In the early part of 2026, self-driving AI agents are no longer conceptual ideas but production-ready systems actively negotiating supplier contracts, finishing procurement transactions, and optimizing supply chains with minimal human intervention. This is a paradigm shift in the way businesses engage in commerce, driven by the convergence of innovations in large language models, multi-agent orchestration frameworks, and open payment protocols.

Large payment systems (Visa, Mastercard) and commerce companies (OpenAI, Stripe, Google) have invested billions of dollars in infrastructure to support agent-to-agent transactions. Early adopters are realizing 23-31% cost savings and 40-70% productivity gains in procurement processes. For technology visionaries and business leaders, knowledge about AI-to-AI commerce is no longer a choice but a strategic necessity.

The Market Opportunity: From Concept to Scale

Market Size and Growth Projections

The global AI in procurement market is experiencing explosive growth, reflecting enterprise confidence in agent-based technologies:

- Current Scale (2023): USD 1.9 billion

- Projected Scale (2033): USD 22.6 billion

- Compound Annual Growth Rate: 28.1%

Global AI in Procurement Market Trajectory (USD Billions)

Looking beyond the procurement function in particular, McKinsey estimates that agentic commerce revenue will reach $1 trillion by 2030, which puts the total addressable market into perspective as being significant but not large compared to the $30+ trillion spent on retail worldwide.

This would indicate that the market is still in the early stages of adoption, with much growth potential as the capabilities of agents evolve.

Enterprise Adoption Is Accelerating

Gartner’s forecast indicates a clear transition from proof-of-concept to production-ready:

- 2025: Fewer than 5% of enterprise apps will embed task-specific agents

- 2026: 40% of enterprise apps will embed task-specific agents

- 2028: 15% of daily work decisions will be made autonomously by agentic AI

This rapid growth is not based on hype but on hard financial numbers. Companies using AI agents are seeing:

- Average ROI: 312% within the first year

- Direct cost savings: 40–70% efficiency gains for routine tasks

- Time reduction: Loan processing from 3 days to 4 hours

- Invoice processing: 5x more invoices per person; 80% reduction in late payment penalties

- Supply chain optimization: 23–31% cost reduction; 40–50% reduction in stockouts

Business Impact Metrics from AI Agent Deployments

These metrics are the reason why procurement is now a high priority. While customer service or content creation may have seen incremental benefits from AI, agent-based procurement offers auditable cost savings at scale.

The Negotiation Paradigm: How Autonomous Agents Make Deals

What Has Changed: From Recommendations to Authority

The role of AI in procurement has always been a decision-support tool. While machine learning could analyze supplier information, suggest pricing approaches, or point out contract issues, the human had the final say.

This is no longer the case. Today’s autonomous agents have real decision-making power:

Autonomous Supplier Discovery and Evaluation. Instead of waiting for human researchers to discover and evaluate potential suppliers, agents autonomously:

- Search market data in real-time to discover suppliers who satisfy organizational criteria

- Simultaneously evaluate supplier reliability, cost-effectiveness, and sustainability performance

- Aggregately predict supplier risk based on external signals (credit ratings, financial viability, geopolitical risk)

- Continuously monitor current suppliers and automatically switch to new suppliers when performance declines or risk factors arise

Multi-Issue Contract Negotiation. Agents can negotiate dozens of issues simultaneously—price, payment terms, delivery schedules, liability provisions, compliance issues, warranty terms—and stay strategically consistent and organizationally aligned.

Game-Theoretic Strategy Adaptation. Instead of using fixed negotiation scripts, agents use reinforcement learning to dynamically adjust their strategy in response to the actions of their negotiation counterparts. Large-scale negotiation tournaments demonstrate that highly effective negotiation strategies combine traditional negotiation theory (warmth, credibility, understanding of counterpart constraints) with AI-specific strengths (chain-of-thought reasoning, quick scenario analysis, pattern recognition over past negotiations).

Direct Transaction Execution. Using trusted, tokenized payment infrastructure, agents can directly execute transactions without revealing their organizational payment information, finishing the negotiation-to-settlement process with no human involvement.

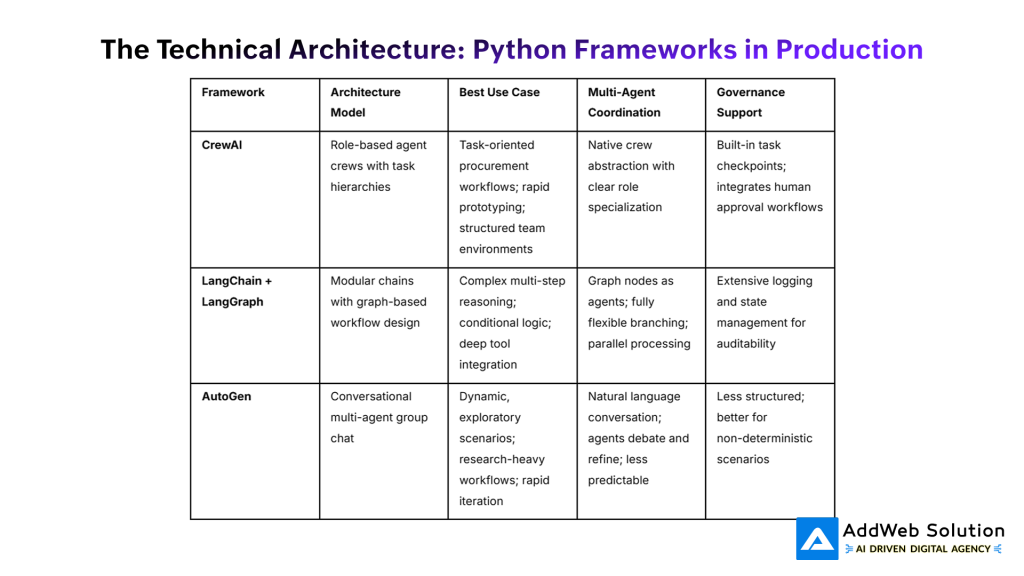

The Technical Architecture: Python Frameworks in Production

To construct production-ready negotiation agents, one must choose the appropriate framework and orchestration strategy. At present, there are three Python frameworks that lead the way:

For procurement and negotiation, the most operationally feasible frameworks are CrewAI and LangGraph. CrewAI’s role-based architecture is well-suited to the way procurement teams function in practice—a sourcing agent finds candidates, a risk analyst analyzes terms, a negotiator manages conversations, a compliance officer checks off requirements. LangGraph is particularly adept at conditional escalation routes, automatically escalating high-value negotiations for human approval before commitment.

Agent Negotiation Dynamics: Winning Against Other Agents

When two agents negotiate directly, with a buyer agent from one organization and a seller agent from another, some fascinating dynamics arise that are different from human-to-human negotiation.

Findings from research studies on large-scale AI negotiation competitions include:

Capability Drives Outcomes. Agents with more capable language models (as measured by performance on general reasoning tasks) will reliably reach better negotiation outcomes as buyers and sellers. This is a disturbing disparity: organizations with more advanced language models will have a systematic economic advantage over others in agent-to-agent negotiation. A buyer with GPT-4-level reasoning capabilities will systematically beat a buyer with a smaller model, independent of the negotiation context.

Success Factors Blend Theory and Execution. Agents that display warmth—positive, grateful, and inquiring—close more deals and attain better subjective results for their counterparts. At the same time, agents that display dominance assert more value. The best strategy is complex: it must combine warmth to sustain the negotiation process and dominance to assert value.

Failure Modes Are Real and Quantifiable. Agent-to-agent transactions show several categories of risk:

- Constraint Violation: The buyer agents disregard budget constraints and overpay, and the seller agents accept prices lower than their cost.

- Negotiation Deadlock: The agents get trapped in circular counter-offers without reaching an agreement.

- Early Settlement: The agents with lenient parameters settle too quickly instead of optimizing for better terms.

These failure cases are not mere hypotheses. They happen in production environments because LLMs, although highly powerful, have trouble maintaining perfect fidelity to complex constraints during extended interactions.

Real-World Applications: Tangible Business Impact

Supply Chain Optimization and Vendor Management

Use Case: A mid-market manufacturing firm has a complex supply chain with over 200 active suppliers in 15 geographic regions. Before, supplier selection and contract renewal took 6-8 weeks of manual analysis and approval.

Agent Implementation:

- Autonomous sourcing agents scan market data continuously, finding new supplier candidates based on quality and cost parameters

- Risk agents track active suppliers in real time using aggregated external data (credit ratings, regulatory notices, geopolitical events)

- When risk thresholds are crossed (e.g., supplier credit rating falls below acceptable standards), agents automatically initiate supplier switch procedures

- Negotiation agents manage renewal negotiations, seeking better terms while preserving supplier relationships

Results: Supplier assessment cycles reduced from 8 weeks to 2-3 days. Cost per unit reduced by 23-31% via continuous optimization and supplier competition. Stockout events decreased by 40-50% via enhanced demand forecasting and ordering.

Invoice Processing and Accounts Payable Automation

Use Case: An enterprise with 10,000+ invoices per month from various suppliers struggles with processing invoices against purchase orders, resolving discrepancies, authorizing payments, and securing early payment discounts.

Agent Implementation:

- Document extraction agents automatically read invoice PDFs, extracting line items, terms, and vendor details

- Matching agents match invoice information with purchase orders and goods receipt documents

- Reconciliation agents point out discrepancies (incomplete orders, differences in quantities or prices) and either automatically correct common problems or send to human analysts for review

- Approval workflow agents distribute invoices for approval according to company policies (amount, vendor, cost center)

- Payment agents automatically process payments based on terms, capturing available early payment discounts

Results: Processing power grew 5 times per accounting professional. Time spent on manual processing decreased from 4-6 hours per batch to 20-30 minutes. Late fees decreased by 80% by better capturing discounts for 2/10 net 30 terms.

Dynamic Contract Negotiation and Renewal

Use Case: An international company is required to renew more than 500 vendor contracts every year. These contracts contain complex clauses such as pricing structures, volume guarantees, service level agreements, liability limits, and payment conditions.

Agent Implementation:

- Analysis agents uncover past contract terms and performance data to identify trends and successful precedents

- Risk agents assess new contract terms based on organizational policies, pointing out unacceptable liability terms and payment conditions

- Negotiation agents offer counter-proposals supported by market intelligence (similar vendor rates, past pricing patterns)

- Compliance agents check contract wording for adherence to regulatory norms and industry best practices

- Decision agents suggest human approval/disapproval, pointing out high-risk decisions for senior review

Results: The time taken to renew contracts reduced from 6-8 weeks to 2-3 weeks. Procurement specialists shifted from processing contracts (data entry, contract review) to managing relationships. Organizations are able to secure better contract terms by leveraging data-driven negotiations with full market context.

The Governance Imperative: Control Without Stifling Efficiency

Despite the great potential of autonomous agents, there is a pressing need for governance. In 2026, a survey of enterprises revealed that 60% of those using AI agents did not have governance in place.

The need for governance of autonomous agents is now widely accepted. There are three aspects of this that must be addressed.

1. Explainability and Audit Trails

When an agent commits an organization to a contract, it is necessary that the stakeholders be able to understand why that particular decision was made. This is achieved through the use of Agent Decision Records (ADRs), which record the following information:

- Data inputs: Supplier performance metrics, budget constraints, market conditions, and regulatory requirements

- Reasoning chain: What the agent sought to optimize for, what alternatives were considered, what constraints were binding

- Decision output: The terms and confidence level associated with the decision

- Policy alignment: How the decision is aligned with organizational policy and approver mandates

In more advanced systems, every message exchanged between agents is recorded, allowing auditors to reconstruct the entire conversation and see how both agents’ decisions led to the terms.

2. Human-in-the-Loop Controls

However, despite the capabilities of the agents, human oversight is a non-negotiable in the short term. The best practices that are currently being followed are:

- Escalation thresholds: These are decisions that are automatically escalated to human approval if they go beyond the cost/risk thresholds

- Exception flagging: These are terms that are flagged by the agents as being against policy or beyond risk tolerance and require human approval before acceptance

- Periodic audits: These are post-hoc audits of decisions made by the agents to check for drift from policy or potential failure modes

- Override capability: This is the capability of humans to override decisions initiated by the agents, even after they have been executed, within a specified time window

Companies that have the highest ROI are the ones that follow these best practices and do not see them as a hindrance but as a risk management strategy. A financial services company that rushed to full agent autonomy without risk management controls lost heavily when an investment advisory agent made recommendations based on outdated market data. It took months of manual corrections and heavy legal bills to recover.

3. Transparency Standards and Compliance Frameworks

The regulatory environment is quickly taking shape. Businesses can expect the following standards to be enforced:

- Agent accountability: Specific definition of which individuals granted agent functionality and are liable for the results

- Compliance validation: Automatic checks to ensure that agent decisions comply with regulations (GDPR, CCPA, sector-specific laws)

- Dispute resolution: Specific procedures when other parties contest agent-agreed terms, with proof of agent reasoning available

- Liability allocation: Specific language in contracts regarding which party assumes financial liability if an agent commits an unauthorized act

Early leaders are already incorporating these standards into their agent platforms today, gaining a strategic edge through forward-thinking compliance rather than patching issues after the fact.

Adoption Reality: Market Signals and Organizational Challenges

The pace of enterprise adoption is quickening, but key friction points still exist.

Current Adoption Status (Q1 2026)

- Payment Processing: 33% of B2B payment flows are using or piloting AI agents

- Procurement Negotiations: 1 in 5 B2B sellers will meet buyer procurement agents by end of 2026

- Customer Service: 30-35% of mid-to-large enterprises are using agents for first-line support

- Invoice Processing: Primarily adopted in large enterprises with 10,000+ invoices per month

The key point here is that the adoption rates differ. Customer service is a rapid adopter because the cost of failure is low (wrong response to a support question vs. a mis-signed contract). Procurement is a more measured process because the stakes are high.

Primary Blockers to Scaled Adoption

Despite compelling ROI, organizations cite three major challenges:

Data Readiness (58% of organizations cite as #1 blocker). Agents perform optimally only when fed clean, integrated, consistently formatted data. Most organizations have data scattered across legacy systems—ERP, procurement platforms, supplier databases—with inconsistent taxonomies and quality standards. Normalizing this data infrastructure often takes 6–12 months, delaying agent deployment by that period.

Governance Maturity Gaps. 60% of organizations deploying agents lack formal governance policies. These organizations are taking outsized risk, operating agents without audit trails, explainability, or escalation thresholds. As soon as an agent makes a costly mistake, these organizations face regulatory or operational consequences.

Trust and Risk Asymmetry. Executives understand the upside (cost savings, efficiency) but worry about downside risk if agents malfunction. A single high-profile agent failure—a contract signed at below cost, a procurement vulnerability introduced through poor supplier vetting—can devastate organizational confidence in the entire approach.

Organizations that are winning in 2026 share common characteristics: they start with narrowly scoped use cases (invoice matching, not full negotiation), they invest in data infrastructure upfront, they implement governance from day one, and they maintain human oversight even when agent capability permits full autonomy.

Competitive Dynamics: The Standards War and Vendor Landscape

The emergence of open protocols for agent-to-agent commerce has sparked a competitive battle for dominance, with substantial implications for enterprise strategy.

Major Protocol Contenders

Agentic Commerce Protocol (ACP). Developed jointly by OpenAI and Stripe in early 2025, ACP provides a standardized language for agents to discover merchants, negotiate terms, and complete purchases. ACP emphasizes simplicity, quick adoption, and integration with existing payment infrastructure. It is stewarded by OpenAI and Stripe but positioned as an open standard.

Agent2Agent Protocol (A2A). Google’s competing standard, announced in April 2025, is designed to enable cross-platform agent orchestration with greater flexibility for multi-party negotiations and complex workflow coordination.

Proprietary Platforms. Major commerce players (Amazon, Shopify) are building agent capabilities into their platforms but not necessarily exposing interoperable APIs. This creates the risk of “walled gardens” where agents can transact within an ecosystem but not across boundaries.

Strategic Implication: Avoiding Lock-In

Organizations should adopt a “one-to-many” strategy—implementing agents capable of communicating across multiple protocols. This avoids dependency on a single vendor and positions the organization to capitalize on whichever protocol emerges as standard. Smart contract implementation and agent design should prioritize protocol agnosticism, ensuring agents can transact through multiple channels without reimplementation.

The Road Ahead: 2026-2027 Priorities

Multi-Agent Orchestration Becomes Standard

Single agents hit capability ceilings. Complex procurement requires specialized agents (sourcing agent, risk analyst, negotiator, compliance officer) coordinated through central orchestration layers. Organizations implementing multi-agent crews will achieve:

- Higher success rates through diverse perspectives (e.g., risk analyst flagging terms negotiator might accept)

- Faster resolution through parallel processing (e.g., risk assessment and compliance review occurring simultaneously)

- Better auditability through clear role separation and decision accountability

Negotiation Becomes an Outsourced Service

Just as organizations outsourced payment processing to Stripe, they will increasingly outsource agent-to-agent negotiation to specialized platforms. “Negotiation-as-a-service” vendors will likely emerge as significant acquisition targets for larger commerce platforms, creating a new category of enterprise software.

Regulatory Frameworks Crystallize

Governments and regulators are focusing on liability, fairness, and transparency in agent-based commerce. Organizations should prepare for requirements around:

- Human approval thresholds for high-value decisions

- Explainability mandates for agent reasoning

- Continuous compliance monitoring in agent decisions

- Dispute resolution mechanisms specific to agent-initiated transactions

Human-Agent Collaboration Becomes the Default

Early hype around “fully autonomous” agents is giving way to pragmatism. The durable model involves agents handling 80–90% of routine decisions and escalating exceptions for human review. This hybrid approach maximizes efficiency while preserving accountability and adaptability to novel situations.

Future-Proof Your AI Stack with Python’s Powerhouses

Pooja Upadhyay

Director Of People Operations & Client Relations

Conclusion: The Transition Is Irreversible

AI-to-AI commerce is not a distant future scenario. It is a production reality reshaping procurement, negotiation, and supply chain management. Autonomous Python agents, powered by large language models and orchestrated through specialized frameworks, are already closing deals, optimizing supplier networks, and executing transactions with minimal human involvement.

For technology leaders, the question is not if to adopt AI agents but how to do so responsibly. Organizations that treat agentic commerce as a governance and strategy challenge—not just a technology implementation—will capture disproportionate value. Those that implement comprehensive audit trails, explainability mechanisms, and human oversight from the start will build competitive moats through trustworthiness and compliance readiness.

The organizations that will dominate the next three years are not those with the most advanced agents, but those with the most mature governance and integration capabilities. The age of human-centric procurement is not ending; it is fundamentally shifting toward human-AI collaboration at unprecedented scale and velocity.

- https://market.us/report/ai-in-procurement-market/

- https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-automation-curve-in-agentic-commerce

- https://github.com/yasserfarouk/negmas

- https://milvus.io/ai-quick-reference/what-is-the-role-of-negotiation-in-multiagent-systems

- https://proceedings.mlr.press/v216/chen23c/chen23c.pdf

- https://arxiv.org/html/2503.06416v3

- https://www.ijcai.org/proceedings/2024/1012.pdf

- https://www.cs.ox.ac.uk/people/michael.wooldridge/pubs/ai-review2008.pdf