this is significantly cheaper than re-platforming to specialized ML vendors.\

Implementation Roadmap: 12-Month Path to 400% ROI

E-commerce businesses often ask: “Where do we start?” Here’s a proven 12-month roadmap:

Phase 1: Foundation (Months 1–2)

Focus: Data collection, infrastructure setup, first quick win

- Months 1–2: Implement data collection layer (customer behavior, transactions, browsing). Set up cloud infrastructure (AWS/GCP) for storage and compute. Deploy first use case: AI chatbot for customer support. Expected ROI: 25–40%

- Team required: 2–3 backend developers, 1 DevOps engineer

- Budget: $15,000–$30,000

- Success metric: Chatbot handling 30% of support queries with >90% satisfaction

Phase 2: Scale (Months 3–6)

Focus: Revenue-generating features, advanced personalization

- Months 3–4: Deploy product recommendation engine. Begin A/B testing personalized product feeds. Expected ROI: 60–100%

- Months 5–6: Implement demand forecasting model to optimize inventory. Launch churn prediction system to identify at-risk customers. Expected ROI: 80–150%+

- Team required: 1–2 data scientists, 3–4 ML engineers, 2–3 backend developers

- Budget: $40,000–$80,000

- Success metric: 15%+ conversion lift, 20%+ AOV increase, 10%+ churn reduction

Phase 3: Optimize (Months 6–12)

Focus: Continuous refinement, advanced features, ROI maximization

- Months 6–9: Implement dynamic pricing engine. Develop predictive upsell models. Launch advanced personalization (device-specific, time-of-day, cohort-based). Expected ROI: 150–300%

- Months 9–12: Optimization phase—continuous model retraining, A/B testing variant recommendations, fraud detection enhancement. Expected ROI: 200–400%+

- Team required: 1–2 optimization specialists, 1–2 data analysts

- Budget: $20,000–$40,000

- Success metric: Sustained 20%+ revenue uplift, <5% fraud rate, >95% inventory accuracy

Cumulative 12-month ROI: Based on typical e-commerce metrics, this roadmap targets 200–400% ROI by month 12, with breakeven typically occurring around month 4–6.

The Business Case: Financial Model

Let’s work through a realistic financial model for a mid-market e-commerce retailer:

Baseline assumptions:

- Monthly revenue: $500,000

- Conversion rate: 2.5%

- Average order value: $75

- Monthly transactions: 6,667

- Monthly visitors: 266,800

Year 1 predictive analytics investment:

- Platform & API costs: $1,500–$3,000/month ($18,000–$36,000 annually)

- Implementation & development: $50,000–$75,000 (one-time)

- Talent (1 data analyst + fractional data scientist): $60,000–$80,000 annually

- Total Year 1 cost: $128,000–$191,000

Expected returns by month 12:

- Conversion rate improvement: 2.5% → 3.1% (+24% lift)

- AOV improvement: $75 → $87 (+16% lift)

- Combined revenue lift: 2.5% → 3.1% * 1.16 = +41% revenue impact

- Additional monthly revenue: $500K * 0.41 = $205,000/month

- Annual additional revenue: $2.46 million

ROI calculation:

- Year 1 investment: $160,000 (midpoint)

- Year 1 revenue gain: $2.46 million

- Year 1 net return: $2.3 million

- ROI: 1,437%

While this assumes upper-range improvements, even conservatively (20–25% combined lift instead of 41%), the ROI exceeds 600%—well above typical IT investments.

Critical Success Factors: Why Some Fail (And How to Avoid It)

Not every predictive analytics initiative succeeds. Research on failed implementations reveals consistent patterns:

The Major Pitfalls

1. Poor Data Quality & Integration

The #1 reason predictive models underperform: dirty, incomplete, or siloed data. Retailers frequently encounter fragmented data across sales systems, CRM platforms, and web analytics tools. The solution isn’t better algorithms—it’s unified data infrastructure. Invest in data cleaning, validation, and integration platforms before building ML models.

2. Misalignment Between IT and Business Teams

Technical teams build sophisticated models. Business teams don’t understand them. Result: models don’t match business requirements. Solution: Cross-functional ownership from day one. A business stakeholder must own each use case’s success metrics.

3. Lack of Skilled Personnel

Data scientists are expensive and in short supply. Many retailers try to hire one expert who becomes a bottleneck. Solution: Start with pre-built platforms and managed services (OpenAI, Cohere, Google Cloud AI) rather than building everything in-house.

4. Market Volatility & Model Degradation

Real-world markets are chaotic. Predictive models trained on historical data struggle with unprecedented events (economic shocks, competitive disruptions). Solution: Implement continuous retraining pipelines. Models decay rapidly in retail; monthly or quarterly updates are necessary.

5. Inflexible Legacy Systems

Many retailers are locked into rigid on-premise ERP systems that don’t integrate with modern ML platforms. Solution: Cloud-first architecture from the start. Use Laravel’s flexibility to integrate with cloud ML services without ripping out your entire backend.

The 2026 Competitive Landscape: AI Becomes Table Stakes

Looking ahead to 2026, the market dynamics are clear:

Merchants without AI will face margin compression. As competitors leverage dynamic pricing powered by predictive analytics, businesses using static pricing will lose price wars. As others personalize recommendations, generic product feeds will see conversion decline. As competitors deploy chatbots, customers will expect instant support from all retailers.

Zero-click commerce is accelerating. AI agents that browse and purchase on behalf of customers are no longer science fiction—they’re launching in 2025–2026. Retailers who aren’t building AI-friendly product feeds and structured data will become invisible to these agents.

AI agents as personal shoppers will reshape how customers discover and buy products. Traditional search-based discovery will decline. Retailers must adapt selling strategies to be AI-friendly, which means clear product data, transparent pricing, and predictable business logic.

Investment in AI infrastructure becomes mandatory. Retailers allocating 20% of tech budgets to AI today will likely increase that to 25–30% by 2026. Those still below 5–10% will struggle to catch up.

Key Metrics to Track: Building Your Measurement Framework

Once you’ve deployed predictive analytics, tracking the right KPIs is critical. Here’s what matters:

Business Impact Metrics

- Revenue attribution: Incremental revenue generated by AI features (measured via holdout testing)

- Conversion rate lift: Percentage improvement in conversion rates (overall and by channel)

- Average order value uplift: Dollar increase in mean transaction value

- Customer lifetime value: Increased CLV due to better retention and personalization

- Churn reduction: Percentage of predicted-at-risk customers retained via intervention

Operational Metrics

- Forecast accuracy: Mean Absolute Percentage Error (MAPE) or Root Mean Square Error (RMSE) for demand forecasts

- Inventory efficiency: Reduction in stockouts, overstock incidents, and carrying costs

- Customer satisfaction: Net Promoter Score (NPS), CSAT improvement with AI features

- Cost reduction: Support costs per ticket, marketing cost per acquisition, operational overhead reduction

Model Performance Metrics

- Precision & recall: How many true positives the model identifies

- AUC-ROC score: Model’s ability to distinguish between classes (crucial for fraud detection, churn prediction)

- Latency: Inference time for real-time recommendations (target: <100ms for customer-facing features)

The critical principle: link every model metric to a business metric. A model with 95% accuracy means nothing if it doesn’t drive revenue.

The Path Forward: Your 2026 Strategy

The e-commerce leaders of 2026 will be those who embedded predictive analytics into their operational DNA in 2025. Here’s the strategic imperative:

Step 1: Commit to data-first culture. Start collecting and cleaning data now. Data is the prerequisite for everything that follows. Without high-quality data, ML delivers no value.

Step 2: Choose your first high-impact use case. Don’t try to boil the ocean. Pick one: churn prediction, recommendation engine, or demand forecasting. Execute, measure, and scale on success.

Step 3: Leverage managed services & platforms. You don’t need in-house data scientists to start. OpenAI, HuggingFace, Google Cloud AI, and Cohere offer pre-built models and APIs. Use them.

Step 4: Build measurement discipline from day one. Define success metrics before deployment. Track them religiously. Adjust models based on data, not intuition.

Step 5: Scale incrementally. Use month 0–6 to prove ROI on your first use case. Use months 6–12 to add adjacent capabilities. By month 12, you’ll have a comprehensive predictive analytics platform generating 200–400% ROI.

Conclusion: No Business Is Too Small to Start

The barrier to entry for predictive analytics has collapsed. Cloud platforms, managed ML services, and Laravel’s integration flexibility mean that even 5–10 person e-commerce teams can deploy production-grade AI systems within 60–90 days.

The real cost isn’t technology—it’s the cost of waiting. Every month without predictive analytics is lost revenue, missed customer insights, and increasing competitive disadvantage. By 2026, this won’t be a differentiator anymore. It’ll be the baseline expectation.

The question isn’t “Can we afford to implement predictive analytics?” It’s “Can we afford not to?” The data suggests the latter is far more expensive in the long run.

Start Your AI Journey Today

The tools exist. The frameworks exist. The proven ROI exists. What’s missing is action. If you’re serious about e-commerce growth in 2026, predictive analytics isn’t optional—it’s imperative.

For technical teams: Start with Laravel integrations to OpenAI or HuggingFace APIs. Deploy a chatbot or recommendation engine as your proof-of-concept.

For business leaders: Allocate 15–20% of your tech budget to AI initiatives. Set clear ROI targets. Measure ruthlessly.

For the entire organization: Embrace a data-driven culture where decisions are informed by predictive insights, not hunches.

The businesses dominating e-commerce in 2026 will be those that started their predictive analytics journey in 2025. Don’t be left behind.

Resources:

- https://blogs.nvidia.com/blog/ai-in-retail-cpg-survey-2025/

- https://www.shopify.com/in/blog/ai-statistics

- https://www.technavio.com/report/e-commerce-predictive-analytics-market-industry-analysis

- https://www.sap.com/sea/blogs/ai-predictive-analytics-drive-ecommerce-profitability

- https://www.bloomreach.com/en/blog/roi-for-machine-learning-ecommerce

- https://kpidepot.com/kpi-data/predictive-analytics-279

- https://fiveable.me/predictive-analytics-in-business/unit-1/key-performance-indicators-kpis/study-guide/wg8uVdJ6dTqee0k0

- https://www.youtube.com/watch?v=l8pA91qZlqo